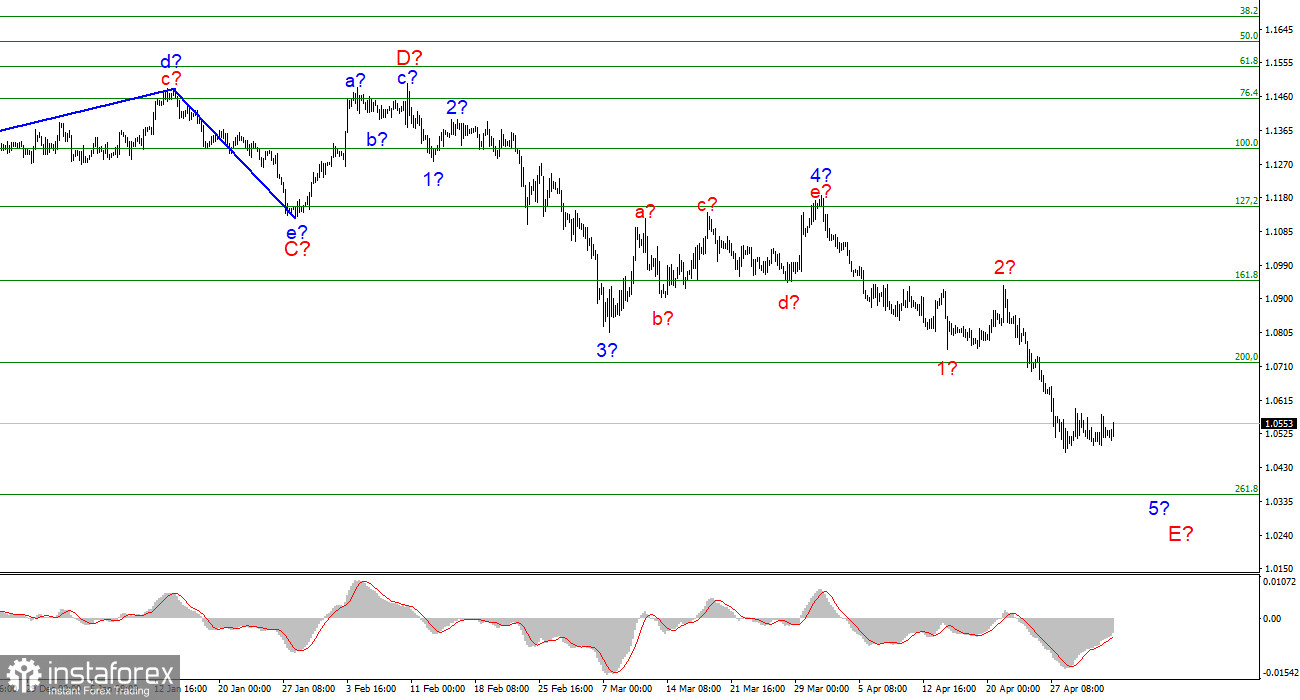

The wave marking of the 4-hour chart for the euro/dollar instrument continues to look convincing. The instrument continues to build a descending wave 5-E, which may be the last in the structure of the descending trend segment. If this is true, then the decline in the quotes of the euro currency may continue for another one or two weeks, since this wave may turn out to be a five-wave in its internal structure. At the moment, three internal waves are visible inside this wave, so I'm counting on building another pulse wave. A successful attempt to break through the 1.0721 mark, which equates to 200.0% by Fibonacci, indicates that the market is ready for further sales of the euro currency. In the coming days, the instrument may decline to the level of 1.0355, and there only 350 basis points will remain to price parity with the dollar. Presumably, the construction of the current downward wave and the entire downward section of the trend can be completed near this mark. If the breakout attempt of 1.0355 turns out to be successful, then the instrument will further complicate its wave structure.

Ahead of the Fed meeting, poor labor market data

The euro/dollar instrument rose by 30 basis points on Wednesday. Market activity was low today, the correction wave continued its construction. Thus, the wave pattern has not changed over the past day. Two reports have been released in the European Union today that could have attracted the attention of the market but did not do so. The index of business activity in the service sector showed a value of 57.7, which exactly coincided with the previous value and market expectations. Retail trade volumes in the European Union decreased by 0.4% m/m in March, which is slightly worse than expected. Nevertheless, at the time of writing, the European currency has grown slightly, so it is obvious that the market did not pay attention to the statistics from the Eurozone.

