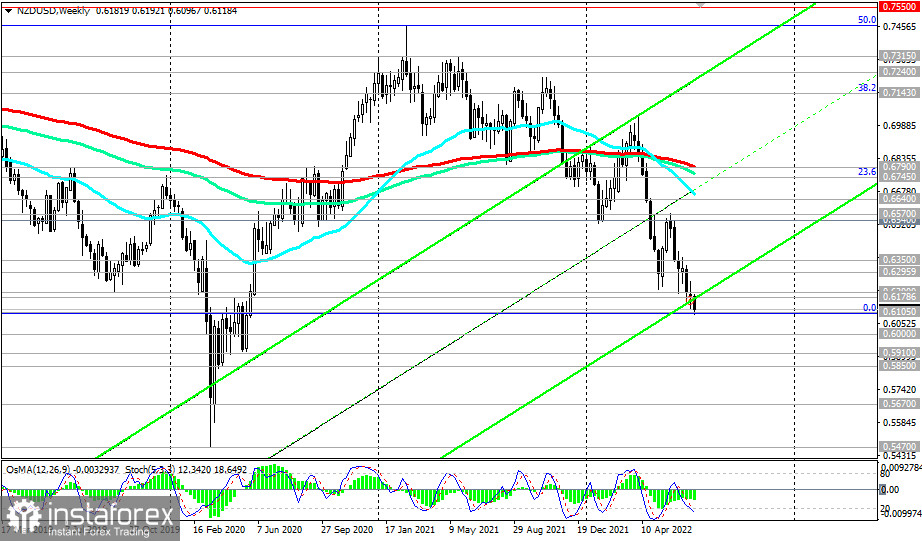

NZD/USD has been trading in the bear market zone for the fourth month in a row, remaining below the key resistance levels of 0.6790 (200 EMA on the weekly chart), 0.6745 (200 EMA on the monthly chart, and the 23.6% Fibonacci retracement level in the global wave of the pair's decline from the level of 0.8820 in 2014–2015), 0.6640 (200 EMA on the daily chart).

NZD/USD is trading near 2-year lows at 0.6120, after reaching the 2014–2015 low at 0.6105 again, while investor sentiment on the risks of a global recession intensified in the commodities market.

The tighter course of the Fed's monetary policy is also becoming one of the determining factors in the dynamics of NZD/USD.

Despite the expected next interest rate hike at tomorrow's meeting of the RBNZ, NZD/USD is under pressure from the strengthening US dollar.

In general, the downward dynamics of NZD/USD prevails. And after the breakdown of the local support level of 0.6105, the price is likely to move further downward to the marks of 0.5700, 0.5800, and possibly even lower, to the area of 0.5500, where the price was in March 2020.

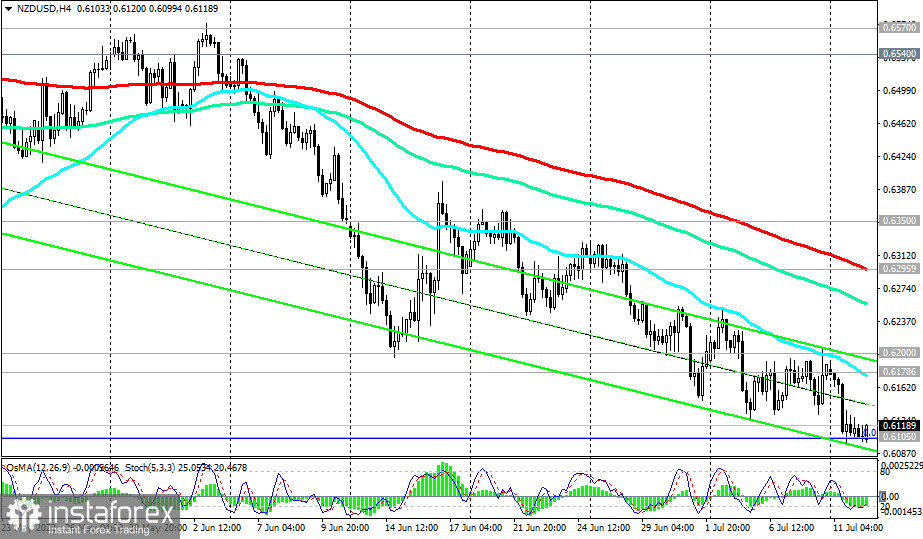

In an alternative scenario, NZD/USD will head towards 0.6350, through which the resistance level in the form of 50 EMA passes on the daily chart. And the signal to start this upward correction will be a breakdown of resistance levels at 0.6179 (200 EMA on the 1-hour chart), 0.6200 with an intermediate target at the resistance level 0.6295 (200 EMA on the 4-hour chart).

In general, the downward dynamics of NZD/USD prevails, which makes short positions preferable.

Support levels: 0.6105, 0.6100, 0.6075, 0.6000, 0.5910, 0.5850, 0.5800, 0.5700, 0.5670

Resistance levels: 0.6179, 0.6200, 0.6295, 0.6300, 0.6350, 0.6400, 0.6500, 0.6540, 0.6570, 0.6640, 0.6745, 0.6790

Trading Tips

Sell Stop 0.6090. Stop-Loss 0.6140. Take-Profit 0.6075, 0.6000, 0.5910, 0.5850, 0.5800, 0.5700, 0.5670

Buy Stop 0.6140. Stop-Loss 0.6090. Take-Profit 0.6179, 0.6200, 0.6295, 0.6300, 0.6350, 0.6400, 0.6500, 0.6540, 0.6570, 0.6640, 0.6745, 0.6790