If the sharp rise in Treasury yields, the collapse of the stock market, and the strengthening of the US dollar allow investors to draw parallels with the taper tantrum of 2013, then Europe is playing out its own tragedy. After the ECB did not give any hints at its last meeting about how it is going to calm the currency bloc's debt market, Italian 10-year bond yields soared higher to an 8-year high of more than 4%. The situation began to resemble the debt crisis of 2011, which threatened the territorial integrity of the eurozone. Unsurprisingly, Christine Lagarde and her colleagues were forced to move.

Bloomberg disseminated information about an extraordinary emergency meeting of the Governing Council, where issues of closing spreads on European bonds are being discussed. How to reinvest the proceeds from repayable securities in order to reduce the differential rates on Italian and German debt is a key indicator of European political risk. It rose to 2.4%, and there were rumors in the market that the continuation of the rally to 3.5% would force the ECB to intervene. The central bank reacted earlier, which reduced the spread.

Dynamics of the Italian and German bond yield differential

In fact, nothing extraordinary has happened yet. The acceleration of inflation to historical highs and the ECB's intention to raise the deposit rate in July with a possible acceleration of the process of monetary restriction naturally lead to an increase in bond yields. In order for Rome, burdened with 150% debt to GDP, not to panic, the European Central Bank needs to buy more Italian than German bonds. The solution is quite simple, but it should have been packaged in a certain form and given to the markets. Lagarde and her colleagues did not do this at the June meeting, they will do it now. Most importantly, they understand that it is dangerous to sit on the sidelines.

Another thing is that the problems of the euro do not end there. The initiative of Britain, which decided to unilaterally amend the international agreement on Brexit, caused anger and a lawsuit from the EU. Brussels insists on the illegality of such actions by London, which could eventually result in a trade war. The deterioration of trade relations and deglobalization are extremely negative factors for the currencies of export-oriented countries and regions, so the fears of the "bulls" on EURUSD are understandable. For now, these fears will have to be postponed, since the Fed meeting is on the agenda.

In my opinion, the market was too early to believe in a 75 bps increase in the federal funds rate. If the Fed makes a 50 bps move, a sell-off in the US dollar could follow.

