The EUR/USD pair rallied after the FOMC and now it is trading at 1.0210 at the time of writing far above the 1.0096 yesterday's low. In the short term, it continues to move sideways, but I really hope that we'll have a clear direction soon.

The DXY crashed, that's why the currency pair jumped higher. Still, an upside continuation is far from being confirmed. Fundamentally, the US economic data came in mixed yesterday. Also, as you already know, the FED raised the Federal Funds Rate from 1.75% to 2.50% as expected. Further rate hikes are expected in the upcoming monetary policy meetings.

Today, the first estimate of US GDP is expected to log a 0.4% growth, while the preliminary GDP Price Index could register a 7.9% growth. The economic figures could bring high volatility.

EUR/USD Downside Stopped By 1.01!

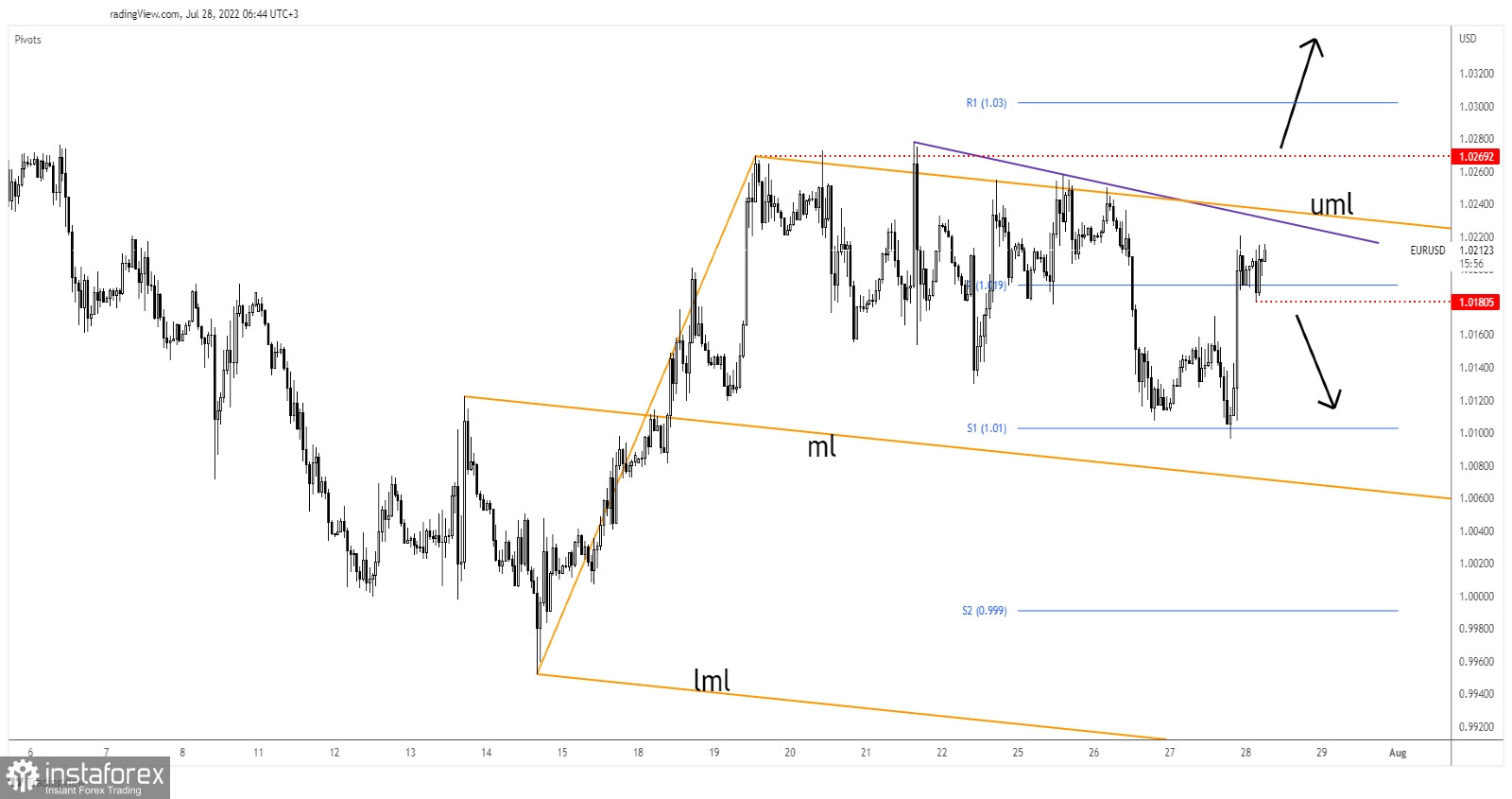

As you can see, EUR/USD found support on the weekly S1 (1.0100) and now it has jumped above the weekly pivot point (1.090). Stabilizing above this broken obstacle may signal further growth in the short term.

The next upside targets are represented by the downtrend line and by the upper median line (uml). 1.0269 represents a static resistance. On the other hand, the near-term support is represented by 1.0180.

EUR/USD Outlook!

A new higher high, jumping, closing, and stabilizing above 1.0269 will activate a larger upside movement and could offer new long opportunities.

Staying below the downtrend line and under the upper median line (uml) and dropping below 1.0180 may announce a new sell-off towards the S1 (1.0100) again.