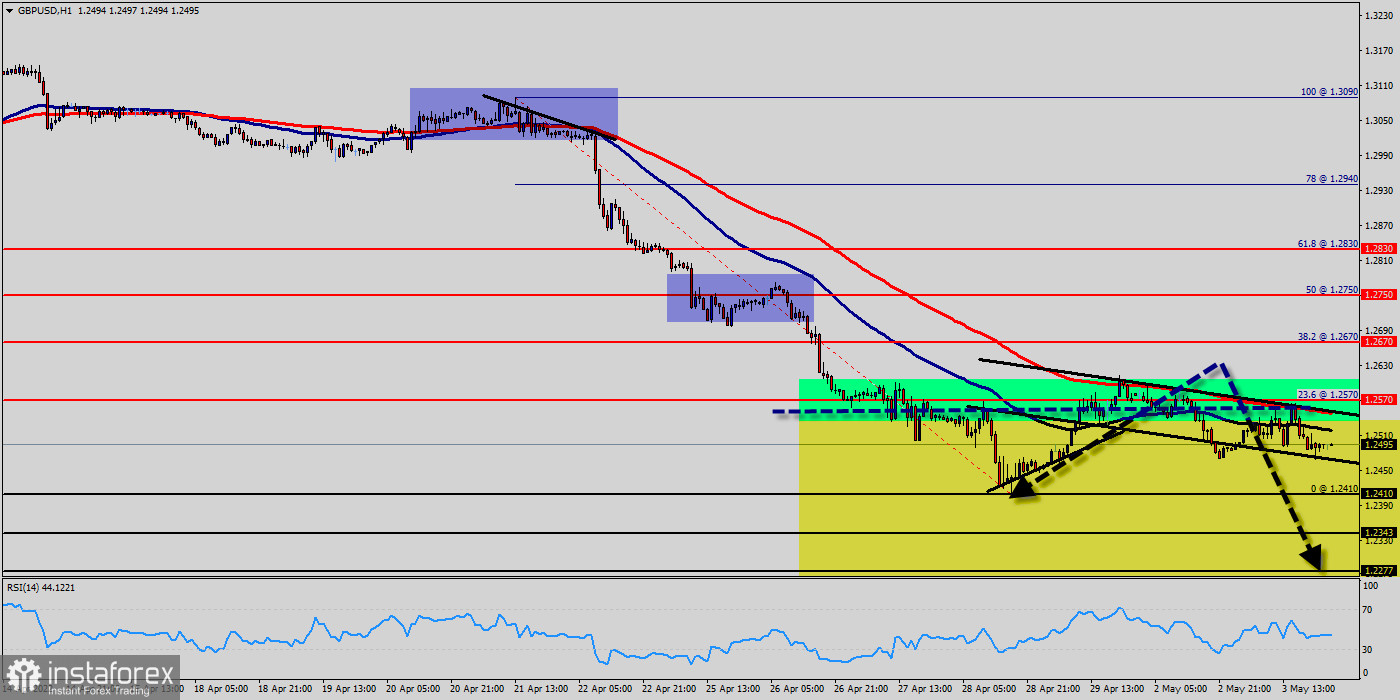

The direction of the GBP/USD pair into the close this week is likely to be determined by trader reaction to 1.2410 and 1.2527.

The GBP/USD pair climbed above the level of 1.2410 before it started a downside correction. It broke a fateful bullish trend line with support near 1.2410 on the hourly chart.

Right now, the GBP/USD pair settled below the key 1.2527 resistance.

So, it is at a risk of a downside break below 1.2527. According to previous events, the GBP/USD pair has still moving between the level of 1.2527 and the 1.2410 level (those levels coincided with the Fibonacci retracement levels 23.6% and double bottom respectively).

Look for the intraday a strong downside bias to continue as long as the GBP/USD pair holds below the price of 1.0937 which represents the daily pivot.

If this move creates enough late session downside momentum then look for a wave into 1.2570, followed closely by 1.2500.

The GBP/USD pair settled below the 1.2570 resistance zone, opening the doors for more downsides in the near term.

Similarly, The EUR/USD pair could dive if it breaks the 1.2500 support.

Today, the first resistance level is seen at 1.2570 followed by 1.2670, while daily support 1 is seen at 1.2410.

Furthermore, the moving average (100) starts signaling a downward trend.

Therefore, the market is indicating a bearish opportunity below 1.2570 or 1.2500. For that, it will be good to sell at 1.2500 with the first target of 1.2410. It will also call for a downtrend in order to continue towards 1.2343 in coming hours.

On the contrary, if a breakout takes place at the resistance level of 1.2670, then this scenario may become invalidated. Remember to place a stop loss; it should be set above the second resistance of 1.2690.