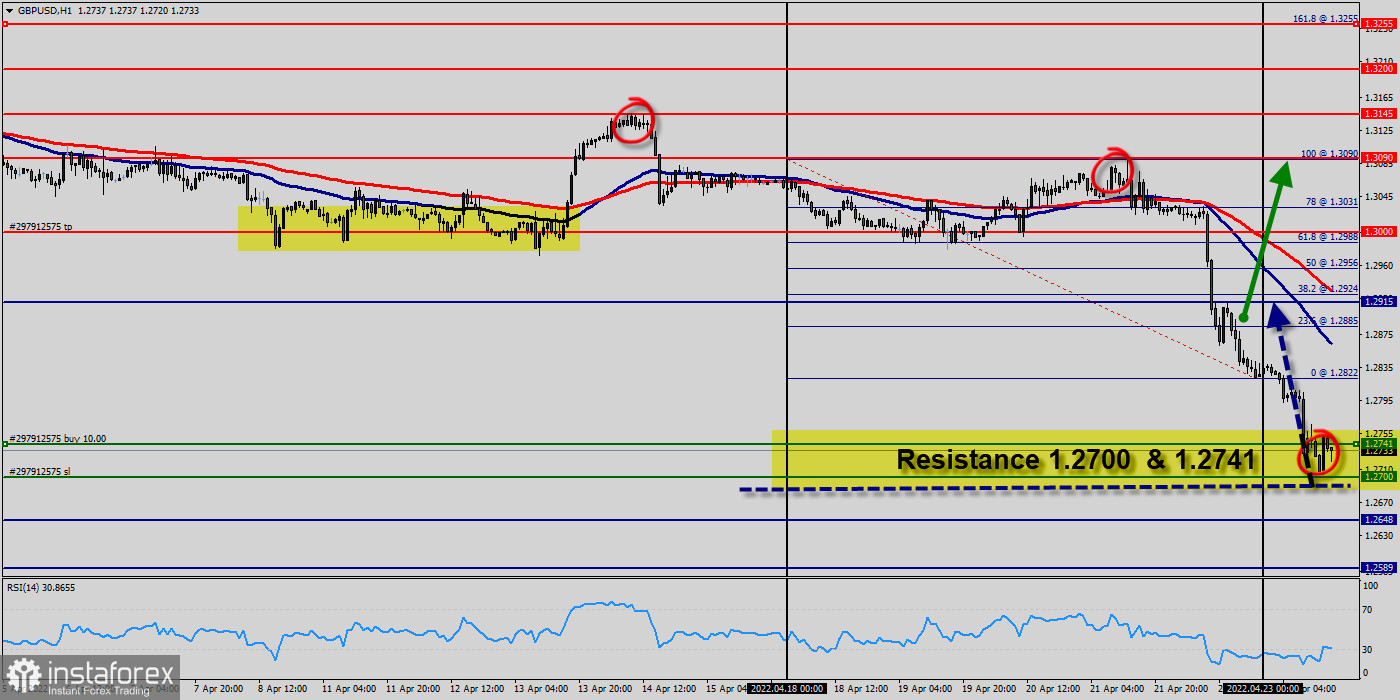

The GBP/USD pair tests support area at 1.2700 - 1.2741. The GBP/USD pair is currently trying to settle above the support at 1.2700, while the U.S. dollar is moving higher against a broad basket of currencies.

The GBP/USD pair to head lower towards 1.2700 on a weekly close above 1.2700 (major support) so as to try rebound from this level to call for a new bullish wave.

The GBP/USD pair shows oversold conditions in the short term with the Relative Strength Index (RSI) indicator on the one-hour chart staying well below 40.

A close above the 1.2700 mark for the week would signal further gains ahead to a test of the 1.2915 level in the coming days.

Further close above the high end may cause a rally towards 1.2915. Nonetheless, the weekly resistance level and zone should be considered.

Consequently, there is a possibility that the GBP/USD pair will move upside. The structure of a fall does not look corrective.

In order to indicate a bullish opportunity above 1.2700, buy above 1.2700 with the first target at 1.2915 ( weekly pivot point).

If the pair succeeds in passing through the level of 1.2915, the market will indicate the bullish opportunity above the level of 1.2915 in order to reach the second target at 1.3003.

On the downside, 1.2700 (psychological level) aligns as the first support before 1.2742. The market mood, however, needs to turn neutral before sellers decide to book their profits. Hence, it's possible to see additional losses before the pair makes a correction.

If the pair fails to pass through the level of 1.2742, the market will indicate a bearish opportunity below the level of 1.2742. Hence, the market will decline further to 1.2648 in order to return to the daily support 1 (1.2648). Moreover, a breakout of that target will move the pair further downwards to 1.2589.