Crypto Industry News:

Bitcoin has been hailed as the most famous blockchain use case, showing the efficiency of the technology in successfully delivering an immutable and truly decentralized ledger over the past 13 years. Adding to this years of innovation involving altcoins, NFT, DeFi and more, a study by fintech giant Deloitte outlined the untapped potential of the cryptocurrency ecosystem to open up to new markets for the sports industry.

Fan and NFT tokens were first introduced to the industry to increase fan engagement through collectibles and voting mechanisms. However, Deloitte predicts the industry will continue to use cryptocurrency and blockchain technology in the coming years.

Highlighting the upcoming trends in the sports industry, Deloitte's 2022 industry outlook report predicts a possible increase in blockchain-enabled innovations, as a result of which "The use of NFT, cryptocurrencies, fan tokens and ticket innovation will grow and evolve."

Deloitte expects the sports industry to start connecting viewers to season tickets via blockchain soon. While the first step towards this goal would only mean tying up match tickets to the NFT to reward fans, the innovation of smart contracting has the potential to open up new applications.

As a result, organizers and sports teams can create new revenue streams as smart contracts streamline processes related to dynamic ticket pricing and resale. However, Deloitte identified four key factors that the ecosystem must deal with: implementing new standards, educating fans and taking into account, inter alai, tax consequences.

In addition, a Deloitte study revealed that the NFT catalyzed the fusion of the physical and virtual worlds in sports, while predicting over $ 2 billion in sports-related NFT deals in 2022 alone.

Technical Market Outlook:

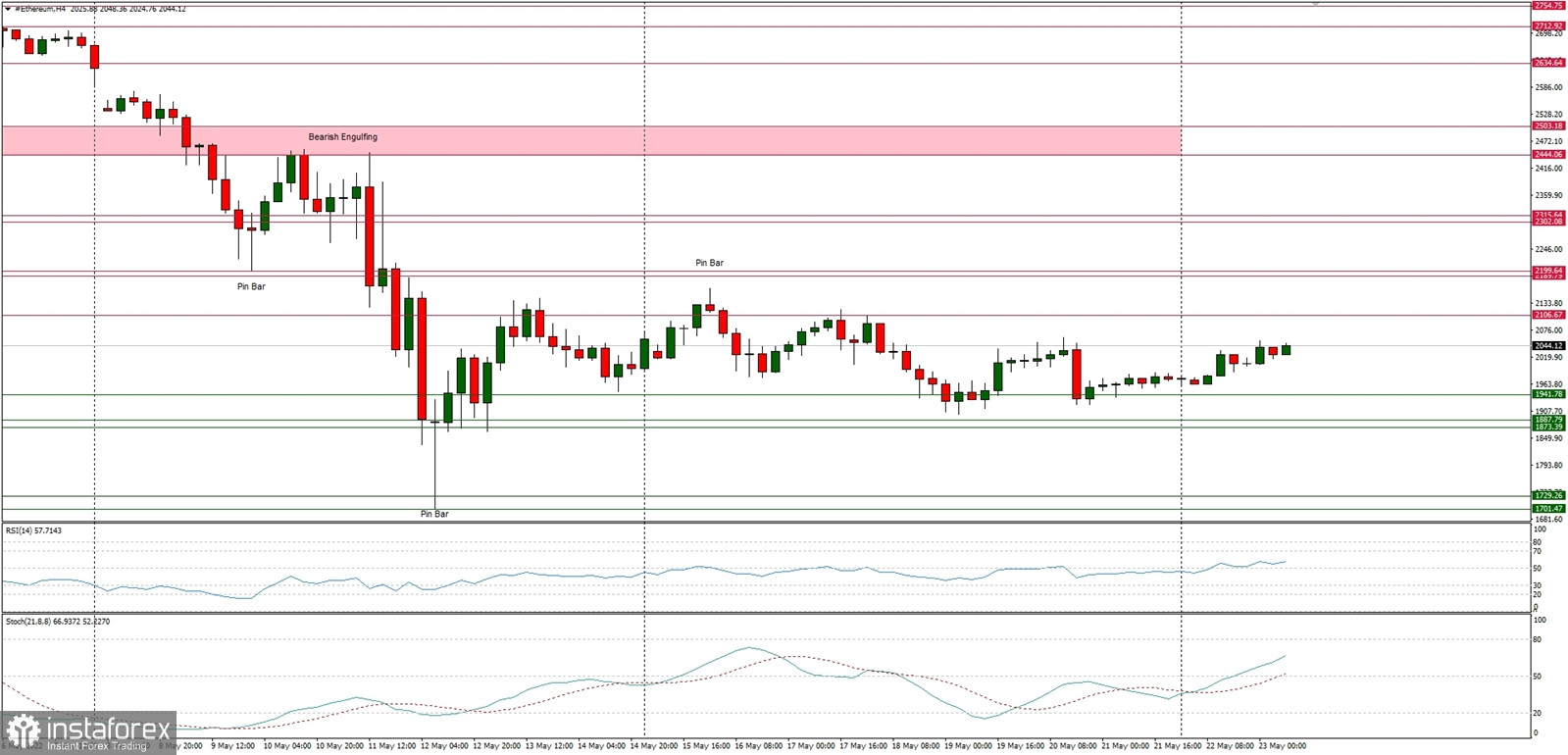

The ETH/USD pair has successfully bounced from the range low located at the level of $1,887 and is heading higher. The nearest technical resistance is seen at $2,106 and $2,199, but the weak and negative momentum still supports the short-term bearish outlook. The market keeps making lower lows and lower highs on the H4 time frame chart, so the down trend intact.

Weekly Pivot Points:

WR3 - $2,386

WR2 - $2,268

WR1 - $2,122

Weekly Pivot - $2,009

WS1 - $1,865

WS2 - $1,755

WS3 - $1,597

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $2,000 and continues to make new lower lows with no problems whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the level of $1,420.