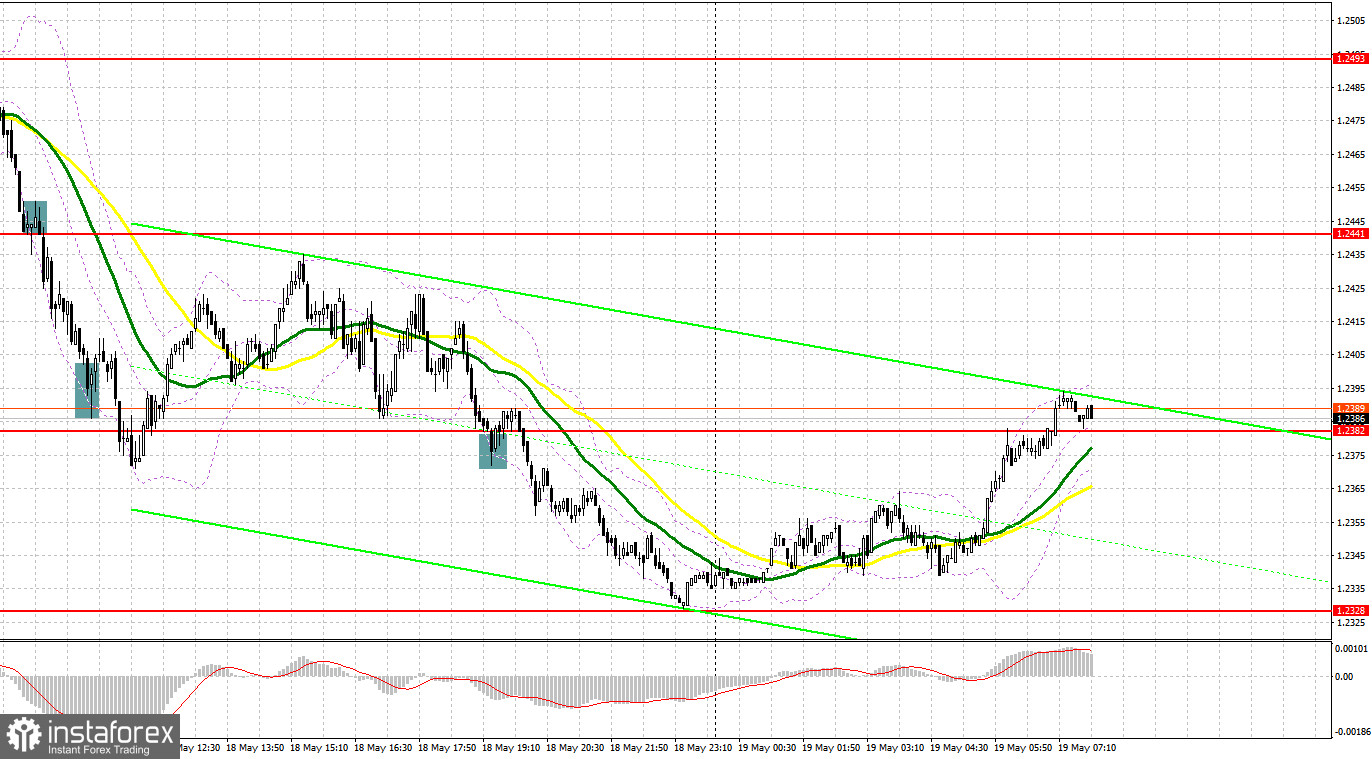

Yesterday, traders received several signals to enter the market. Let us look at the 5-minute to clear up the market situation. A less than expected rise in the UK inflation confused buyers of the pound sterling, making them close long positions. A break and an upward test of 1.2452 led to a rise in the number of short positions with the target at 1.2399. As a result, traders gained about 50 pips. Meanwhile, a false break of 1.2399 turned out to be a less profitable signal than expected. Early yesterday, the pair began rising from this level, but then dropped to 1.2399. In the second part of the day, the price did not test the expected levels. Only at the end of the US trade, the pound/dollar pair showed a false break of 1.2382. However, this signal also brought losses.

Conditions for opening long positions on GBP/USD:

