GBP / USD climbed up on Wednesday and tested the resistance level of 1.3569 (red bold line). After that, it pulled back downwards, closing the daily candle at 1.3491. But today, there is a high chance that the pound will resume its bullish trend.

With regards to economic reports, an important news is expected at 14:30 (for USD). However, trading will most likely remain in a narrow sideways channel, especially since today is a holiday in many countries (Christmas Eve).

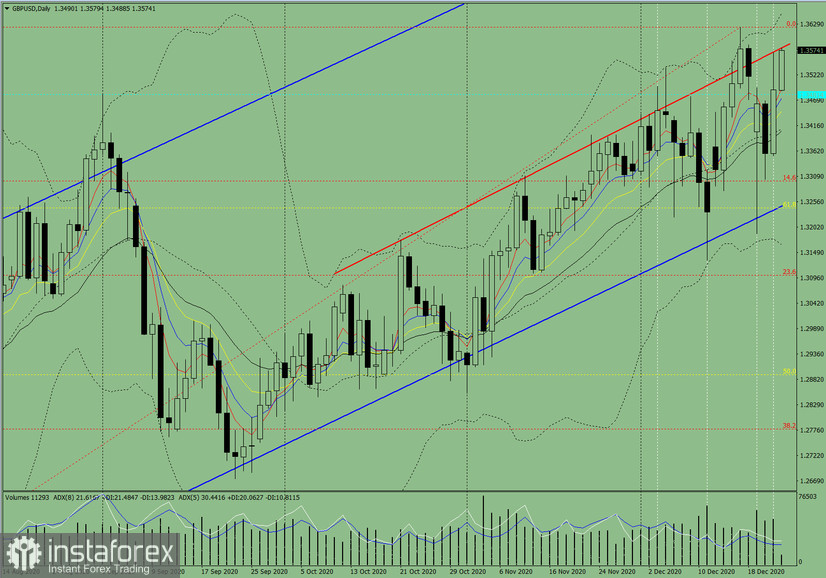

Trend analysis (Fig. 1).

Today, the pound may move from 1.3491 (closing of yesterday's daily candle) to 1.3580 (red bold line). And after testing this level, the bulls can continue working upwards, the target of which is 1.3623 (red dotted line) - upper fractal and daily candle from December 17.

Figure: 1 (daily chart).

Comprehensive analysis:

- Indicator analysis - up;

- Fibonacci levels - up;

- Volumes - up;

- Candlestick analysis - up;

- Trend analysis - up;

- Bollinger lines - up;

- Weekly chart - up.

General conclusion:

The pound may move from 1.3491 (closing of yesterday's daily candle) to 1.3580 (red bold line) today. And after the quote tests this level, pound bulls can continue raising the price to 1.3623 (red dotted line) - upper fractal and daily candle from December 17.

Alternative scenario: price may move from 1.3491 (closing of yesterday's daily candle), to 1.3580 (red bold line). And after testing this level, pound bears may work for a price drop, the target of which is 1.3481 (blue dotted line).