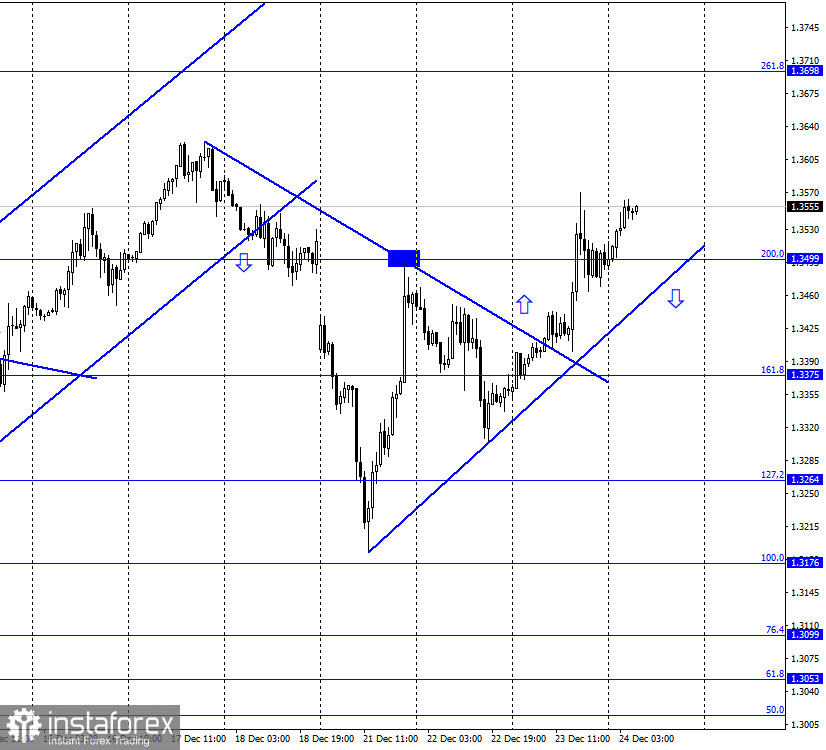

GBP/USD – 1H.

According to the hourly chart, the quotes of the GBP/USD pair continue the growth process and have consolidated above the corrective level of 200.0% (1.3499). Thus, the growth process can be continued in the direction of the next corrective level of 261.8% (1.3698). The upward trend line keeps the current mood of traders "bullish". Meanwhile, London and Brussels seem to have finally agreed on the terms of the UK's withdrawal agreement. At least in the course of yesterday, information was received from two sources at once that the parties had agreed that the deal was ready. However, there is still no official information confirming this. No comment from Ursula von der Leyen or Boris Johnson. It should also be noted that information about the agreement was received from journalists, and everyone knows that this kind of information is not always true. Nevertheless, traders believed it, and the British dollar is growing again. "It looks like the agreement pretty much exists. The question is, when will it be announced, today or tomorrow?" said an unnamed senior official in the European Union. I want to remind you that only the negotiating teams and the head of the European Commission with the British Prime Minister know all the terms of the deal. Thus, possibly, the current version of the deal will not suit someone in the European Union or the UK Parliament, which blocked the agreement with the EU three times during the time of Theresa May. Now the composition of the Parliament is different, the majority in it are conservatives, so if the deal suits Johnson, then the Parliament will vote for it.

