The GBP/USD currency pair fell by 200 points on Friday. We have already said in previous articles that there was no specific reason for such a serious collapse of the British currency. Nevertheless, a new fall in the pound sterling, as they say, has been brewing for a long time. Moreover, this applies not only to the pound but also to the euro. By and large, they now have about the same set of factors that provide them with a fall against the US currency. It's just that the euro currency is declining more gradually, and the pound sterling stood in one place, and then crashed down like a downed plane. Thus, the downward trend for the pound/dollar pair remains, and the fundamental, geopolitical, and macroeconomic backgrounds support the further growth of the US dollar. However, it is unlikely to do without an upward correction this week. In favor of its beginning, the CCI indicator enters the oversold area, while much lower than the -250 level. Therefore, we do not expect that the pair's fall will continue immediately on Monday or Tuesday. Most likely, this week there will be a consolidation of the pair.

By the way, the results of the presidential elections in France will be announced today. Of course, this event has practically nothing to do with the pound sterling. But it has to do with the whole of Europe, with relations between Russia and European countries, with geopolitics. Recall that if by some miracle Marine Le Pen wins the elections, it will mean that France will take an "anti-European" political course. Le Pen has been repeatedly linked with Russia and there is no doubt that Moscow's influence on the European Union will increase if she wins. It is very difficult to say what this may lead to in the context of the geopolitical conflict in Ukraine. However, most experts still give the victory to Macron. 90% of various voting simulations in the second round indicate the victory of the incumbent president of France. We also believe that Macron will win, but at this moment is unlikely to support the euro or the pound. It's just an important event.

Is the American economy that strong? How much can the Fed rate rise?

There is only one event scheduled in the UK this week - a speech by the Chairman of the Bank of England, Andrew Bailey, on Thursday. Recently, Bailey has not pleased the markets with important statements. Recall that even when the Bank of England raised the key rate for the first time at the end of last year, it came as a surprise, since the representatives of the regulator in no way even hinted at a possible tightening of monetary policy. Therefore, we do not expect high-profile statements from Bailey.

In the States, the macroeconomic background will be much more fun and interesting. On Tuesday, the once important reports on applications for long-term use goods and sales of new homes will be published. On Thursday - the GDP report for the first quarter of 2022 and applications for unemployment benefits. On Friday - changes in the volume of personal income and expenses of the American population and the level of consumer sentiment from the University of Michigan. As you can see, almost all of this week's reports will be secondary. Only the GDP report can be noted, the forecast for which is +1.1% q/q. This is not too much, but much more than in the European Union, where the economy can add only 0.2-0.3% over the same period. Thus, as before, we can conclude that the United States can raise the key rate without the risk of recession, but the European Union does not have such an opportunity. From our point of view, this divergence between the monetary policies of the ECB and the Fed may continue to be decisive for the euro/dollar exchange rate. No matter how many percent of the growth of the American economy, their number is still greater than in Europe. In addition, we do not forget that the geopolitical picture in Ukraine is also much more relevant to Europe than to the United States. It is Europe that may face a food and energy crisis. It was to Europe that several million refugees from Ukraine crossed over. It is Europe that is dependent on Russian gas and oil.

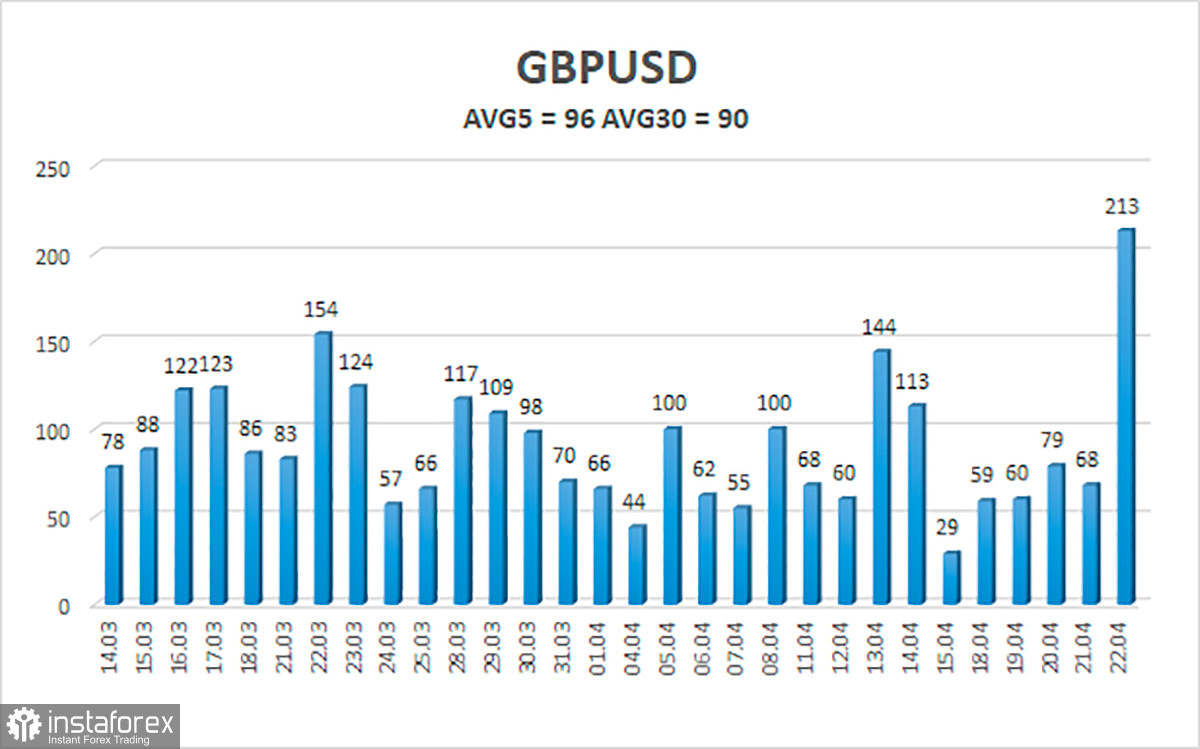

The average volatility of the GBP/USD pair over the last 5 trading days is 96 points. For the pound/dollar pair, this value is "average". On Monday, April 25, thus, we expect movement inside the channel, limited by the levels of 1.2739 and 1.2931. A reversal of the Heiken Ashi indicator upwards will signal a round of upward correction.

Nearest support levels:

S1 – 1.2817

S2 – 1.2756

S3 – 1.2695

Nearest resistance levels:

R1 – 1.2878

R2 – 1.2939

R3 – 1.3000

Trading recommendations:

The GBP/USD pair on the 4-hour timeframe has finally overcome the Murray level of "2/8" - 1.3000 and continues a strong downward movement. Thus, at this time, you should stay in sell orders with targets of 1.2756 and 1.2739 until the Heiken Ashi indicator turns up. It will be possible to consider long positions if the price is fixed above the moving average line with targets of 1.3062 and 1.3123.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.