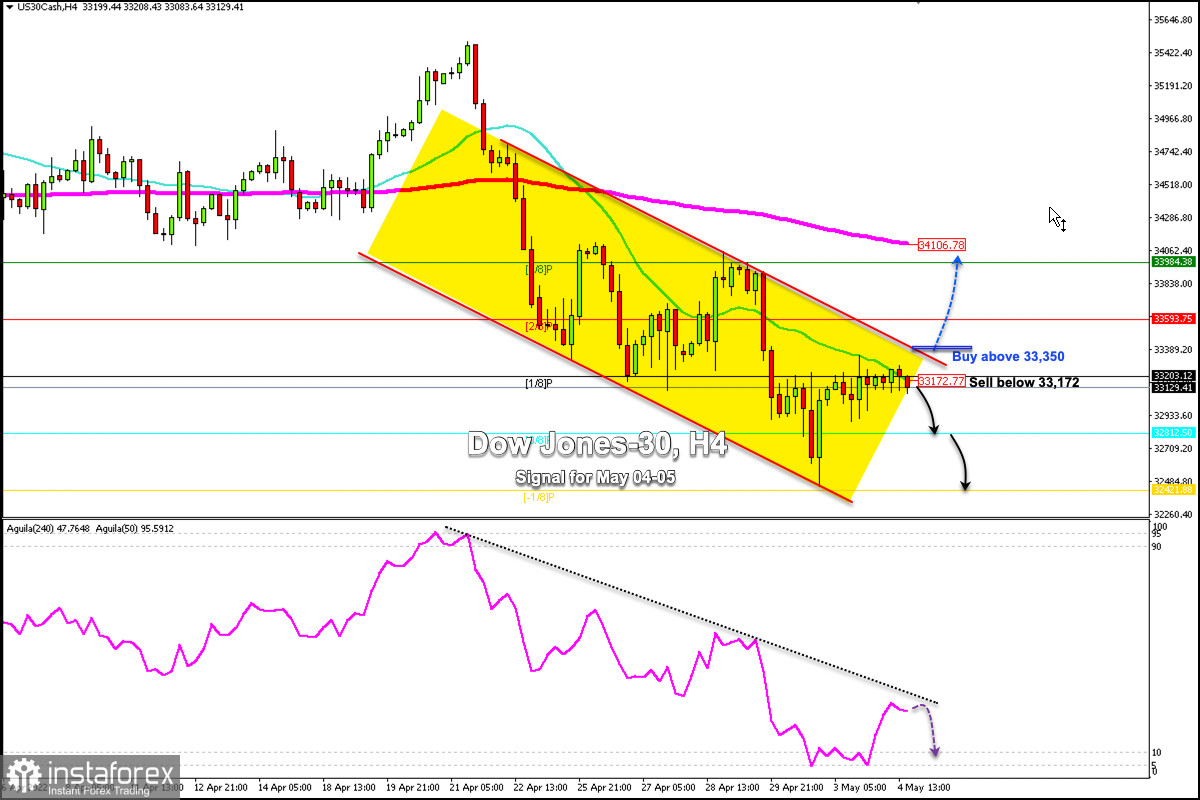

Early in the American session, the Dow Jones-30 Industrial Index (#INDU) is trading below the 21 SMA at 33,172 and below the 1/8 Murray at 33,203.

Since April 21, the Dow Jones has been trading inside a downtrend channel. It is likely to continue the downward movement in the next few hours towards 0/8 Murray at 32,812 and even down to -1/8 Murray at 32,421.

Everyone expects the Fed to raise rates by 0.50% when it announces its decision in the afternoon of the American session (2:00 PM). The market has already priced in this hike and is pricing in 3 more aggressive rate hikes of 0.50% this year.

In his press conference, Jerome Powell will give details about the next increases in the interest rate. This will make the markets move with high volatility waiting to digest the Fed's agenda.

According to the 4-hour chart, we can see that the Dow Jones is trading under downward pressure below the 21 SMA located at 33,172. DJ30 is likely to continue its downtrend in the coming hours and may reach the key level of 32,421 (-1/8).

Conversely, a close on the 4-hour chart above 33,350 will mean a break of the downtrend channel and a trend reversal so that the index could climb to 2/8 Murray at 33,593 and even to the 200 EMA at 34,106.

Since April 21, the eagle indicator has been oscillating inside a downtrend channel and is likely to continue to give a negative signal in the coming days.

Our trading plan is to sell below 33,172, with targets at 32,812 and 32,421. The eagle indicator is giving a negative signal which supports our bearish strategy.