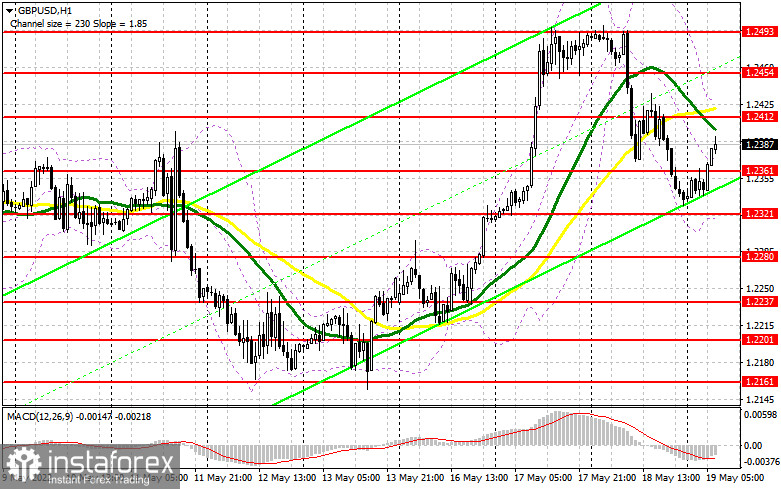

During the Asian trade, bulls were trying to keep the upward trend, which began on May 13. However, it is a hard nut to crack. Nevertheless, the pair may test the resistance level of 1.2412 amid the absence of macroeconomic reports from the UK. In my opinion, now buyers should primarily protect 1.2361. If the CBI industrial order expectations report returns pressure on the pound sterling, it will be better to focus on 1.2361 touched during the Asian trade. Only a false break of this level will give a long signal with the target at 1.2412. If the pair consolidates above 1.2412, it may jump. A downward test of this level may affect yesterday's stop orders placed by sellers. In this case, the pair could climb to the high of 1.2493, where it is recommended to lock in profits. A farther target is located at 1.2574. If the British pound declines and buyers fail to protect 1.2361, following a more likely scenario, the pair may collapse again. That is why traders should remain cautious when opening long positions. It is better to enter the market after a false break of the daily low of 1.2321. It is also possible to buy the asset after a bounce off 1.2280 or lower – off 1.2237, expecting a correction of 30-35 pips.

Conditions for opening short positions on GBP/USD:

If bears manage to protect 1.2412, they will have a chance to regain control over the market. In this case, the pound sterling may decline to the low recorded early this week. A false break of 1.2412 may boost the number of short orders with the target at 1.2361. A break and an upward test of this level will give an additional sell signal, thus pushing the British pound to a new low of 1.2321. A farther target is located at 1.2280. If the price tests this level, it will hardly rise further. However, this scenario will become possible only in the second part of the day after the publication of the US statistics and amid more intense bearish sentiment. If the pound/dollar pair rises and bears fail to protect 1.2412, the pair may surge. In this case, it will be wise to avoid sell orders until the pair hits another strong resistance level of 1.2454. Even then, traders may go short only after a false break of the level. It is also possible to sell the pound/dollar pair after a rebound from the weekly low of 1.2493, expecting a drop of 30-35 pips within the day.

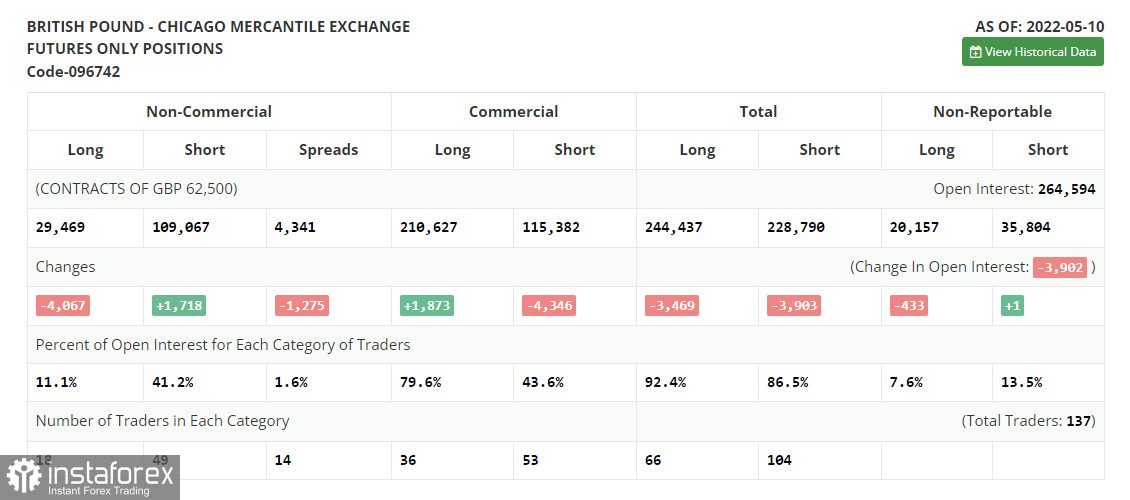

COT report

According to the COT report from May 10, the number of long positions dropped, whereas the number of short orders increased. Investors are selling off the British pound amid problems in the UK economy and surging inflation. Against the backdrop, the pound sterling is losing its attractiveness as demand for safe-haven assets and more profitable instruments is constantly growing. The Fed's monetary policy tightening is likely to go on supporting the greenback, pushing the British pound lower. Meanwhile, the key interest rate hike by the Bank of England has not brought results yet. In addition, rumors that the regulator may stop the normalization of monetary policy may cause new concerns among investors. I have already said that at the moment it is extremely difficult to estimate inflationary risks due to the current geopolitical situation. However, it is obvious that the consumer price index will go on climbing in the next few months. The UK labor market condition is also boosting inflation. The fact is that employers have to offer higher wages to fight for every employee. The COT report for May 10 unveiled that the number of long non-commercial positions slumped by 4,067 to 29,469, while the number of short non-commercial positions rose by 1,718 to 109,067. As a result, the negative value of the non-commercial net position jumped to -79,598 from -73,813. The weekly closing price decreased to 1.2313 from 1.2490.

Signals of indicators:

Moving Averages

Trading is performed below 30- and 50-day moving averages, thus pointing to an attempt of bears to regain control over the market.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

In case of a decline, the lower limit of the indicator located at 1.2321 will act as support. If the pair grows, the resistance level will be located at 1.2425.

Description of indicators- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions is a total number of long positions opened by non-commercial traders.

- Short non-commercial positions is a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.