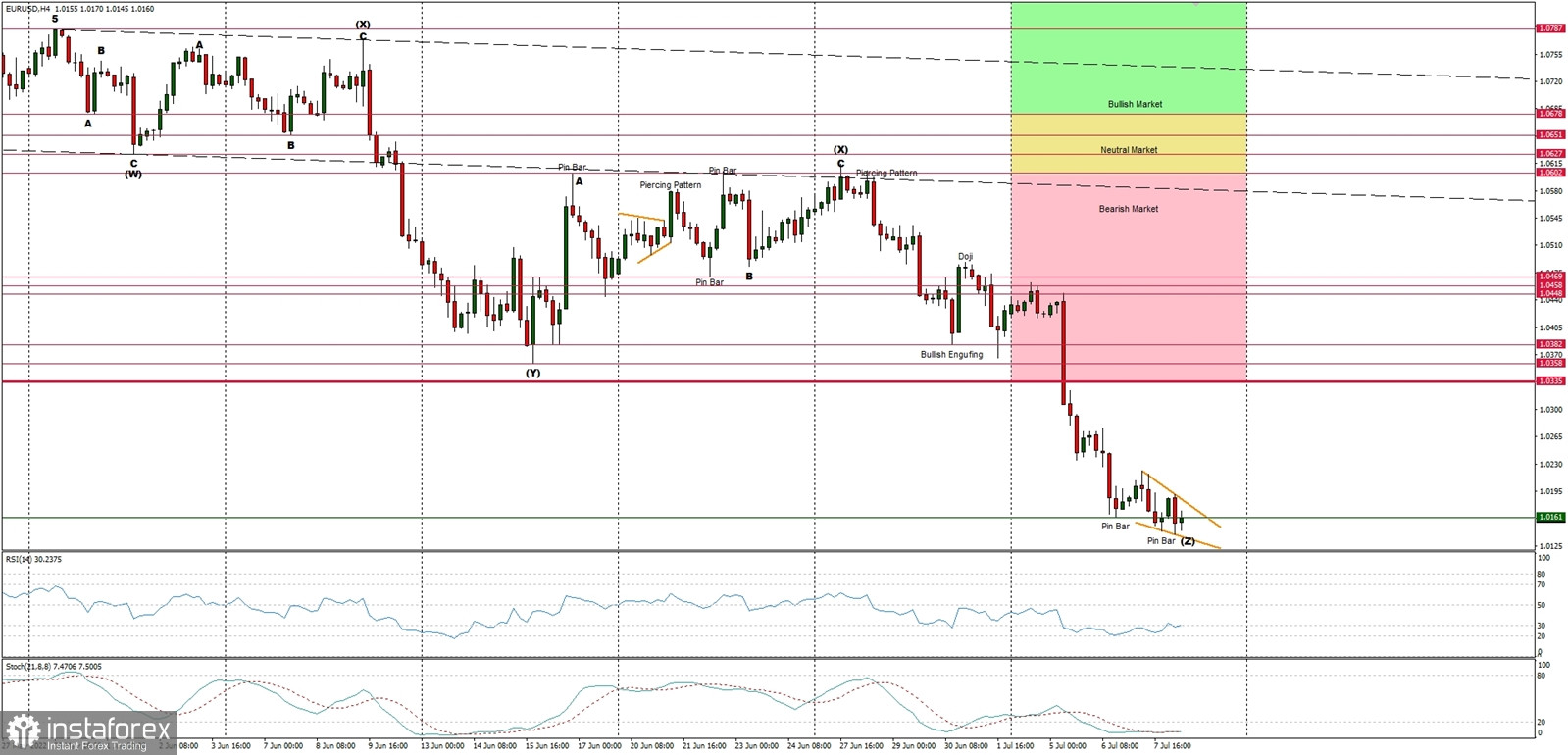

Technical Market Outlook:

The EUR/USD pair had been continuing to move lower, so bears made a new monthly low at the level of 1.0139 (at the time of writing the analysis). The next target for bears, in the case of a sustained breakout lower, is seen at the monetary parity level of 1.0000. The last biggest bounce had been capped at the supply zone seen between the levels of 1.0448 - 1.0469, since then all the bounces are shallower. The weak and negative momentum on the H4 time frame supports the bearish outlook for EUR. Please notice, that despite the recent efforts, the market participants keep trading inside the bearish zone (pink), the level of 1.0615 is still unreachable for them, and they need to break above the level of 1.0678 to enter the bullish zone (green). All of the shallow bullish bounces are still being faded by bears.

Weekly Pivot Points:

WR3 - 1.0797

WR2 - 1.0704

WR1 - 1.0546

Weekly Pivot - 1.0455

WS1 - 1.0287

WS2 - 1.0199

WS3 - 1.0048

Trading Outlook:

The up trend can be continued towards the next long-term target located at the level of 1.1186 only if the complex corrective structure will terminate soon (above 1.0335) and the market will rally above 1.0678 level. The bullish cycle scenario is confirmed by breakout above the level of 1.0726, otherwise the bears will push the price lower towards the next long-term target at the level of 1.0335 or below, towards 1.0000.