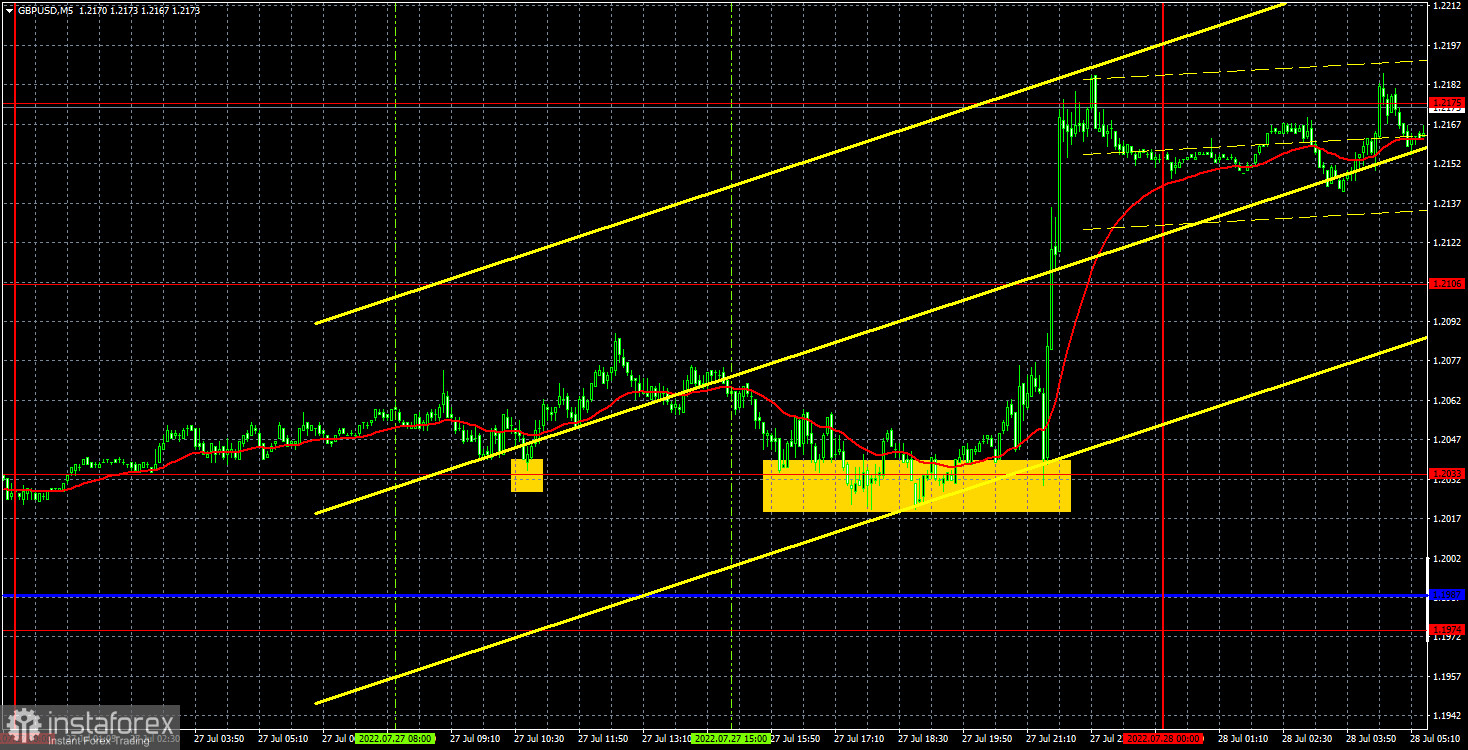

GBP/USD 5M

The GBP/USD currency pair also rose on Wednesday, and this also happened after the Fed meeting, at which the key rate was raised by 0.75%. From our point of view, such a reaction of the market is rather strange, despite the fact that the markets were ready for such a development. However, the British pound had at least technical reasons to show growth. Still, we have an ascending trend line for the pound, which the pair and traders "respect". Therefore, it will be possible to talk about a new fall for the pound not earlier than when the price settles below it. And there is nothing more to say about yesterday. There were no major events or reports in the UK. A report on orders for durable goods was published in the United States, after which the dollar strengthened its positions somewhat, but what difference does it make if in a couple of hours it was already flying into the abyss? The most interesting thing is that even taking into account the upward trend on the hourly timeframe, it remains unclear why the pound is going to grow further? If traders react as they did yesterday to the Bank of England meeting next week, then the pound will soon fall in price.

There were also very few trading signals for the pound. The price rebounded from the extreme level of 1.2033 during the European trading session and was able to go up after that 40 points. However, it failed to reach the target level, so traders could make a profit on this transaction only by closing it manually. Further, the price rebounded again from the level of 1.2033 at the US trading session, but this time it formed a rebound for several hours, so this signal could not be definitely called strong. If traders still worked it out, then at the time of when the Fed's results were announced, the price was quite far from the point of entry into the deal. Therefore, the deal could not be closed, but simply put Stop Loss on it at breakeven. However, even this option did not bring profit, because before showing a strong growth, the pair returned to the level of 1.2033 for the third time.

