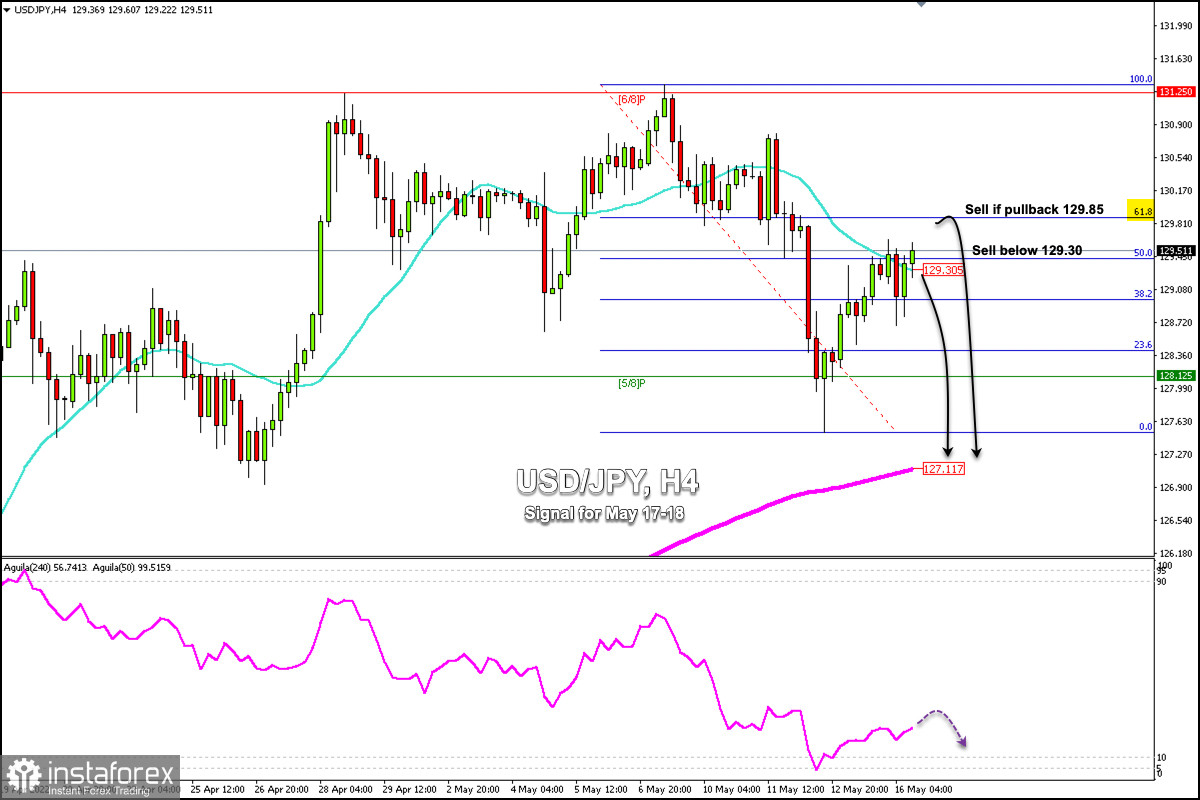

Japanese yen (USD/JPY) is trading above the 21 SMA located around 129.30, between the zone 61.8% Fibonacci and the 50%.

After hitting a low of 127.50 last week, the Japanese Yen is now trading around 129.50. This technical bounce in USD/JPY was due to the apparent stability in financial markets which weighed on the yen as a safe-haven asset.

According to the 4-hour chart, we can see that USD/JPY is making a technical bounce which could be considered an opportunity to sell in the coming days.

The 61.8% Fibonacci indicator is located around 129.85. Around this area, it will be a key point to sell and the pair could resume its short-term downtrend and reach 5/8 Murray at 128.12 and could even drop to 200 EMA around 127.11.

On the other hand, if the Japanese yen consolidates below the 21 SMA located at 129.30 in the next few hours, it will be a clear signal to sell below this level with targets at 38.2% Fibonacci around 129.00 and at 128.12.

On the other hand, any further upside move is likely to face strong resistance near 129.88 (61.8%). Above 61.8% Fibonacci, the key psychological level is located at 130.00, and 6/8 Murray at 131.25. If both levels are surpassed, the bearish outlook will be nullified.

Our trading plan for the next few hours is to sell the Japanese yen below 129.30 or in case of a pullback towards 129.85, it will also be an opportunity to sell. The eagle indicator is in the negative zone and is likely to continue to give a bearish signal in the coming days.