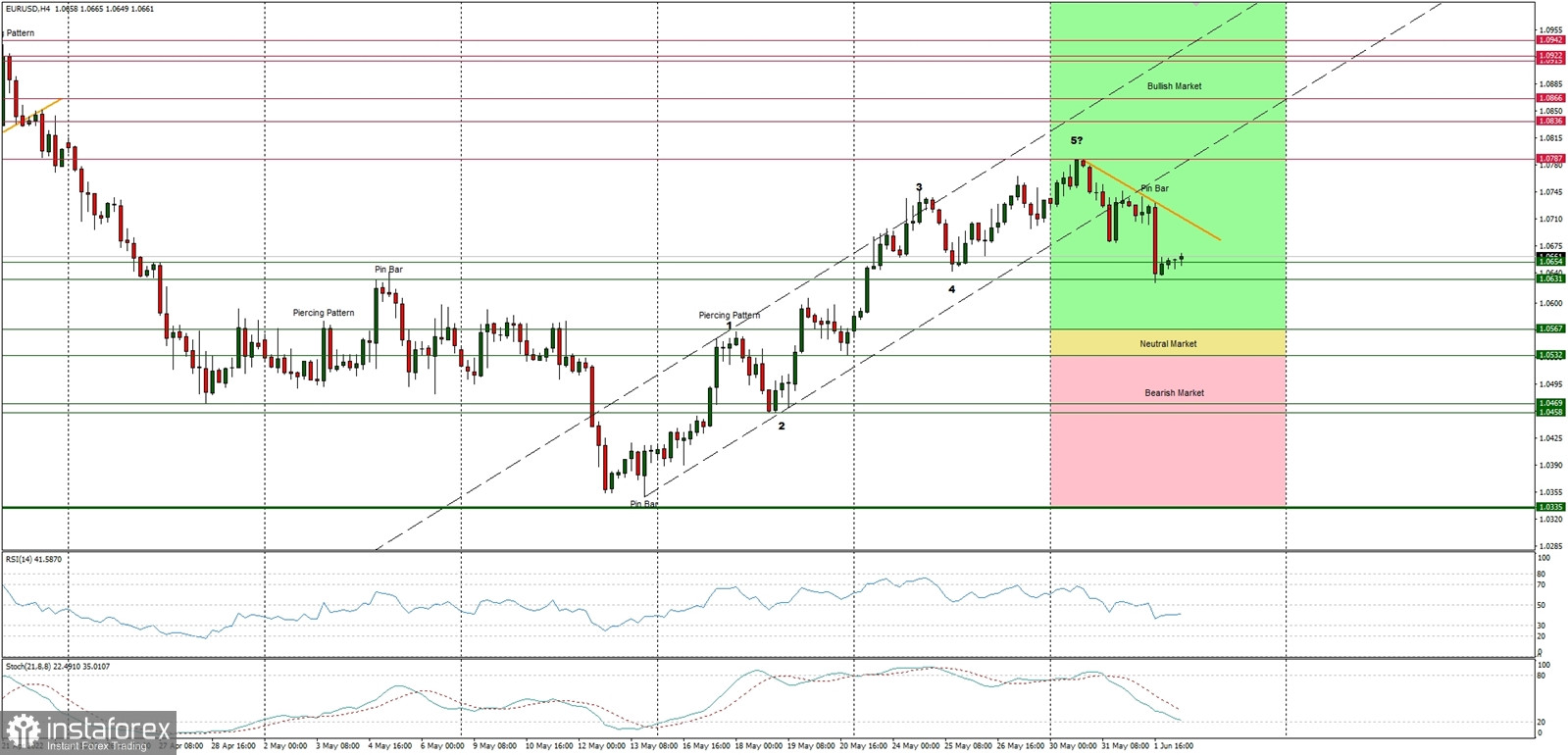

Technical Market Outlook:

The EUR/USD bulls failed to break through the key short-term supply zone located at the level of 1.0786 and did not hit the 161% Fibonacci extension of the wave C located at 1.0805. Instead, the market fell out of the channel and tested the immediate technical support located at 1.0654. If this level is clearly violated, the termination of the impulsive cycle is confirmed and the correction to the downside is in progress. The nearest technical resistance is seen at 1.0678, 1.0715 and at the local high located at 1.0787.

Weekly Pivot Points:

WR3 - 1.1043

WR2 - 1.0898

WR1 - 1.0827

Weekly Pivot - 1.0691

WS1 - 1.0625

WS2 - 1.0485

WS3 - 1.0411

Trading Outlook:

The market had bounced from the key long-term technical support located at the level of 1.0336 and is heading higher. The up trend can be continued towards the next long-term target located at the level of 1.1186 only if bullish cycle scenario is confirmed by breakout above the level of 1.0726, otherwise the bearswill push the price lower towards the next long-term target at the level of 1.0336 or below.