The GBP/USD pair is expected to trade around the spot of 1.1740 and 1.1800 by the started of this week, according to trading economics global macro models and our expectations. Looking forward, we estimate it to trade at 1.1600 in or August.

From a technical perspective, the overnight swing low, around the 1.1740 area, now seems to act as a support point, below which spot prices could extend the fall towards the 1.1700 mark.

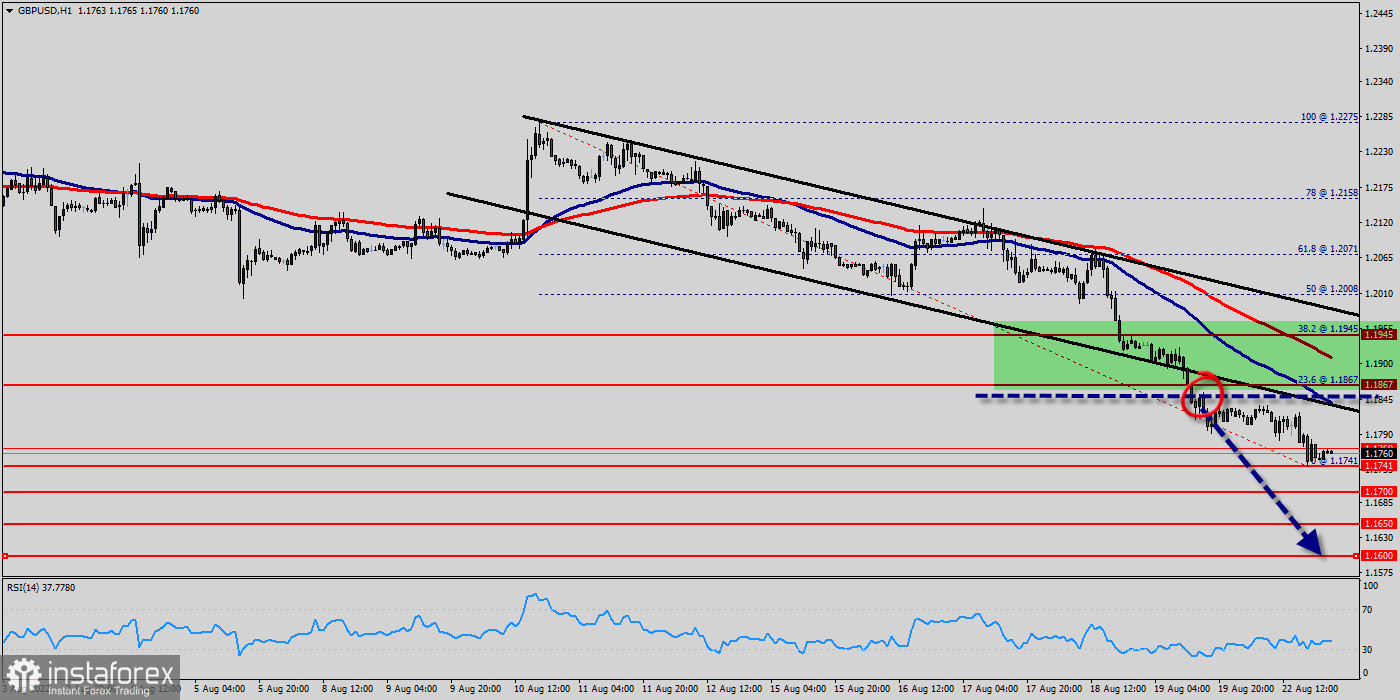

The GBP/USD pair continues to move downwards from the level of 1.1867. Yesterday, the pair dropped from the level of 1.1867 (this level of 1.1867 coincides with the ratio of 38.2%) to the bottom around 1.1840. Today, the first resistance level is seen at 1.1867 followed by Yesterday (the weekly pivot point), while daily support 1 is found at 1.1840. Also, the level of 1.1867 represents a weekly pivot point for that it is acting as major resistance/support this week.

Some follow-through selling would make the GBP/USD pair vulnerable to challenging the valence mark in the near term. The GBP/USD pair rate has fallen over 5% from its August low of 1.1867 to just over 1.1800 at the time of writing on 22 August , despite the European Central Bank (ECB) finally moving to hike interest rates - it is a high risk and jeopardy.

The GBP/USD pair fluctuates in the 1.1740 area, with risk-shifting increasingly to the downside. For these reasons we would be very difficult to see further significant decline for the euro before tomorrow, with signs of stabilization and correction to be the most possible scenario.

A choppy morning saw the GBP/USD pair fall to an early morning low of 1.1740 before rising to a high of 1.1867 (pivot point).

An extended rally could test resistance at 1.1867 and the second major resistance level (R2) at 1.1945. The third major resistance level (R3) sits at 1.2009.

The direction of the GBP/USD pair may reflect the strength of either the EU or US economy. Moreover, the EUR to US dollar rate may reflect the overall global market sentiment. We had already shared in our previous topic that the psychological price sets at the level of 1.1840.

The GBP/USD weekly forecast is mildly tilted towards the downside as the pair failed to sustain above the 1.1867 area after several attempts. The GBP/USD pair weekly forecast is mildly tilted towards the downside as the pair failed to sustain above the 1.1740 area after several attempts.

Forecast : Today, resistance is seen at the levels of 1.1867 and 1.1800. So, we expect the price to set below the strong resistance at the levels of 1.1867 and 1.1800; because the price is in a bearish channel now. The RSI starts signaling a downward trend. Consequently, the market is likely to show signs of a bearish trend. Thus, it will be good to sell below the level of 1.1800 with the first target at 1.1740 and further to 1.1700 in order to test the daily support. If the GBP/USD pair is able to break out the daily support at 1.1700 , the market will decline further to 1.1650 to approach support 3 in coming hours or days. However, the price spot of 1.1867 and 1.1945 remains a significant resistance zone. Therefore, the trend is still bearish as long as the level of 1.2000 is not breached.

Conclusion :

The general trend of the GBP/USD pair is still stronger to the downside. Investors will not care about the arrival of technical indicators towards oversold levels as far as interacting with the factors of the gains of the US dollar and the continued faltering of the euro. The closest bearish targets are currently 1.7000 and then the parity price for the currency pair. New targets 1.1650 and 1.1600 (historical target).