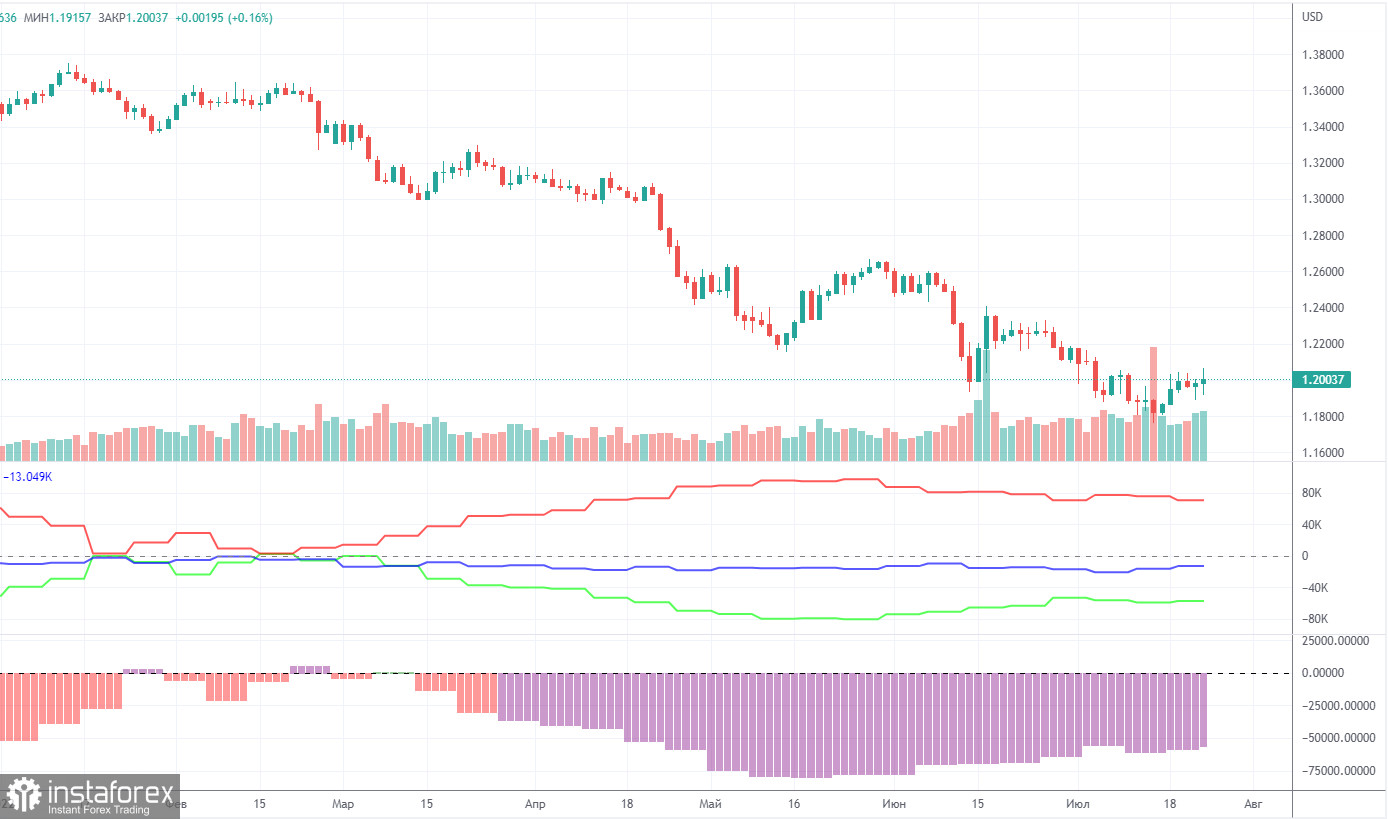

COT report:

The latest Commitment of Traders (COT) report on the British pound again showed insignificant changes. During the week, the non-commercial group closed 1,900 long positions and 3,700 short positions. Thus, the net position of non-commercial traders increased by 1,800. But what does it matter if the mood of the big players still remains "pronounced bearish", which is clearly seen in the second indicator in the chart above? And the pound, in spite of everything, still cannot show even a tangible upward correction? The net position has been falling for three months, now it has been slowly growing for several months, but what difference does it make if the British currency still continues to depreciate against the US dollar? We have already said that the COT reports do not take into account the demand for the dollar, which is probably still very high right now. Therefore, even for the strengthening of the British currency, the demand for it must grow faster and stronger than the demand for the dollar. The non-commercial group currently has a total of 89,000 shorts open and only 32,000 longs. The net position will have to show growth for a long time to at least equalize these figures. Neither macroeconomic statistics nor fundamental events support the UK currency. As before, we can only count on corrective growth, but we believe that in the medium term, the pound will continue to fall.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. July 28. The bright future of the US currency.

