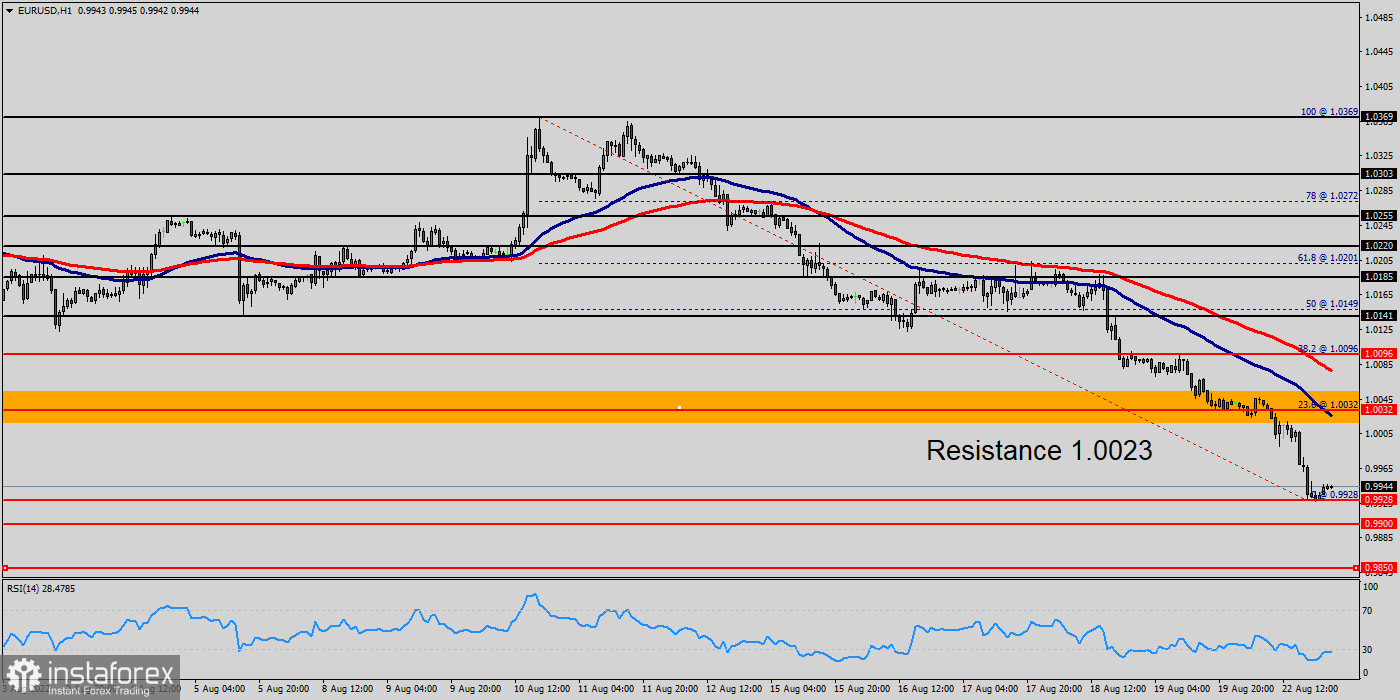

The EUR/USD pair dropped sharply from the level of 1.0033 towards 0.9928. Now, the price is set at 0.9945. On the hourly chart, the resistance of EUR/USD pair is seen at the level of 1.0033 and 1.0096.

It should be noted that volatility is very high for that the EUR/USD pair is still moving between 1.0033 and 0.9900 in coming hours.

Amid the previous events, the pair is still in a downtrend, because the EUR/USD pair is trading in a bearish trend from the new resistance line of 1.0033 towards the first support level at 0.9900 in order to test it.

Also, it should be noticed that resistance 1 is seen at the level of 1.0033 which coincides the daily pivot point. Moreover, the price spot of 1.0033 remains a significant resistance zone.

The EUR/USD pair fell with Euro inflation elevated and still falling , the cost of living crisis taking hold andgrowth slowing, the outlook for the Euro is deteriorating. Meanwhile, the USD is supported by safe-haven flows and hawkish Federal Reserve (Fed) bets.

Therefore, there is a possibility that the EUR/USD pair will move downside and the structure of a fall does not look corrective.

However, the price spot of 1.0033 remains a significant resistance zone. Thus, the trend is still bearish as long as the level of 1.0033 is not breached.

In order to indicate the bearish opportunity below 1.0033, sell below 1.0033 with the first target at 0.9900. Additionally, if the EUR/USD pair is able to break out the first support at 0.9900, the market will decline further to 1.2055 0.9850 in order to test the weekly support 2.

On the other hand, , stop loss should always be taken into account, accordingly, it will be of beneficial to set the stop loss above the last bullish wave at the level of 1.1000.

Signal :

If the pair succeeds to pass through the level of 0.9928, the market will indicate a bearish opportunity below the level of 0.9928. The trend is still bearish as long as the price of 1.0033 is not broken. Thereupon, it would be wise to sell below the price of at 0.9928 with the primary target at 0.9900. Then, the EUR/USD pair will continue towards the second target at 0.9850 (a new target is around 0.9803). Thus, the market is indicating a bearish opportunity below the above-mentioned support levels, for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside.