The crisis of 2008 forced the Federal Reserve to take emergency measures. Including the introduction of the so-called quantitative easing program. Its essence boils down to buying various securities from various financial institutions. Primarily bonds. With an obligation to buy them back. Through this program, the central bank injected huge amounts of money into the economy. At the same time, the terms for the repurchase of assets were not initially set. And even when the program was completed, it was actually extended by the introduction of new ones. As a result, a lot of securities accumulated on the Fed's balance sheet, and not of the highest quality. After all, the events of 2008 showed that many issuers of securities, especially bonds, are in principle insolvent. But urgent action had to be taken. So the Fed was ready to provide financing even on the security of securities, which are usually called "junk". All to save the economy. But after the financial position of the banking system stabilizes, the central bank should begin the reverse process. That is, financial institutions redeem previously sold securities from the Fed and return the funds poured into the economy.

The fact that this is inevitable was known back in 2009. No one really knew exactly when that would happen. Initially, it was assumed that just a couple of years after the start of the very first program. More than ten years have passed since then. And this happened yesterday. The Fed has embarked on what is known as quantitative tightening. Within three months, buyback volumes will gradually increase and reach $95 billion per month. In the face of several trillion dollars poured into the financial sector over the years, this is a drop in the ocean. So the program will stretch for years. Nevertheless, the very fact of the reversal of funds flows immediately led to a noticeable strengthening of the dollar and a decrease in stock indices. After all, the funds received through quantitative easing programs were directed to all kinds of financial markets. Especially in the stock market. And not only in the United States, but throughout the world. American banks have begun to liquidate their positions en masse and prepare the necessary funds, which they must now return to the Fed. This is such a large-scale and even epoch-making event that all others fade against its background. So there is no point in considering some kind of macroeconomic statistics.

But the initial shock has already passed. Of course, the action of the quantitative tightening program will permanently put pressure on all financial markets without exception. So, ceteris paribus, the dollar will strengthen rather than depreciate. Macroeconomic statistics can only influence the speed of this process. And apparently, the euro will continue to lose its positions just at the expense of statistics. The fact is that the growth rate of producer prices may accelerate from 36.8% to 39.0%. In other words, inflationary pressure continues to rise. Although inflation in Europe is already at a record high.

Producer price index (Europe):

However, the strengthening of the dollar will not be as impressive as yesterday. It will be held back by US statistics. It is possible that it will even lead to a slight weakening of it. After the opening of the US session. After all, data on employment in the United States will be released today. Employment should rise by 205,000, which is significantly less than 247,000 last month. That is, we are talking about a slowdown in the positive dynamics in the labor market, which looks more like a negative factor.

Employment change (United States):

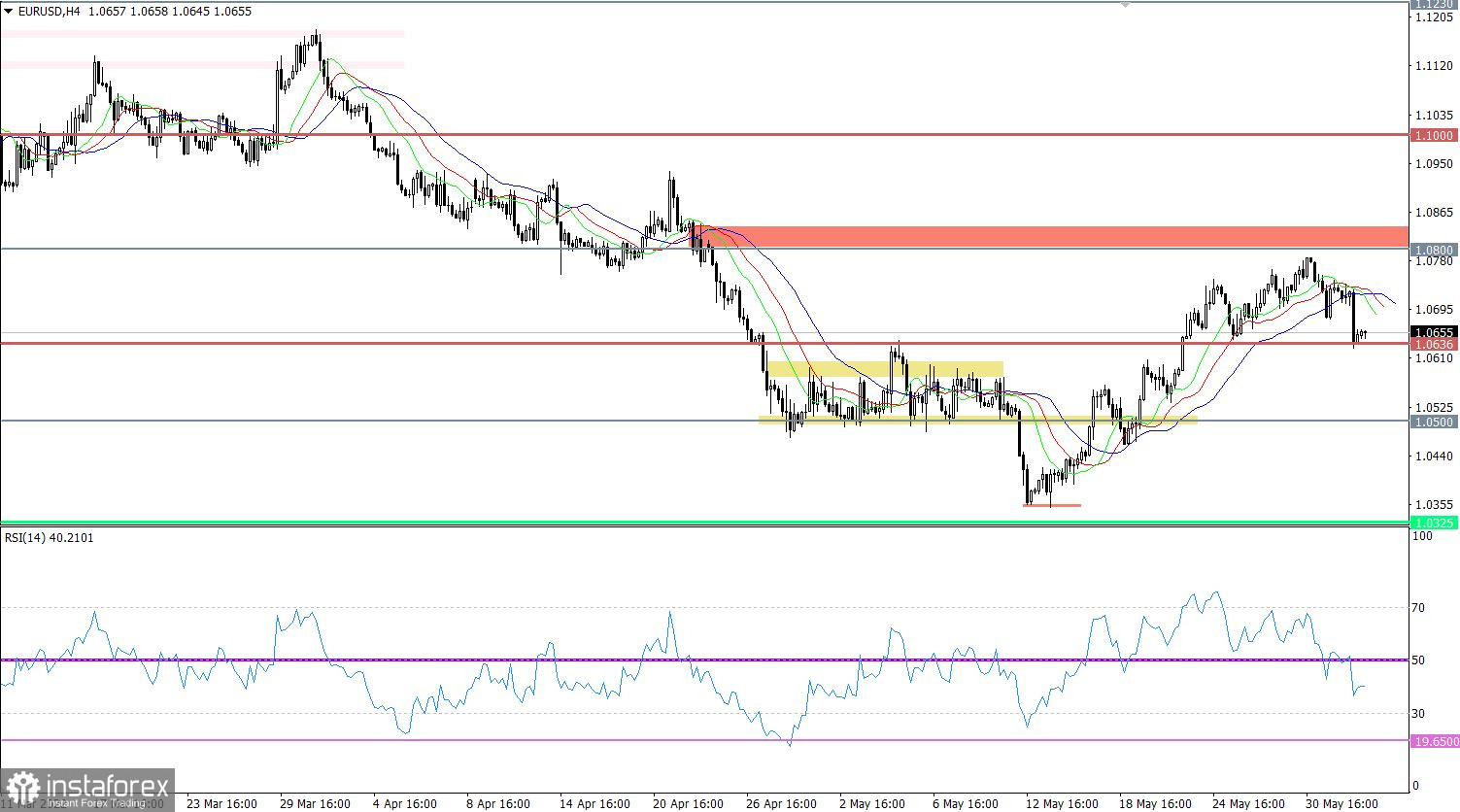

The EURUSD currency pair accelerated its decline, as a result of which the euro fell towards the level of 1.0636. This movement indicates the completion of the corrective move, where a phased process of restoration of dollar positions may soon take place.

The technical instrument RSI H4 is moving in the lower area of the indicator, which indicates a high interest of traders in short positions. RSI D1 crossed the middle line 50 from top to bottom, which may signal the end of the correction stage.

The moving MA lines on Alligator H4 have changed direction, which is considered a sell signal. Alligator D1 is late with a signal about the completion of the correction, there is no intersection between the MA lines.

Expectations and prospects:

In order to confirm the signal to sell the euro, the quote needs to stay below the level of 1.0636 for at least a four-hour period. In this case, traders will have high chances of moving towards the values of 1.0570-1.0500.

Otherwise, the market may experience another stagnation with a local rollback relative to the pivot point.

Comprehensive indicator analysis has a short-term and intraday sell signal due to the down cycle. Indicators in the medium term have a variable signal due to the change in trading interests.