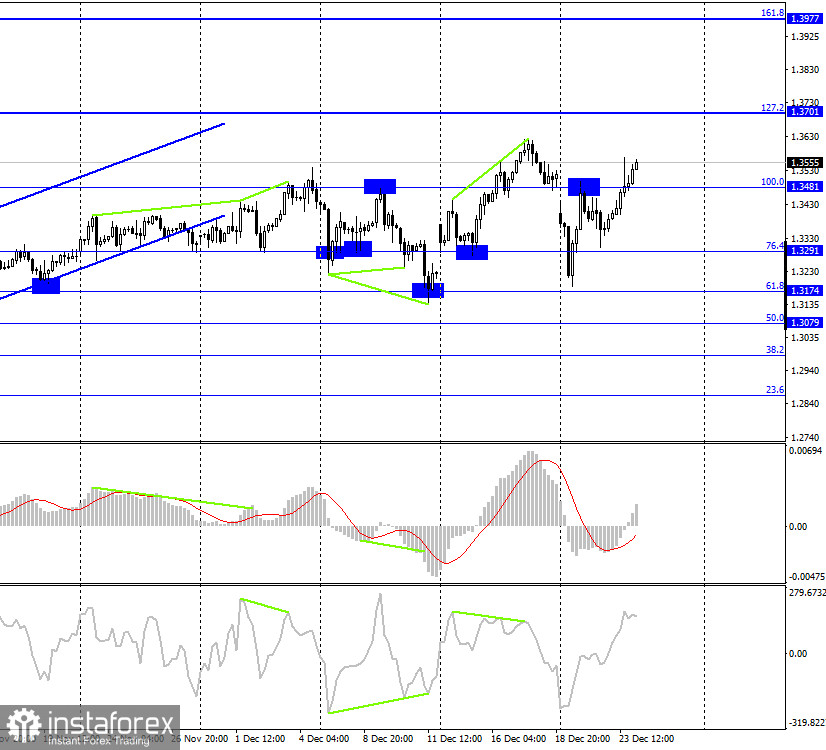

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair has consolidated above the corrective level of 100.0% (1.3481) and continues the growth process in the direction of the next Fibo level of 127.2% (1.3701). Today, the divergence is not observed in any indicator.

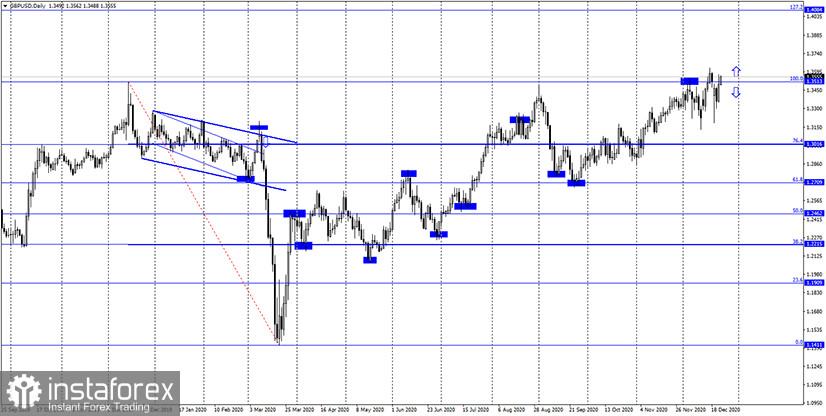

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a consolidation under the corrective level of 100.0% (1.3513), which now increases the probability of a new fall with the goal of the Fibo level of 76.4% (1.3016). Fixing above the level of 100.0% will again work in favor of the British currency.

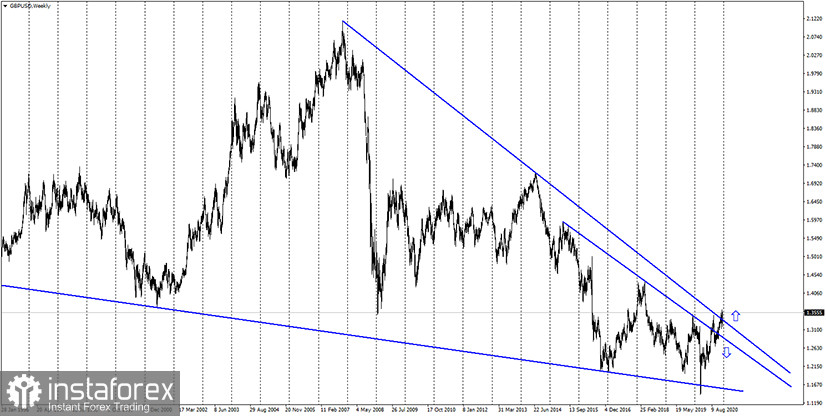

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed an increase to the second downward trend line. A rebound from it in the long term will mean a reversal in favor of the US dollar and a long fall in the British dollar's quotes.

