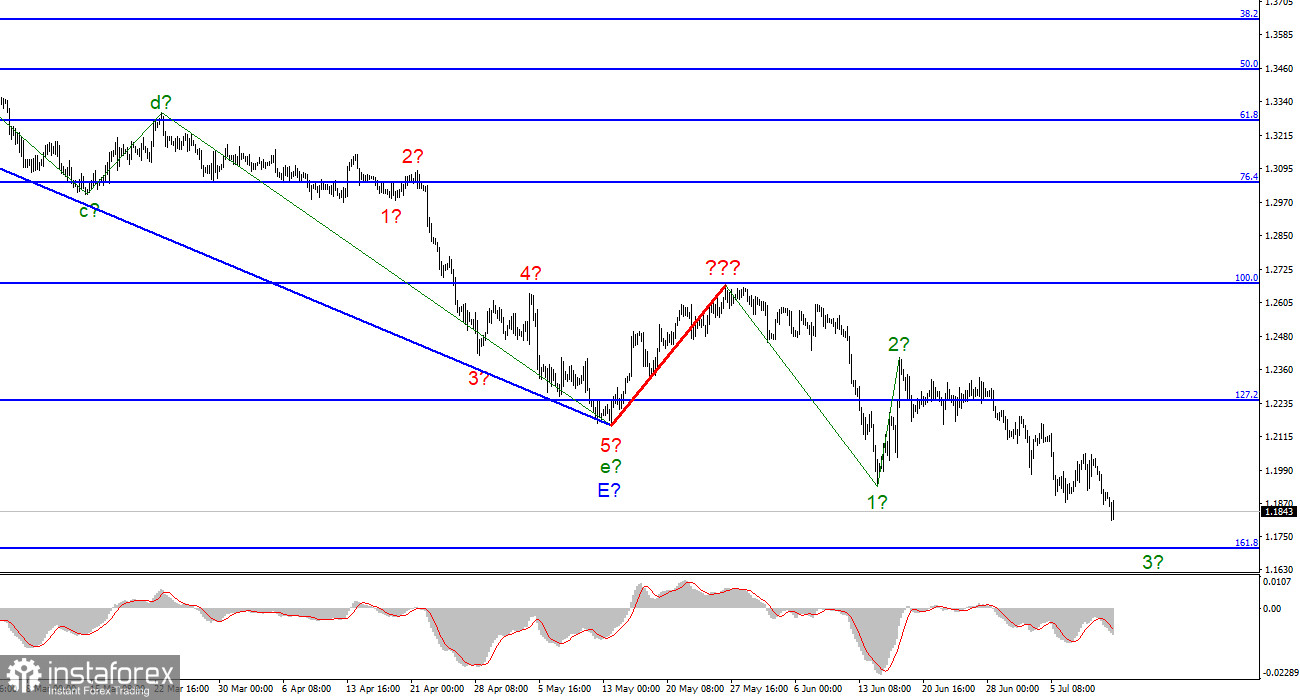

The wave marking for the pound/dollar instrument required clarifications, which were made. The upward wave constructed between May 13 and May 27 does not currently fit into the overall wave picture, but it can still be considered corrective as a segment of the downward trend. Thus, we can now definitively state that the construction of the correction section of the trend has been canceled, and the downward section of the trend will assume a longer and more complex shape. I am not a big fan of continually complicating the wave marking when dealing with a trend zone that is significantly elongating. I believe it would be considerably more efficient to identify rare corrective waves, after which new impulse structures could be constructed. We currently observe waves 1 and 2, so we can assume the instrument is in the process of constructing wave 3. If this is the case, the decline may continue with targets near the 161.8% Fibonacci level. The market has demonstrated that it is now more important to adhere to the trend than to mark waves.Former Minister of Finance Rishi Sunak is the second candidate for the position of prime minister.

During July, the pound/dollar exchange rate decreased by 20 basis points. Yesterday, I stated that Foreign Minister Liz Truss is the leading candidate for the position of British prime minister. However, within a single day, the situation completely changed. Former Finance Minister Rishi Sunak has also declared his candidacy for the upcoming elections and has already received the support of more than thirty Conservative Party members of parliament. Consequently, Sunak is currently the frontrunner in the election race. This week will see the first round of elections, and the list of candidates for prime minister will close today. There are eleven applications, but only two or three candidates have a realistic chance of winning.