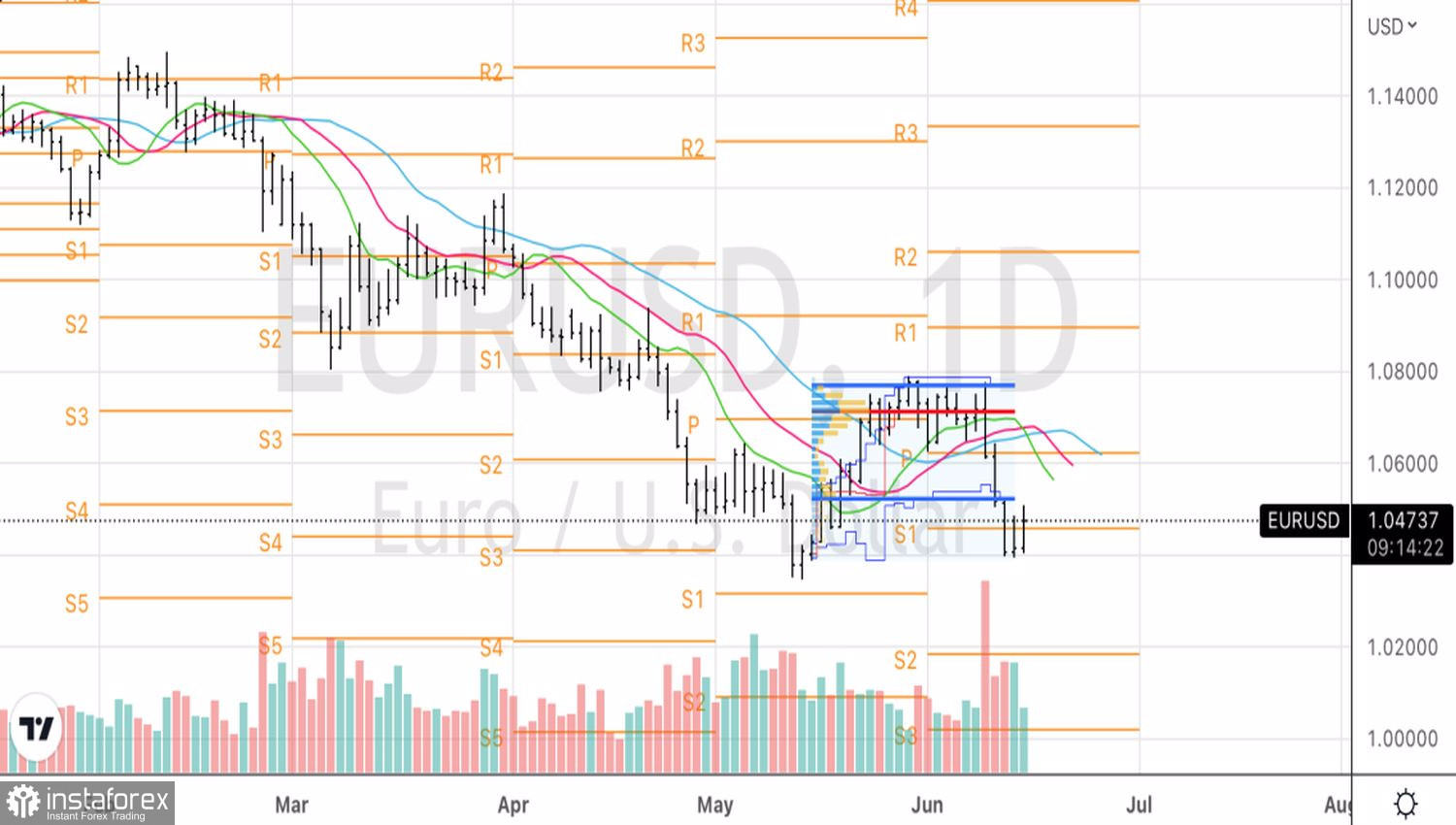

EURUSD, Daily chart

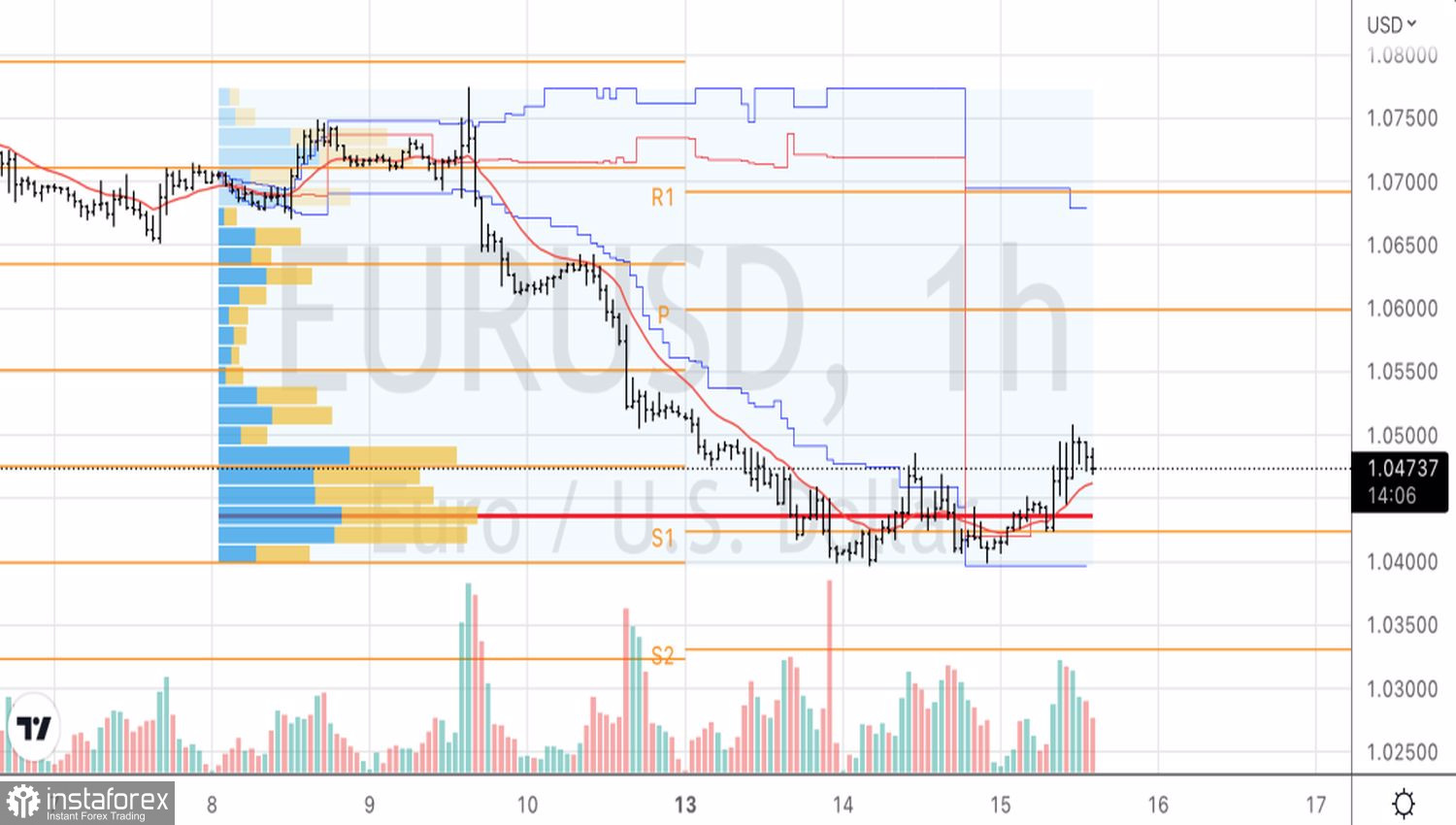

EURUSD, Hourly chart

Technically, there is an inside bar on the EURUSD daily chart. Breaking through its upper boundary at 1.0475 is the basis for purchases, the lower one at 1.04 is for sales. There is a Double Bottom on the hourly time frame. The signal for the formation of short-term longs will be an update of the local high at 1.051.