Crypto Industry News:

Central bank governors and finance ministers from the Group of Seven, or the G7, are reportedly planning to discuss cryptocurrency regulation.

According to a Reuters report, Bank of France governor Francois Villeroy de Galhau said representatives from the United States, Canada, Japan, Germany, France, Italy and the UK are likely to discuss issues related to the regulatory framework for cryptocurrencies at a meeting in the German cities of Bonn and Konigswinter . Villeroy reportedly said the recent volatility in the cryptocurrency market - possibly referring to some stablecoins receding from the US dollar and falling prices of major tokens - was a "wake-up call" for regulators around the world.

"Europe paved the way for MiCA," Villeroy said at an emerging markets conference in Paris, referring to the European Parliament's rules to create a regulatory framework for cryptocurrencies. "We will probably [...] discuss these issues at the G7 meeting in Germany this week, among others."

"Cryptographic assets can disrupt the international financial system if they are not regulated, supervised and interoperable in a consistent and appropriate manner across jurisdictions," added the President of the Bank of France.

According to the G7 website, finance ministers and central bank governors will meet in Germany on May 18-20 to discuss policies related to the reconstruction and financial stability of member states in the light of the COVID-19 pandemic, "shaping the upcoming transformation processes in a context of digitization and neutrality. climate change and the business policy of the International Monetary Fund. The group has issued guidelines for the possible introduction of central bank digital currencies in 2021.

Technical Market Outlook:

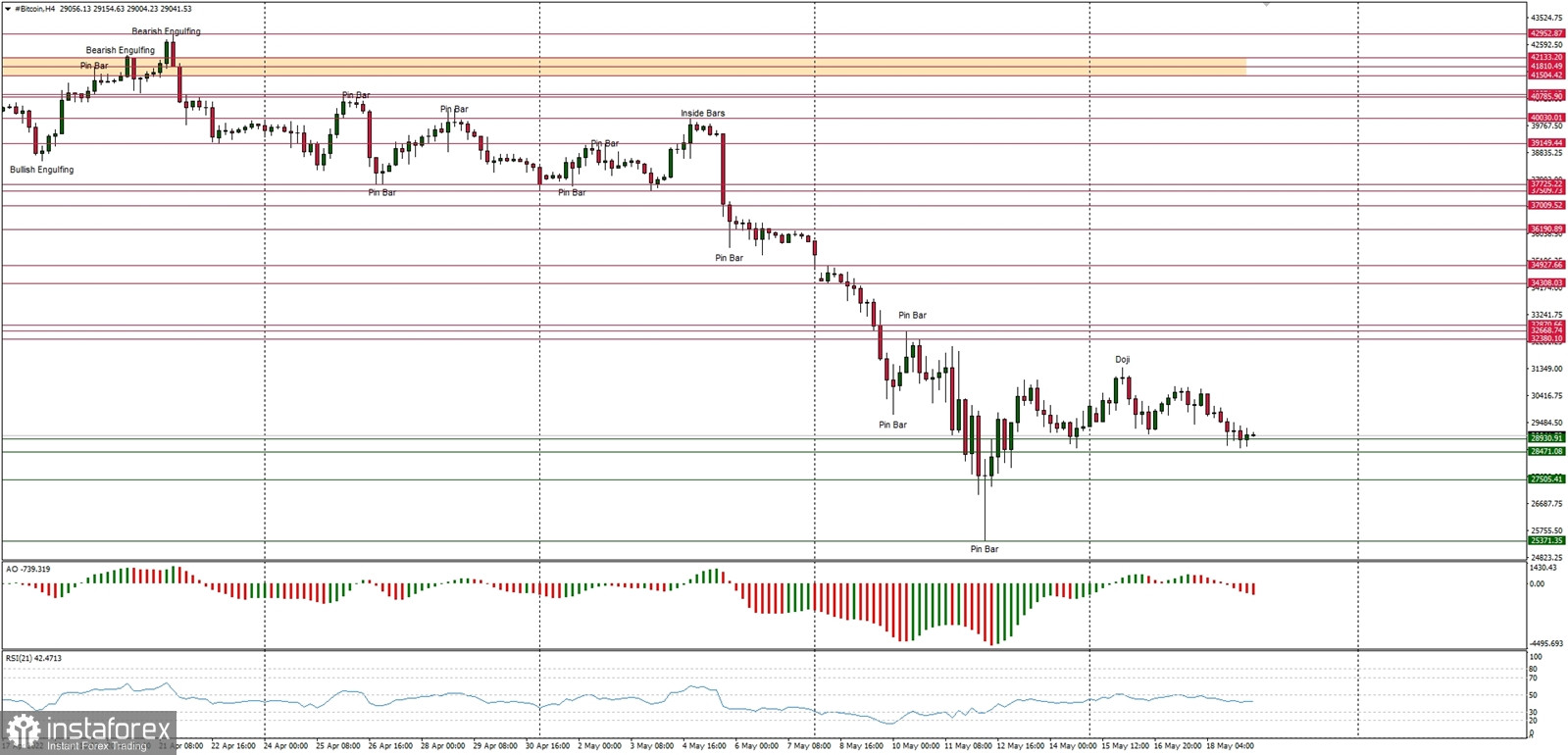

The BTC/USD pair has been seen consolidating the recent gains made from the bounce from the low located at the level of $25,371. The bulls keep trying to bounce higher and are currently testing the range lower level seen at $28,980. The local high was made at the level of $31,190 so far, but bulls are not that keen to continue the bounce anymore. The weak and negative momentum supports the short-term bearish outlook with a new target for bears seen at the level of $20,000. The market keeps making lower lows and lower highs on the H4 time frame chart, so the down trend is intact.

Weekly Pivot Points:

WR3 - $44,348

WR2 - $39,422

WR1 - $35,469

Weekly Pivot - $30,396

WS1 - $26,266

WS2 - $21,367

WS3 - $17,368

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames continues. So far every bounce and attempt to rally is being used to sell Bitcoin for a better price by the market participants, so the bearish pressure is still high. The key long term technical support is seen at the round psychological level of $20,000.