I do not wish to discuss who could win the election at this time. I can only predict that the general direction of the United Kingdom's development will not change dramatically. As is customary in election campaigns, all candidates for the vacant position left by Boris Johnson are currently making fantastical claims. However, it is uncertain how many of these predictions will be realized. None of the leading candidates made promises that would significantly alter foreign policy or the economy. As usual, we're discussing tax cuts, national cohesion, etc. What is a British citizen's current focus? Monday and Tuesday were devoid of any non-political news. I believe market sentiment is currently the most influential factor in the pound's depreciation. I am certain that it will continue for several weeks, as the wave structure beginning on May 27 does not appear to be fully equipped.

General conclusions

The increased complexity of the pound/dollar pair wave pattern now suggests a further decline. For each "down" MACD signal, I recommend selling the instrument with targets near the estimated mark of 1.1708, which corresponds to 161.8% Fibonacci. An unsuccessful attempt to surpass 1.1708 may result in a departure of quotes from the reached lows, but it is unlikely to produce a corrective wave 4, as the final descending segment of the trend will assume a non-standard shape in this case.

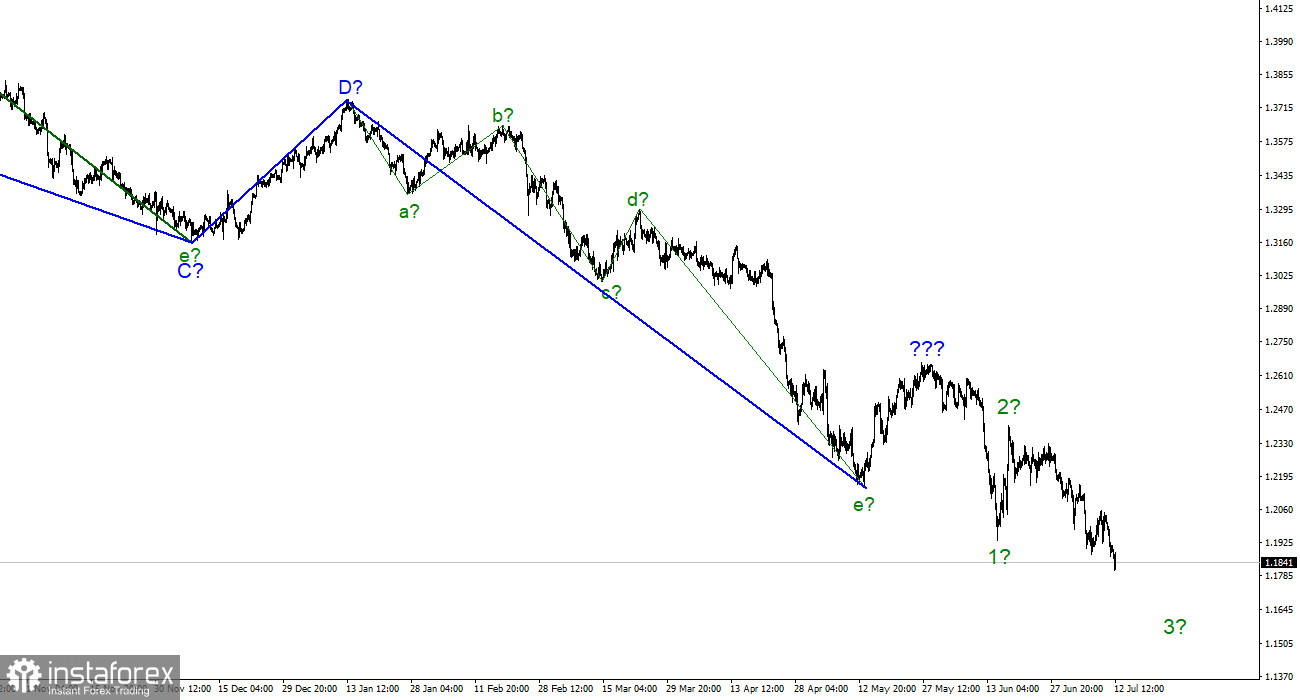

At the higher wave scale, the image resembles the euro/dollar instrument very closely. The same ascending wave does not conform to the current wave pattern, followed by the same three descending waves. Thus, one thing is unmistakable: the downward segment of the trend continues to develop and can reach almost any length.