The content of the minutes of the meeting of the board of the European Central Bank greatly disappointed investors, and as a result, the single European currency took another step towards parity with the dollar. The thing is that on Monday, the head of the Bundesbank announced the need for a cautious approach to raising interest rates, otherwise it could lead to the bankruptcy of a number of countries in the euro area. Everyone took this as a warning that the ECB will raise the refinancing rate extremely slowly, while the inflation rate is already so high that some emergency measures are needed. It clearly follows from the content of the minutes that during the next meeting, the refinancing rate will be increased by only 0.25%, while it was previously assumed that it would be increased by 0.50%.

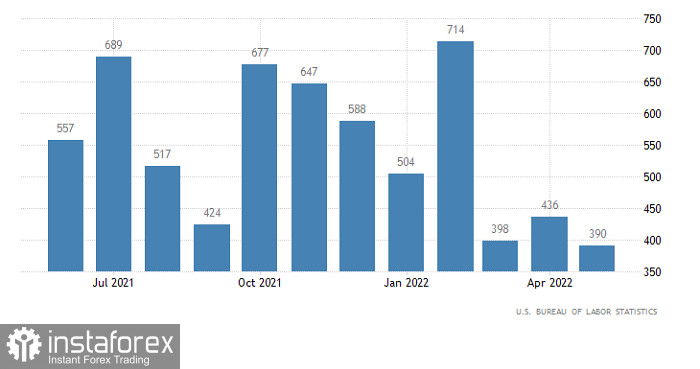

However, today the single currency may well strengthen its position. After all, the main event of the day is the report of the United States Department of Labor. And while the unemployment rate should remain unchanged, 300,000 new jobs could be created outside of agriculture. While 390,000 were created last month, it looks like the US labor market is losing momentum and there are signs of a worsening situation. Given the obvious local overbought dollar, this may well be enough to weaken the positions of the US currency.

Number of new non-agricultural jobs (United States):

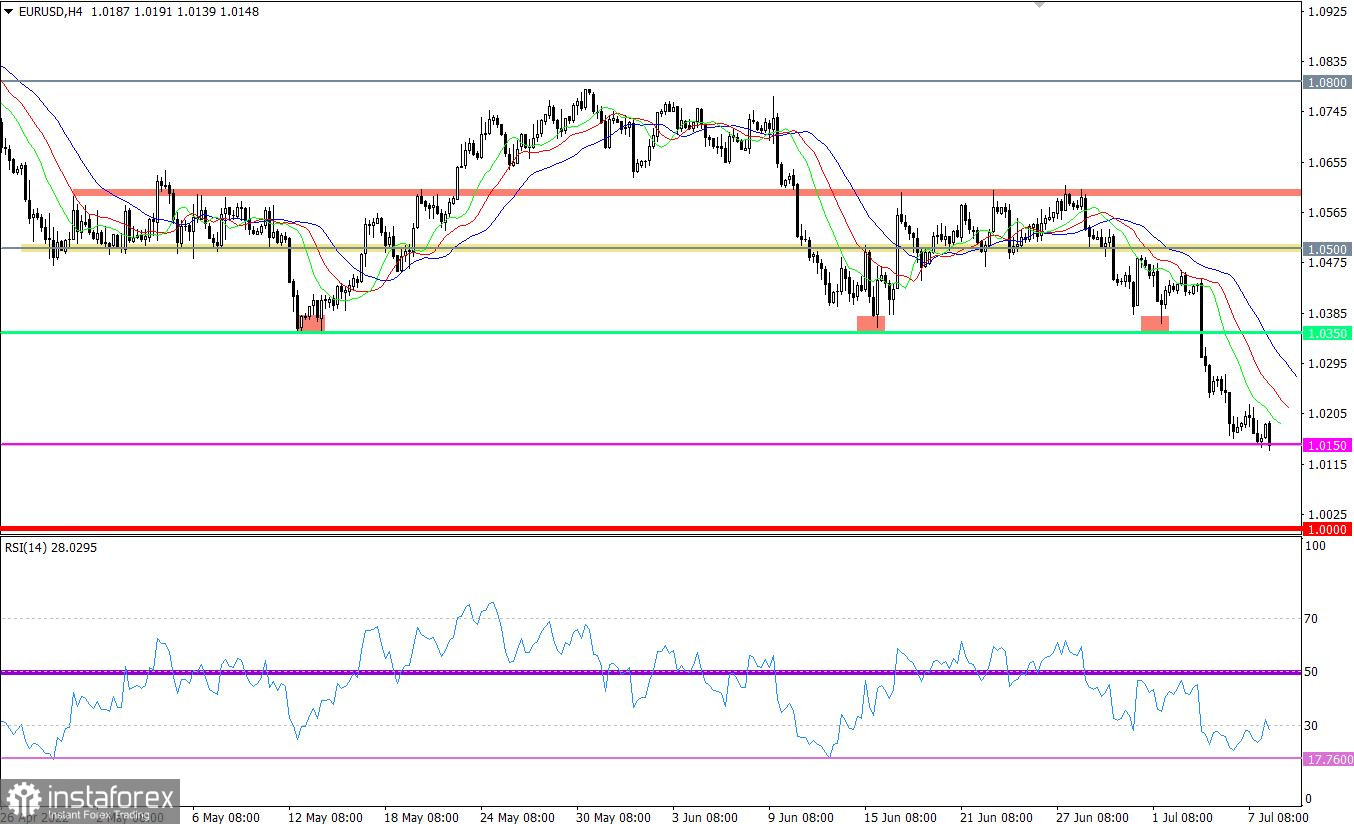

The EURUSD currency pair, after a short stop, resumed its decline. This move led to a breakdown of the level of 1.0150, thereby increasing the chances of euro sellers to see historical parity.

The technical instrument RSI H4 is moving in the oversold zone, which indicates a high interest of speculators in short positions. In fact, traders ignored the signal about overheating of short positions and the euro being oversold.

Moving MA lines on the Alligator H4 and D1 indicators are directed downwards, which corresponds to the direction of the main trend.

Expectations and prospects

In this situation, the stable presence of the price below the value of 1.0150 significantly increases the chances of a subsequent decline in the quote. As a possible perspective, traders are considering parity. It is worth considering that the initial convergence with such an important psychological level can provoke a wave of speculation. Thus, chaotic price jumps cannot be ruled out.

Complex indicator analysis has a sell signal in the short, intraday and medium term due to the inertial downward move.