In the US, a more important report on the state of the labor market has been released. The change in the number of employees from ADP was +247K, which is lower than expectations by 140K. However, in reality, this report is much less important than the Nonfarm Payrolls report. And these two reports very rarely show a correlation with each other. That is, a weak ADP report does not mean that Friday's Payrolls report will also be weak. However, I admit that the reaction to the weak data on the labor market followed. The US currency declined by 20 points, which in itself is a very weak reaction. Now the market will wait for the evening announcement of the results of the FOMC meeting. I have already said in previous articles that the rate will be increased by almost 100% by 50 basis points. High inflation and loud promises of FOMC members leave them no other choice. Moreover, I believe that the rhetoric regarding the monetary policy tightening cycle will not change either. I think that the rate will be brought up to 2.5% in 2022, which is considered neutral. Only after that, it will make sense to analyze inflation and economic growth for the period in which the rate was actively increasing. And only after this analysis, it will be possible to conclude the expediency of new increases. Thus, the US currency may rise throughout 2022, but this is now contradicted by the wave pattern.

General conclusions

Based on the analysis, I still conclude that the construction of wave 5-E. If so, now is still a good time to sell the European currency with targets located around the 1.0355 mark, which corresponds to 261.8% Fibonacci, for each MACD signal "down". Now the construction of an internal correction wave in 5-E can proceed, which can be interpreted as the fourth.

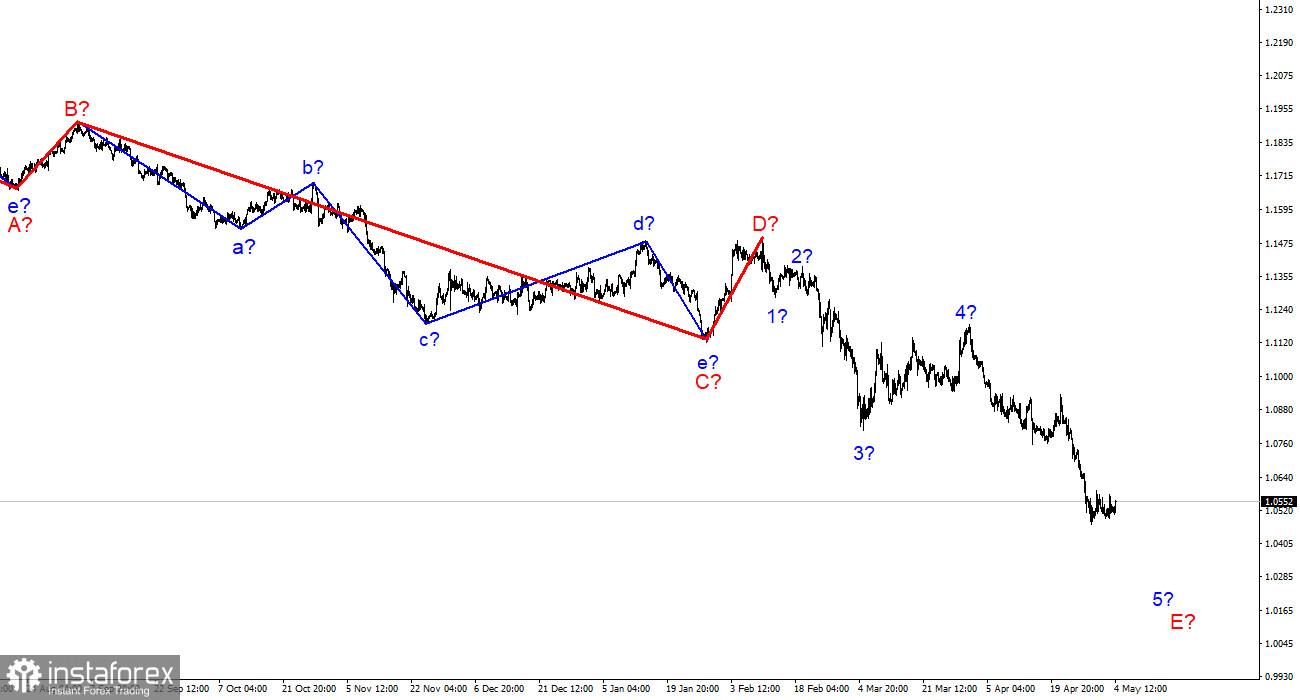

On a larger scale, it can be seen that the construction of the proposed wave D has been completed, and the instrument regularly updates its low. Thus, the fifth wave of a non-pulse downward trend section is being built, which turns out to be as long as wave C. The European currency will still decline for some time.