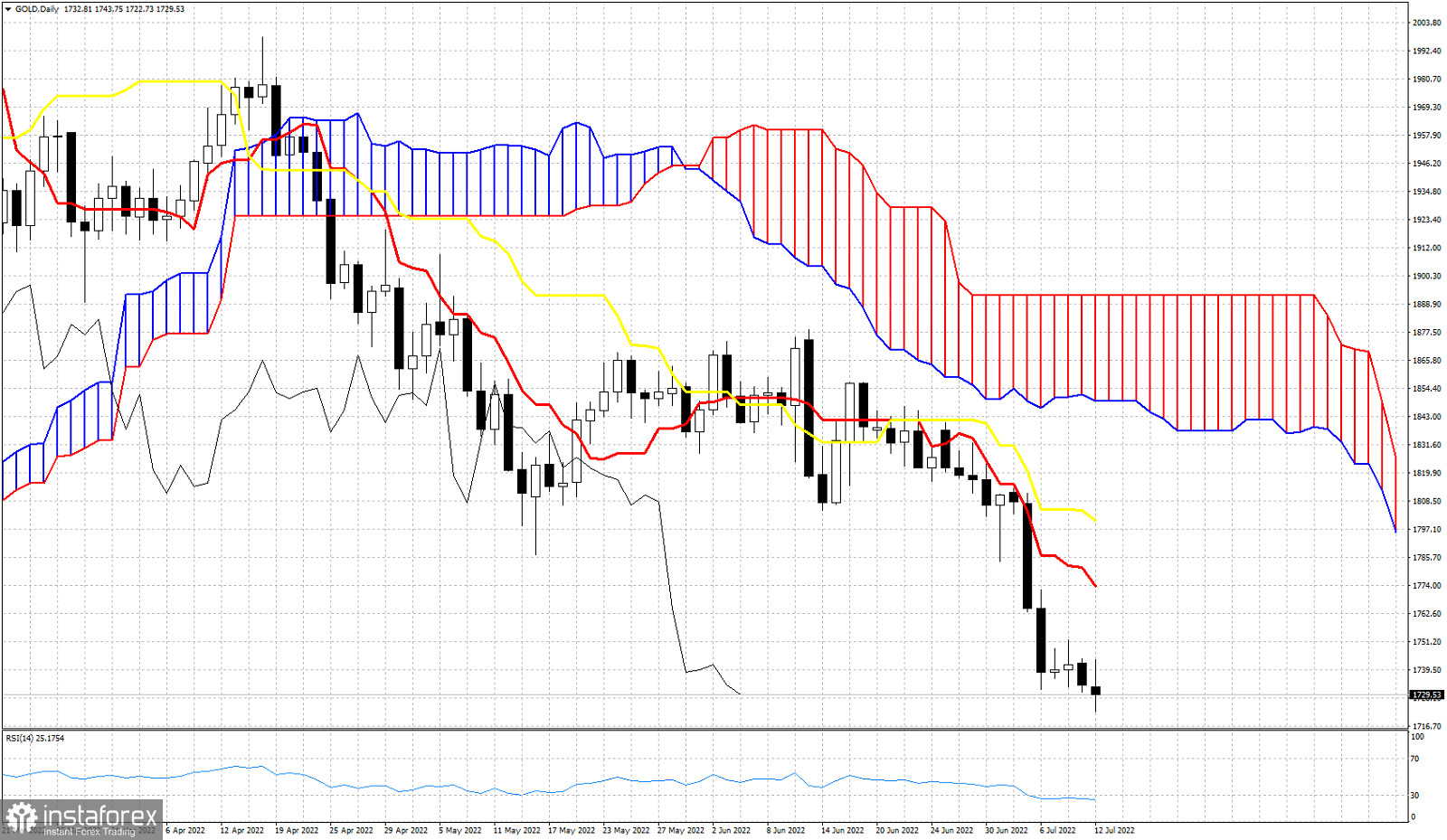

Gold price continues trading above $1,700. Trend remains bearish for the medium-term as price is still below the Daily Kumo (cloud). As we explained in previous posts Gold price justifies a bounce towards $1,770. Today we use the Ichimoku cloud indicator in order to identify key short-term resistance levels that will signal this possible bounce higher. The tenkan-sen (red line indicator) is at $1,773 and this is the first important short-term resistance. The kijun-sen (yellow line indicator) is at $1,800. Previous support is now resistance. The Chikou span (black line indicator) is below the candlestick pattern confirming we are in a bearish trend. The Daily Kumo (cloud) provides the most important resistance at $1,850-90. As long as price is below the Daily Kumo, trend will be controlled by bears. In the shorter time frames, trend remains controlled by bears and bulls will need to recapture $1,770-$1,800 in order to change it.