The euro to dollar (EUR/USD) exchange rate has mostly been in a climb since peaking at 1.0187 in July this year. It briefly rise above the price of 1.0151 in June for continuing to rising above the levels of 1.0151 and 1.0113. The euro (EUR) has tumbled close to 10% against the US dollar (USD) year-to-date as the economic outlook in Europe has deteriorated significantly.

The EUR/USD pair gained some upside momentum after hitting 1.0113 and intraday bias is turned uptrend first. On the upside, above 1.0113 will resume the rebound form 1.0151 to 1.0151 resistance turned support, and then channel resistance at 1.0514. Nevertheless, break of 1.0514 minor resistance will argue that larger up trend is ready to resume, and should bring retest of 1.0203 high first.

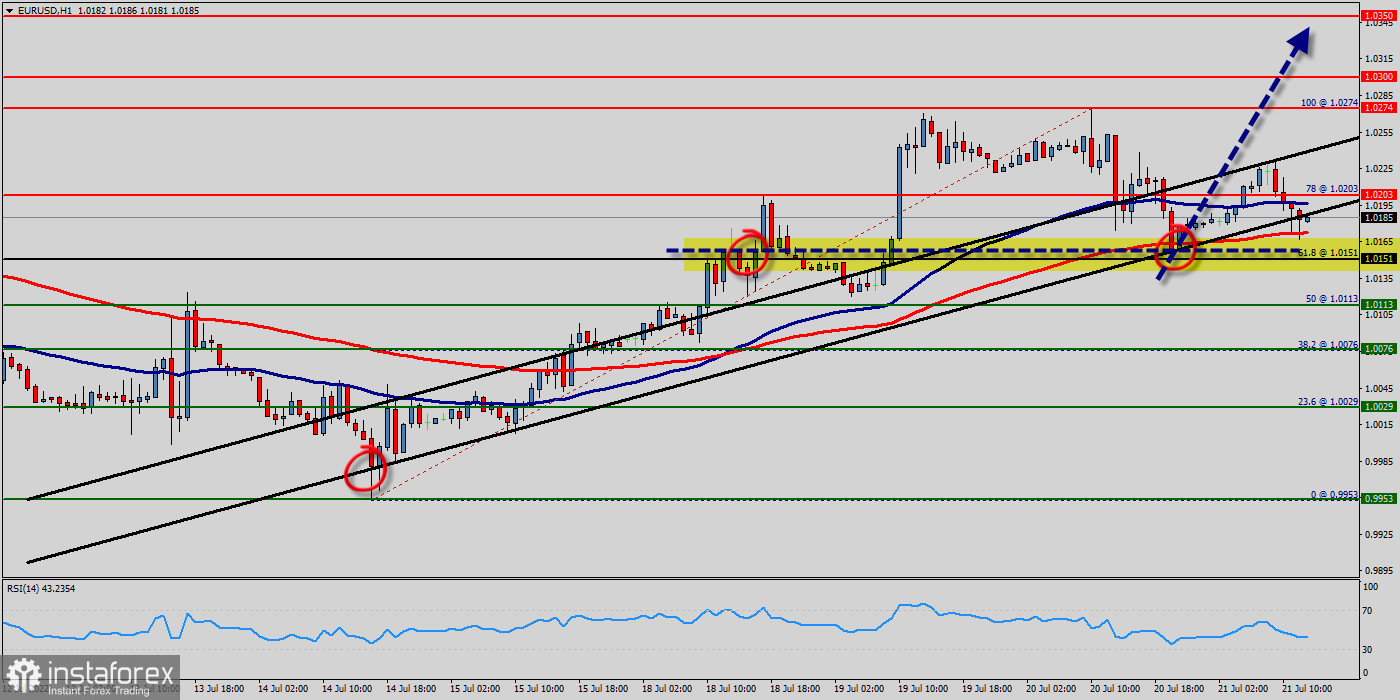

The daily chart for the EUR/USD pair shows a new bullish trend. The price has broken above the 100-SMA and is trading above it. RSI is also trading above the 30 level, which shows bullish momentum is back. If bulls can maintain this momentum, we could see the price breaking above 1.0203 and pushing towards 1.0274 so as to test the double top.

The RSI is still signaling that the trend is upward as it is still strong above the moving average (100). This suggests the pair will probably go up in coming hours. Accordingly, the market is likely to show signs of a bullish trend.

The EUR/USD pair spot exchange rate specifies how much one currency, the Euro, is currently worth in terms of the other, the US dollar. While the EUR/USD pair spot exchange rate is quoted and exchanged in the same day, the EUR/USD pair forward rate is quoted today but for delivery and payment on a specific future date.

In other words, buy orders are recommended above 1.0151 with the first target at the level of 1.0274. From this point, the pair is likely to begin an ascending movement to the point of 1.0274 and further to the level of 1.0300. The level of movement will act as strong resistance and the double top is already set at the point of 1.0274.

However, there is also the possibility that bears might come back. This return could see the price break back below the 100-SMA. If a breakout happens at the support level of 1.0113, then this scenario may become invalidated. Until then, the bias for the EUR/USD pair remains bullish.