GBP/USD fell below the psychological level of 1.2000 on Tuesday for the first time since March 22, 2020. After bottoming at 1.1932, it started a rally that continued into the European session, approaching 1.2124. The pound sterling is rising for the first time after a five-day losing streak when it fell from 1.26 accumulating more than 650 pips.

A correction in the US dollar (USDX) is favoring GBP/USD to the upside on Wednesday. Early in the American session, the pair is trading in the 1.2120 area, with the focus on the Fed meeting to be published at 2 pm.

On June 16, it will be the turn of the Bank of England, which is also expected to raise interest rates. The consensus is for a 25-basis point increase and part of the focus will be on the number of votes for a larger increase of up to 50bp.

Investors seem convinced that the Fed will raise interest rates faster to curb rising inflation. A big rise of 0.75% is expected in the next two meetings in June and July. Therefore, the market's attention will remain on the Fed's announcement, which will be published in the next few hours.

The Fed's decision is expected to weigh on the US dollar and produce strong volatility and short-term trading opportunities around the GBP/USD pair.

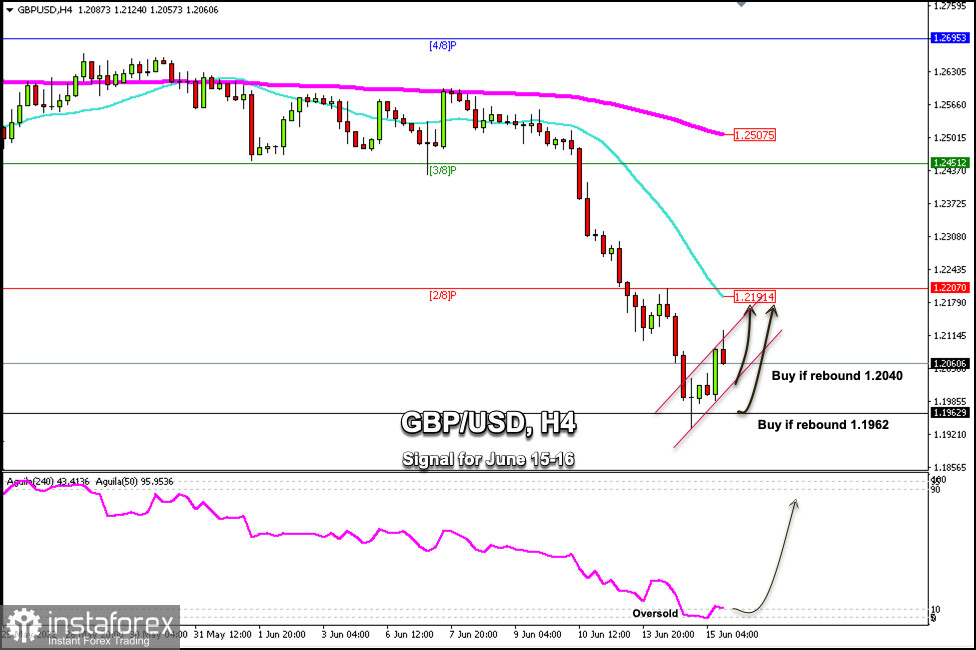

On the 4-hour chart, we can see that the pound sterling has reached zone 1/8 Murray around 1.1962. It can be seen that it is making a technical correction and is likely to find support around the pivot point of 1.2040.

If the GBP/USD pair continues with its technical correction and retests the 1/8 Murray, it will be an opportunity to buy with targets at 1.2000 and 1.2191 there is the 21 SMA.

If the pound sterling makes a daily close below 1.1950 it will be a negative sign and it is likely to continue its decline so we should avoid buying as it could start another bearish move.

According to the eagle indicator, on June 15 the British pound touched the extreme oversold zone around 5-points which is likely to have an imminent bounce in the next few hours and could favor our bullish strategy.