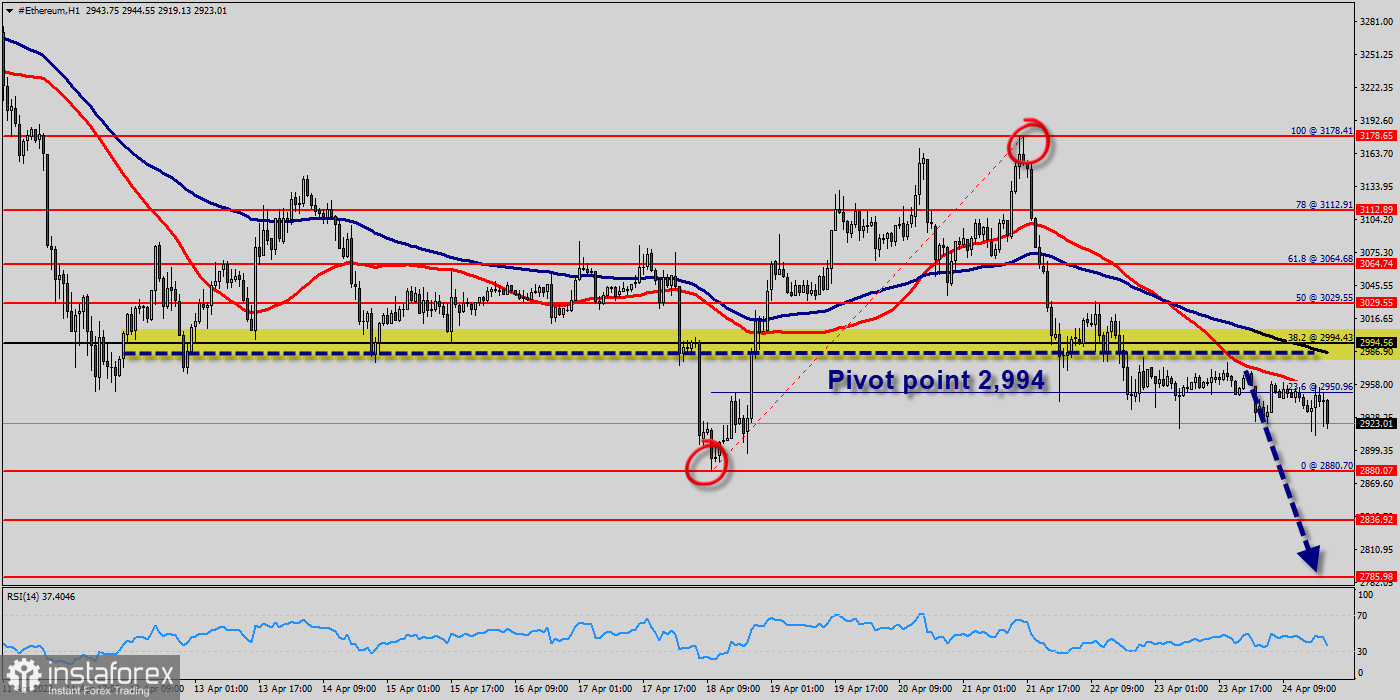

Following the price of $2,994 rejection, the Seller Takers still have the upper hand in the market, as they were able to impose more correction on ETH from the price of $2,994.

The ETH/USD pair couldn't reached stiff resistance at $2,994 and pulled back near $2,880 support, which could be a swing entry opportunity. Previously, price broke out from triangle and below $2,880 (lower low), which signaled trend to continue towards the south.

This was marginally below the long-term floor of $2,994 for bitcoin, and comes as prices failed to break out of yesterday's resistance at $2,994.

The level of $2,994 coincides with a major ratio (38.2% of Fibonacci), which is expected to act as major resistance today. The Relative Strength Index (RSI) is considered oversold because it is below 70.

The RSI is still signaling that the trend is downward as it is still strong below the moving average (100).

If sellers continue to control the market, ETH can be expected to drop to retest the channel's bottom line at $2,880.

On the downside, the $2,880 level represents support. The next major support is located near the $2,836, which the price may drift below towards the $ 2,785 support region.

Forecast (ETH/USD) :

The volatility is very high for that the ETH/USD is still moving between $2,994 and $2,880 in coming hours. Consequently, the market is likely to show signs of a bearish trend again.

So, it will be good to sell below the level of $2,994 with the first target at $2,880 and further to $2,836 in order to test the daily support.

However, if the ETH/USD is able to break out the daily resistance at $2,994, the market will rise further to $3,064 to approach resistance 2 today.