Outlook on December 24:

Analytical overview of major pairs on the H1 TF:

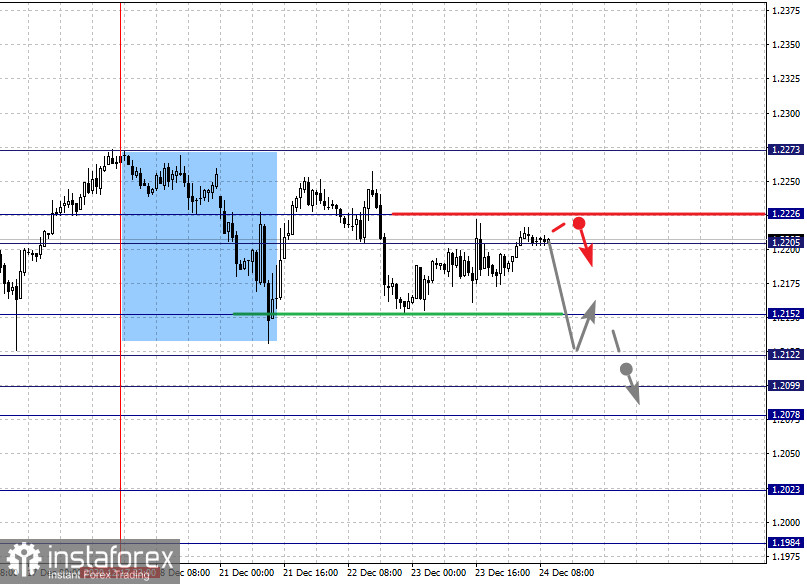

The key levels for the euro/dollar pair are 1.2273, 1.2226, 1.2205, 1.2152, 1.2122, 1.2099, 1.2078, 1.2023 and 1.1984. The development of the downward trend from December 17 is being followed here. Therefore, we expect the decline to continue after the breakdown of 1.2152. In this case, the target is 1.2122. If this level breaks down, it will allow us to move to the level of 1.2099. Price consolidation is near this level. The price overcoming the noise range of 1.2099 - 1.2078 should be accompanied by a strong decline. In this case, the target is 1.2023. For the potential downward target, we consider the level of 1.1984. Upon reaching which, price consolidation and upward pullback can be expected.

Short-term growth, in turn, is possible in the range of 1.2205 - 1.2226. In case that the last value breaks down, it will encourage the formation of an upward potential trend. In this case, the first potential target is 1.2273.

The main trend is the formation of a downward trend from December 17.

Trading recommendations:

Buy: 1.2205 Take profit: 1.2224

Buy: 1.2227 Take profit: 1.2271

Sell: 1.2152 Take profit: 1.2123

Sell: 1.2121 Take profit: 1.2100

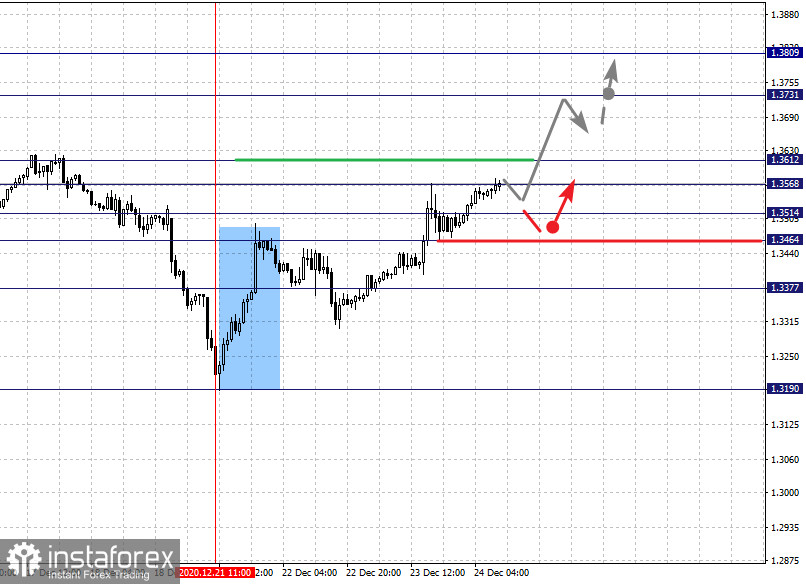

The key levels for the pound/dollar pair are 1.3809, 1.3731, 1.3612, 1.3568, 1.3514, 1.3377, 1.3336, 1.3255 and 1.3190. Here, we are following the upward trend from December 21. In this regard, short-term growth is expected in the range of 1.3568 - 1.3612. If the last value breaks down, it should be accompanied by a strong growth. The target here is 1.3731. On the other hand, we consider the level 1.3809 as a potential upward target. Upon reaching which, a downward pullback is expected.

Meanwhile, short-term decline is expected in the range of 1.3514 - 1.3464. If the last value breaks down, a deep correction will occur. Here, the target is 1.3377.

The main trend is the upward trend of December 21

Trading recommendations:

Buy: 1.3614 Take profit: 1.3730

Buy: 1.3734 Take profit: 1.3806

Sell: 1.3514 Take profit: 1.3465

Sell: 1.3462 Take profit: 1.3380

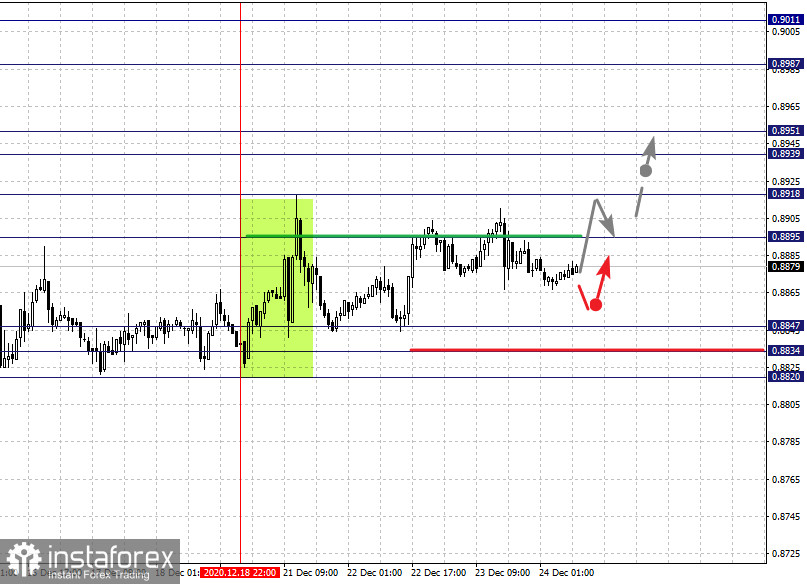

The key levels for the dollar/franc pair are 0.9011, 0.8987, 0.8951, 0.8939, 0.8918, 0.8895, 0.8847, 0.8834 and 0.8820. The price here is forming a potential for the upward trend of December 18. Therefore, we expect the upward movement to continue after breaking through the level of 0.8895. In this case, the target is 0.8918. Price consolidation is expected near this level. If the target breaks down, it will lead to a movement to the level of 0.8939. The price overcoming the noise range 0.8939 - 0.8951 should be accompanied by a strong growth to the level of 0.8987. For the potential upward target, we consider the level of 0.9011. Upon reaching which, downward pullback is expected.

On the other hand, short-term decline is possible in the range of 0.8847 - 0.8834. If the last value breaks down, it will encourage the development of a downward trend. In this case, the target is 0.8820.

The main trend is the formation of an upward potential from December 18

Trading recommendations:

Buy: 0.8895 Take profit: 0.8918

Buy: 0.8920 Take profit: 0.8939

Sell: 0.8847 Take profit: 0.8834

Sell: 0.8832 Take profit: 0.8820

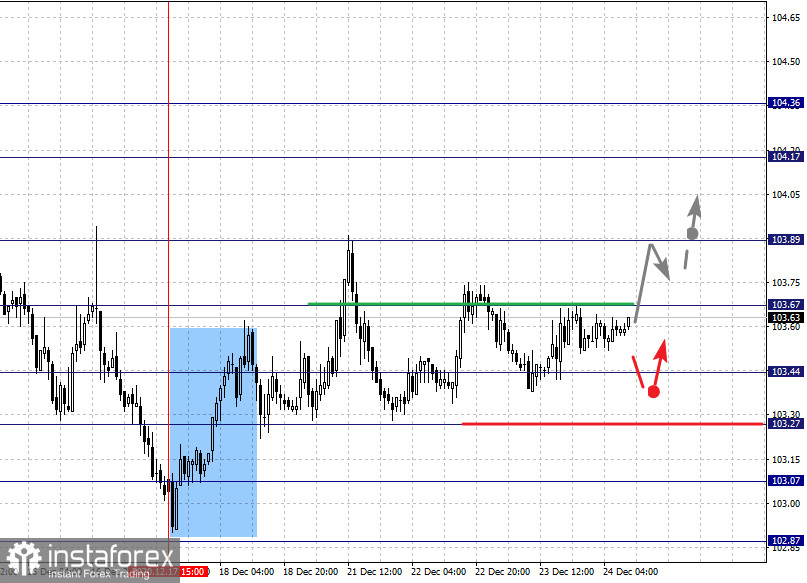

The key levels for the dollar/yen are 104.36, 104.17, 103.89, 103.67, 103.44, 103.27, 103.07 and 102.87. The formation of the initial conditions for the upward trend of December 17 is being observed here. In this regard, short-term growth is expected in the range of 103.67 - 103.89. In case that the last value breaks down, it will lead to strong growth. The target here is 104.17. For the potential upward target, the level of 104.36 is considered. Upon reaching which, a downward pullback is expected.

Short-term decline is expected in the range of 103.44 - 103.27. If the last value breaks down, it will lead to a deep correction. Here, the target is 103.07, which is the key support level for the upward trend.

The main trend is the initial upside conditions of December 17

Trading recommendations:

Buy: 103.68 Take profit: 103.87

Buy: 103.91 Take profit: 104.15

Sell: 103.44 Take profit: 103.28

Sell: 103.25 Take profit: 103.08

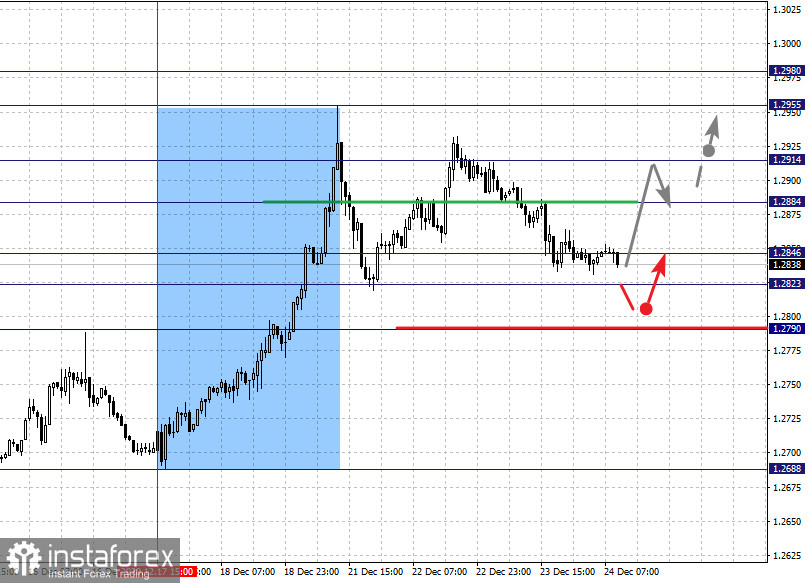

The key levels for the USD/CAD pair are 1.2980, 1.2955, 1.2914, 1.2884, 1.2846, 1.2823 and 1.2790. Here, we are following the upward trend from December 17. In this case, short-term growth is expected in the range of 1.2884 - 1.2914. If the last value breaks down, it will lead to a strong movement. The target is 1.2955. This will be followed by the potential upward target, which is the level of 1.2980. Upon reaching which, price consolidation and downward pullback can be expected.

Short-term decline, in turn, is possible in the range of 1.2846 - 1.2823. If the last value breaks down, a deep correction will occur. Here, the target is 1.2790.

The main trend is the upward trend of December 17

Trading recommendations:

Buy: 1.2885 Take profit: 1.2912

Buy: 1.2916 Take profit: 1.2955

Sell: 1.2846 Take profit: 1.2824

Sell: 1.2821 Take profit: 1.2790

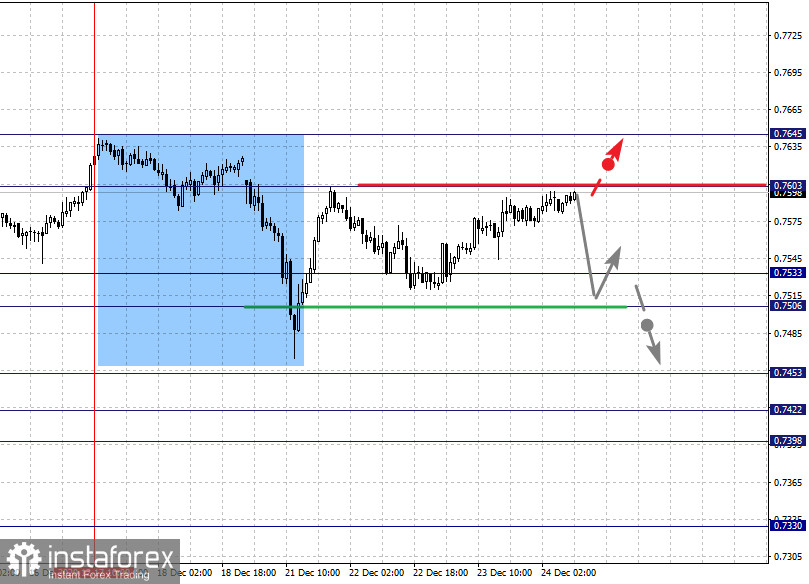

The key levels for the AUD/USD pair are 0.7603, 0.7533, 0.7506. 0.7453, 0.7422, 0.7398 and 0.7330. The downward trend from December 17 is being followed here. Currently, the price is in correction. Now, a short-term decline is expected in the range of 0.7533 - 0.7506. In case that the last value breaks down, it will lead to a strong decline. Here, the target is 0.7453. Its breakdown will allow us to move to the next level of 0.7422. On the other hand, the price passing through the noise range of 0.7422 - 0.7398 should be accompanied by a strong decline towards the potential target - 0.7330.

The key support level for the downward trend is 0.7603. The price breaking through it will encourage the formation of initial upward conditions. In this case, the potential target is 0.7645.

The main trend is the downward trend from December 17, correction stage

Trading recommendations:

Buy: 0.7604 Take profit: 0.7645

Buy: Take profit:

Sell: 0.7533 Take profit: 0.7508

Sell: 0.7504 Take profit: 0.7455

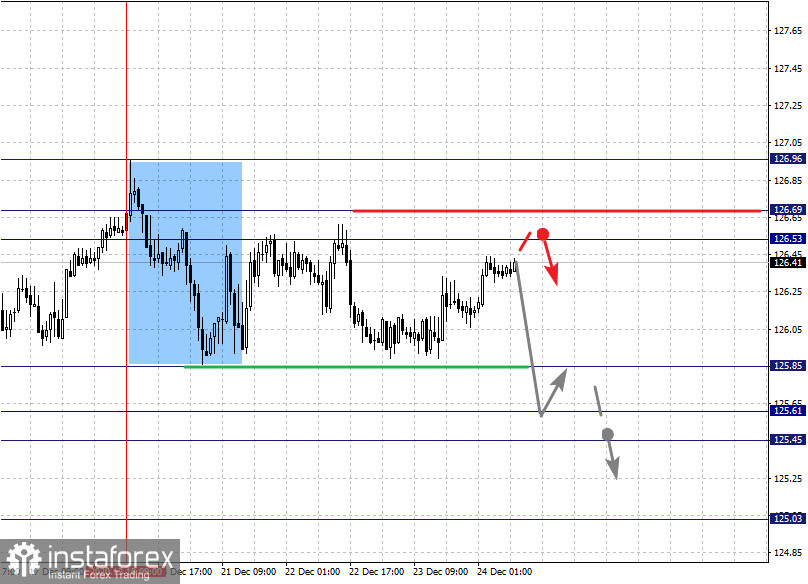

The key levels for the euro/yen pair are 126.96, 126.68, 126.53, 125.85, 125.61, 125.45 and 125.03. Here, the price is forming a potential trend from the downward trend of December 18. Against this background, we expect the decline to continue after breaking through the level of 125.85. In this case, the target is 125.61. Meanwhile, there is a short-term decline and price consolidation in the range of 125.61 - 125.45. In case that the last value breaks down, it will lead to a strong decline. The target here will be 125.03. Price consolidation and upward pullback is near this level.

Now, the range 126.53 - 126.68 is the key support for the downward trend from December 18. If the last value breaks down, it will favor the formation of a potential upward trend. In this case, the target is 126.96.

The main trend is the formation of a potential trend from the downward trend on December 18

Trading recommendations:

Buy: 126.53 Take profit: 126.66

Buy: 126.70 Take profit: 126.95

Sell: 125.85 Take profit: 125.61

Sell: 125.45 Take profit: 125.05

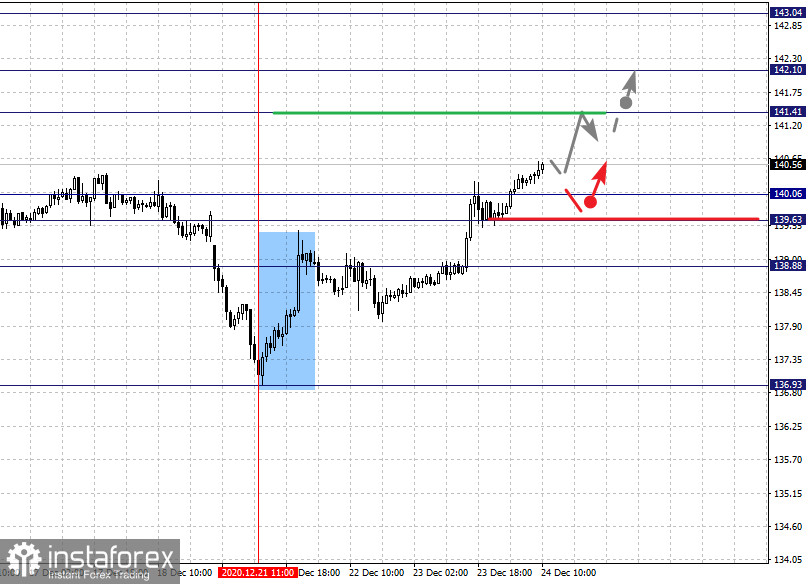

The key levels for the pound/yen pair are 143.04, 142.10, 141.41, 140.06, 139.63 and 138.88. The development of the upward trend from December 21 is being followed here. Currently, a movement to the level of 141.41 is expected. In this case, there is a short-term upward movement and consolidation in the range of 141.41 - 142.10. This will be followed by the level of 143.04, which is considered as a potential upward target. Upon reaching which, price consolidation and downward pullback can be expected.

In turn, short-term decline is expected in the range of 140.06 - 139.63. If the last value breaks down, a deep correction will occur. Here, the target is 138.88, which is the key support above.

The main trend is the upward structure of December 21

Trading recommendations:

Buy: 140.80 Take profit: 141.41

Buy: 141.45 Take profit: 142.10

Sell: 140.06 Take profit: 139.65

Sell: 139.60 Take profit: 139.00