The EUR/USD pair is under selling pressure, at the lower end of its daily range amid concerns related to the Eastern European crisis. German Producer Prices soared to 25.9% YoY in February, signaling inflation is heating up.

The EUR/USD pair met sellers around a relevant Fibonacci resistance level, the 38.2% retracement of this year's decline. The daily chart shows that the risk is skewed to the downside, as a firmly bearish 20 SMA converges with the mentioned level. Technical indicators, in the meantime, remain within negative levels, with the RSI already heading lower, in line with another leg south.

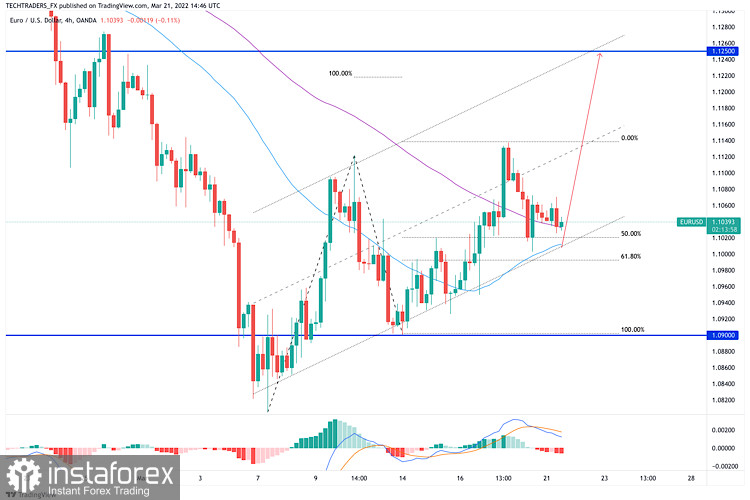

In the near term, and according to the 4-hour chart, the pair is at a brink of breaking lower. It is currently hovering around the 20 and 100 SMAs, both within a tight 10 pips range, as technical indicators are crossing their midlines into negative territory. Below the 1.1000 figure, the pair has room to test the next relevant support level at 1.0965, while below the latter, the pair has room to accelerate its decline towards 1.0800.

Support levels: 1.1000 1.0965 1.0920

Resistance levels: 1.1070 1.1105 1.1150