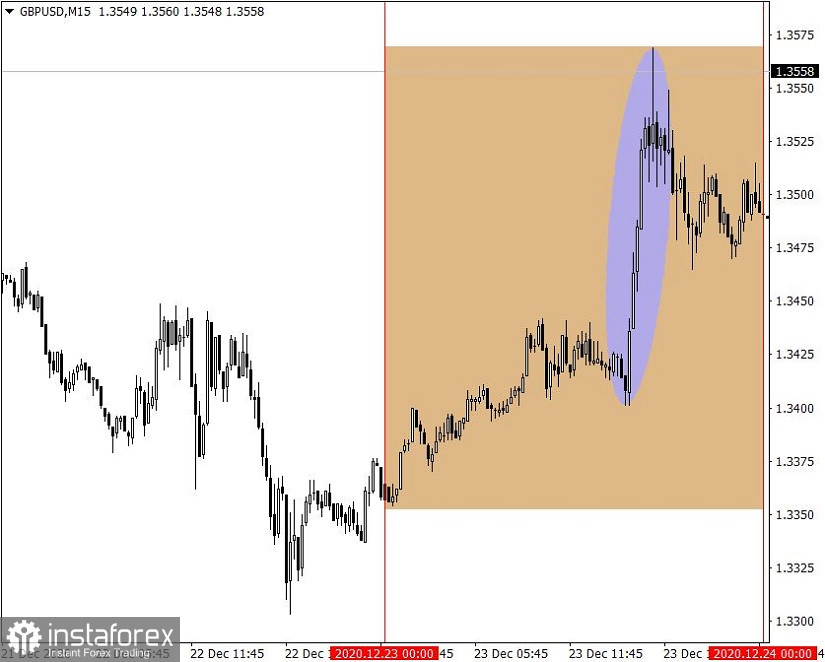

GBP/USD: Previous day's review

Yesterday, the pound rose by 1.5%, that was to the level of 1.3569. It was one of the most intense days in December.

Important events in the economic calendar:

The weekly data on unemployment claims was published in the US, where its volume was expected to increase, but it resulted in a decline. This positively affected the labor market.

The volume of initial applications declined by 89 thousand – from 892 thousand to 803 thousand.

The volume of repeated applications for benefits declined by 170 thousand – from 5,507 thousand to 5,337 thousand, against the forecasted growth of 5,558 thousand.

Together with the applications, Novembers' data on orders for durable goods was also published, where the previous data was revised in favor of growth of 1.3% ---> 1.8%. The current figure came out better than the forecast 0.6% ---> 0.9%.

The US statistics are very good, but the market did not react in any way. The reason for the discrepancy lies in the information flow.

There were rumors yesterday that Britain and Europe agreed on a trade deal after Brexit, but as always, there are no specifics.

The pound sterling rose on expectations of a positive result.

What happened on the trading chart?

A gradual upward movement was initially observed, which carried a recovery process relative to the decline last December 22. After the start of the US trading session, there is a sharp growth of more than 160 points. It was during this time period that the inital rumors began to appear about the possible success of the Brexit negotiations.

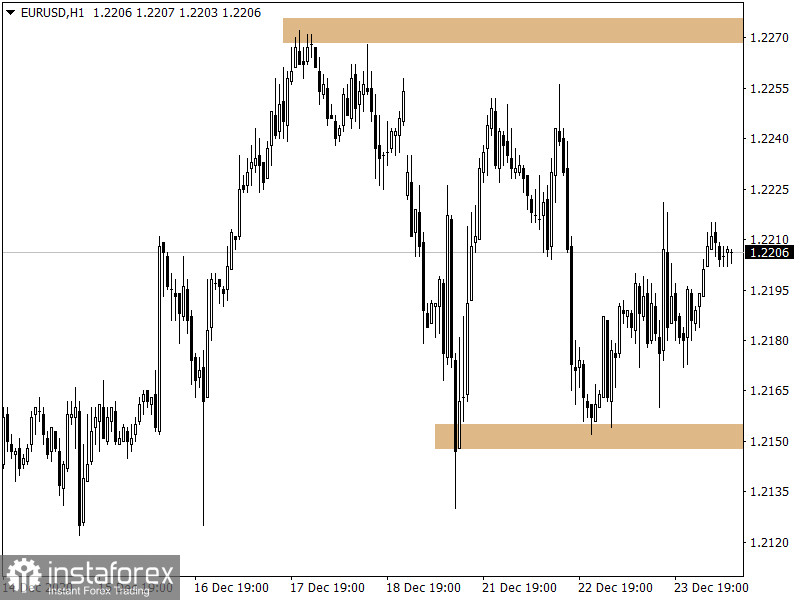

EUR/USD: Previous day's review

The euro also showed local activity yesterday after the pound, but the dynamics was much less.

The market ignored the US statistics, while speculators moved on the basis of positive expectations of a trade deal.

It was seen that there were sharp price surges in the trading chart only in the period of 12:30-13:30 UTC+00, which refers to the informational impact on the market. In general, the quote stood in one place, as if it had a stagnation stage.

Trading recommendation for GBP/USD on December 24

No significant statistics are expected before Christmas Eve. It is worth considering that all major stock exchanges will have early closings.

Brexit news will be the main driver of today's trading activity. The speculators are eagerly waiting for the details on the previously received rumors about progress. If they are confirmed, the trade deal will take place, and the pound will rise again.

The information flow on the hot Brexit topic should be carefully monitored, as it will play the main role in the market and direct the quote.

Here's the market's course of action on the Brexit information background, which is quite simple:

- Positive news around Brexit leads to the pound's strengthening.

- Negative news around Brexit leads to the pound's weakening.

Trading recommendation for EUR/USD on December 24

There are no statistics that are noteworthy today. Germany's statistics will not be published due to Christmas Eve. At the same time, trading volumes are likely to be reduced, so only Brexit information can soothe the stagnation in the market.

Analyzing the trading chart for market cycles, it can be seen that there was a slowdown at the conditional peak of the medium-term upward trend, where the correction was not executed. It can be assumed that a flat range appears on the market from the limits of 1.2150/1.2275, which will hold back speculators for a while.

So, only a breakdown of a certain border can indicate a more effective market movement.