News overview:

There were no economic reports in the UK on Wednesday, however, the pound continued the growth process.

The economic calendar for the US and the UK:

On December 24, the calendar of economic events in the UK and the US is empty, however, the information background will still be strong, as today or tomorrow the achievement of a free trade agreement between the UK and the European Union may be officially announced.

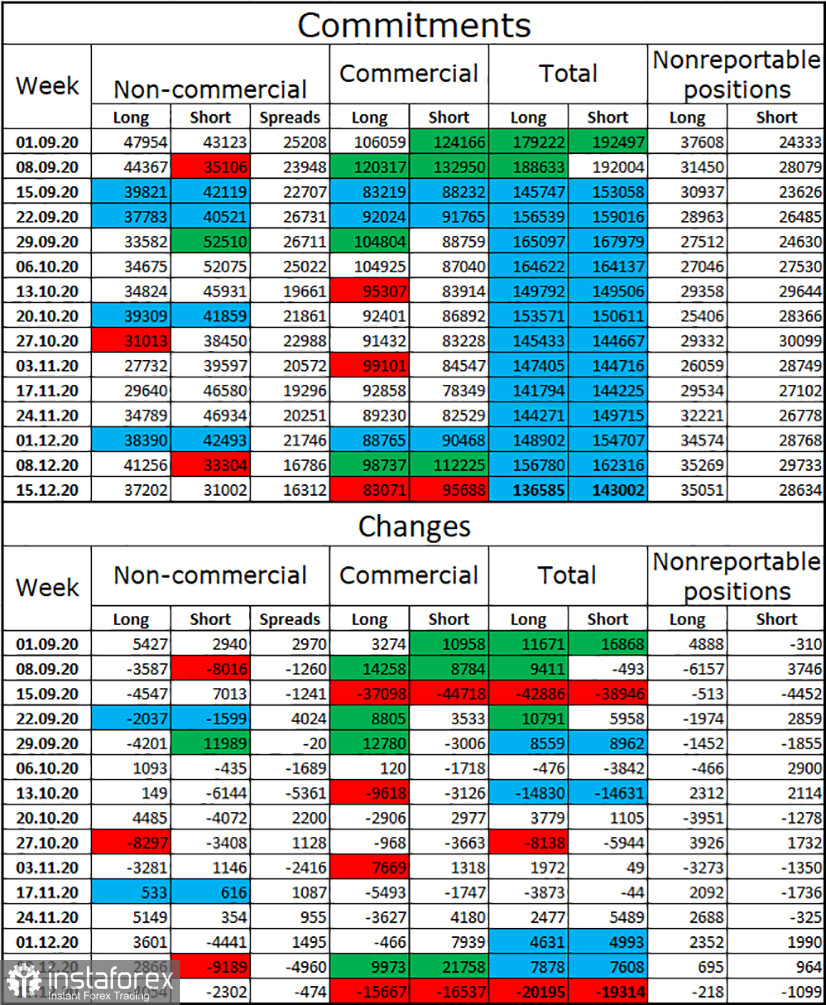

COT (Commitments of Traders) report:

The latest COT report showed that speculators were getting rid of both long and short contracts. This again suggests that traders are afraid of the British and the information background. It is extremely difficult to predict what will happen to the UK economy in 2021. Therefore, the "Non-commercial" category of traders prefers to close trades rather than open new ones. This time, speculators closed 4 thousand long contracts and 2.5 thousand short contracts. Thus, the mood of speculators has become much less "bullish". At the same time, the British continued the growth process, thus, I can draw the same conclusion as for the euro. Major traders are preparing for a new fall in the pound sterling.

GBP/USD forecast and recommendations for traders:

Purchases of the British dollar could be opened by fixing quotes above the descending trend line on the hourly chart, now the target has changed - the level of 1.3698. I recommend selling the pound sterling when it is fixed under the ascending trend line on the hourly chart with a target of 1.3375.

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.