Overview of the GBP/USD pair. July 28. Boris Johnson may not be out of work for long.

Forecast and trading signals for EUR/USD on July 28. Detailed analysis of the movement of the pair and trading transactions.

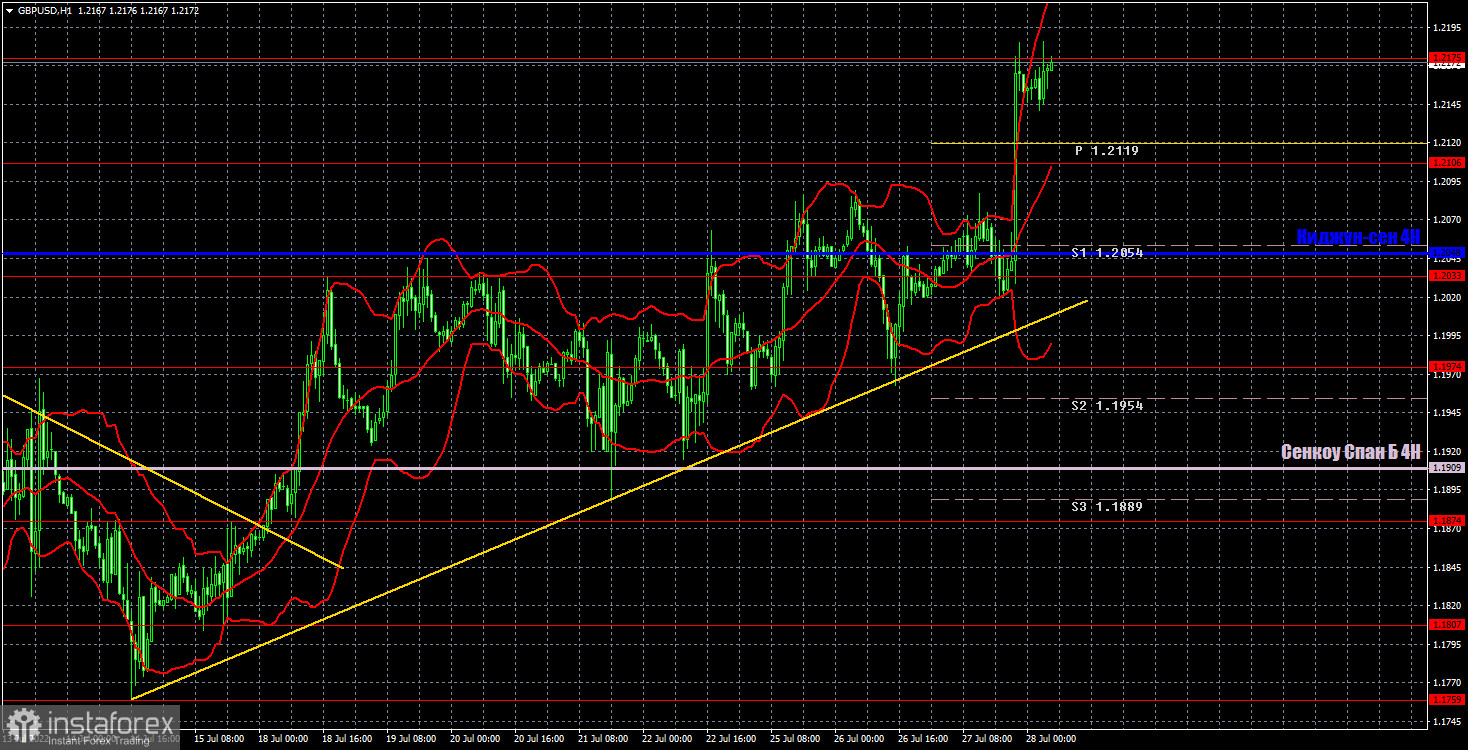

GBP/USD 1H

The British currency managed to stay above the trend line and maintain an upward trend on the hourly timeframe. Despite the fact that the results of the Fed meeting cannot be considered dovish, the US currency fell. The BoE is also likely to raise rates next week, and it would be the ultimate injustice if the pound appreciates on this event as well. There are more chances for the pound's growth now than for the euro's growth. We highlight the following important levels for July 28: 1.1874, 1.1974, 1.2033, 1.2106, 1.2175, 1.2259, 1.2342. Senkou Span B (1.1909) and Kijun-sen (1.2048) lines can also be sources of signals. Signals can be "rebounds" and "overcoming" of these levels and lines. The Stop Loss level is recommended to be set to breakeven when the price passes in the right direction by 20 points. Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The chart also contains support and resistance levels that can be used to take profits on trades. No major events scheduled for Thursday in the UK again. Thus, today traders will continue to work out the results of the Fed meeting and the GDP report for the second quarter in the US.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.