The British pound grew on the news that a Brexit trade agreement may be signed soon.

At the moment, the deal is being finalized at the European Commission headquarters in Brussels, and later today, UK Prime Minister Boris Johnson is scheduled to hold a press conference, during which he can reveal the details of the negotiations.

Yesterday, Johnson had a phone call with European Commission President Ursula von der Leyen, and that allowed the conclusion to take place. Although the details of the conversation were not revealed, one thing is clear: the issue on fishing rights has been resolved, and a Brexit trade agreement may be signed soon.

After the European Commission signs the agreement, the final document will go to the UK, and then to the EU Parliament for approval.

It was rumored that the UK made concessions so that a deal can be concluded. Johnson was said to have agreed that the EU's production cut will only amount to 25% over the next five years, much lower than the initial reduction the UK first proposed (80% in over three years). The EU also rejected the UK's latest proposal, which was to decrease production by 25%. The bloc said it was very difficult to accept, even to countries such as France and Denmark.

The UK's concessions on the issue are understandable, especially since now, they need to solve more serious problems. The introduction of tough quarantine measures in the country amid the new strain of coronavirus is pushing the economy down even further, and the absence of a trade agreement with the EU would deal an equally big blow to the prospects for recovery in the next 3-5 years. But if an agreement is signed, it will ease the burden on the Bank of England, as well as on the budget deficit, which has grown to massive figures this year.

Anyhow, this good news proved to be very favorable for the British pound, though the market reacted very calmly as if it already expected that an agreement would be concluded at the last moment. Nonetheless, if news emerged that a deal was signed today, the pound could break above 1.3565, which will make it easier for the quote to reach the 37th figure, in particular, price levels 1.3750 and 1.3810. A decline in the pound is not expected, but if it happens, GBP / USD might return to 1.3475, and then go below 1.3475. In such a case, the closest support levels will be 1.3310 and 1.3190.

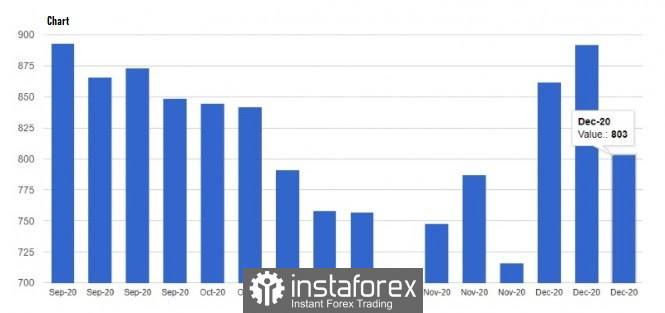

EUR: The latest data on US jobless claims were not much different from the figures last week, which confirms that economic recovery in the country is slowing. The report released by the US Department of Labor said initial jobless claims for the week of December 13-19 was 803,000, up from 892,000 in the previous week. It is clear that the new restrictions that state authorities have implemented are negatively affecting the state of the US labor market.

With regards to the highly-anticipated bailout bill, yesterday, Donald Trump did not sign it, and instead called on lawmakers to increase the amount of direct benefits to $ 2,000. He said the $ 600 that the Congress has approved is absurdly small and needs to be increased to 2,000 per person, or 4,000 per couple. Legislators were clearly not prepared for this, which led to the strengthening of the US dollar against the euro and the British pound.

House Speaker Nancy Pelosi was quick to respond to this call, however, according to House Minority Leader Kevin McCarthy, the attempt to pass such a legislation will fail.

And if the attempt to raise benefits is unsuccessful, then, most likely, a new bill will be brought up for discussion. The new law will provide for larger incentive payments. However, its introduction does not ensure its approval.

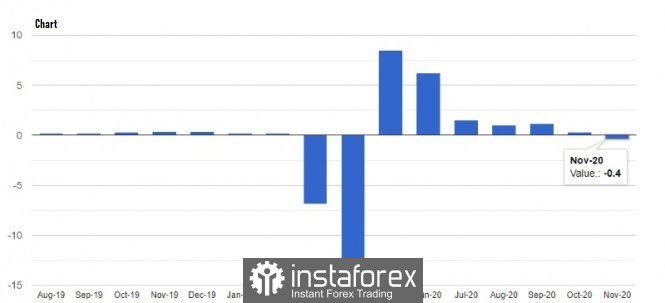

In another note, a report on the personal spending of Americans was released yesterday, which fell much more than economists expected. It seems that this November, US households were more cautious about their spending, thereby leading to reduced spending for the first time in six months. Household incomes also fell sharply.

According to the data, personal spending fell 0.4% in November, and at the same time, household incomes dropped by 1.1%. This low consumer spending will surely affect the growth prospects of the US economy negatively, as they are the main driver of its growth.

Consumer sentiment in the US also declined, dropping to only 80.7 points in December, lower than its preliminary value of 81.4 points. Economists expected the final reading to be 81.0.

Sales in the US primary housing market also fell, decreasing by 11.0% and amounting to 841,000 homes per year. Meanwhile, economists expected an increase to 990,000.

As for the technical picture of the EUR / USD pair, the situation has not changed much, but the breakout of 1.2175 is likely to increase pressure on risky assets, as such would form a new downward wave and completely reverse the current upward trend. In addition, there is a high chance that traders will take profits at the end of this year, so the euro may collapse further to 1.2080 and 1.2040. EUR / USD will grow only if the quote consolidates above 1.2220, after which it will head to 1.2260 and 1.2310.