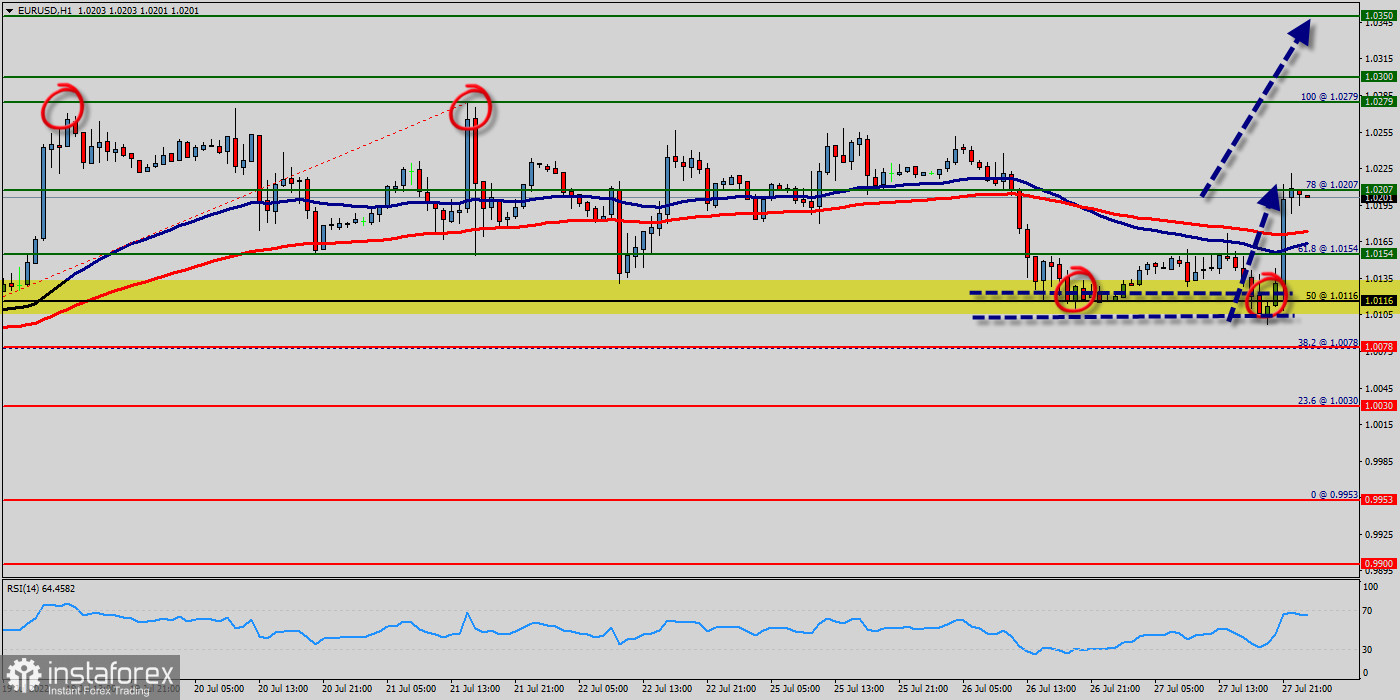

The EUR/USD pair traded lower and closed above the day in the black zone near the price of 1.0116. Today it rose a little, having risen to the level of 1.0198. On the hourly chart, the EUR/USD pair is again trading above the MA (100) H1 moving average line (1.0198). The situation is similar on the one-hour chart. Based on the previous, it is probably worth sticking to the south direction in trading, and while the EUR/USD pair remains above MA 50 H1, it may be necessary to look for entry points to buy for the formation of a correction. Furthermore, the trend is still showing strength above the moving average (100). The EUR/USD pair is staying range above 1.0154 minor support and intraday bias stays upside first.

The EUR/USD pair traded lower and closed above the day in the black zone near the price of 1.0116. Today it rose a little, having risen to the level of 1.0198. On the hourly chart, the EUR/USD pair is again trading above the MA (100) H1 moving average line (1.0198). The situation is similar on the one-hour chart. Based on the previous, it is probably worth sticking to the south direction in trading, and while the EUR/USD pair remains above MA 50 H1, it may be necessary to look for entry points to buy for the formation of a correction. Furthermore, the trend is still showing strength above the moving average (100). The EUR/USD pair is staying range above 1.0154 minor support and intraday bias stays upside first.

On the upside, firm break of 1.0207 will suggest that rebound from 1.0154 has completed. According to the previous events, we expect the EUR/USD pair to trade between 1.0116 and 1.0279.

The support stands at 1.0116, while daily resistance is found at 1.0279. Therefore, the market is likely to show signs of a bullish trend around the spot of 1.0116 - 1.0154.

Further recovery should motivate the pair to challenge recent highs around 1.0207 to allow for extra gains to, initially, the interim hurdle at the 50-day EMA at 1.0207.

The market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 50 EMA is headed to the upside Bias will be back on the upside for retesting 1.0279 high.

On the upside, above 1.0279 will resume the rebound to 1.0154 resistance turned support.

On the other hand, a negative outcome will be potentially bearish for the greenback. On Wednesday the Fed's favoured PCE deflator numbers will also be key. If the EUR/USD pair is able to break out the bottom at 1.0116, the market will decline further to 1.0078 in order to test the weekly support 2. Also, it should be noticed that support 1 is seen at the level of 1.0116 which coincides the daily pivot point.