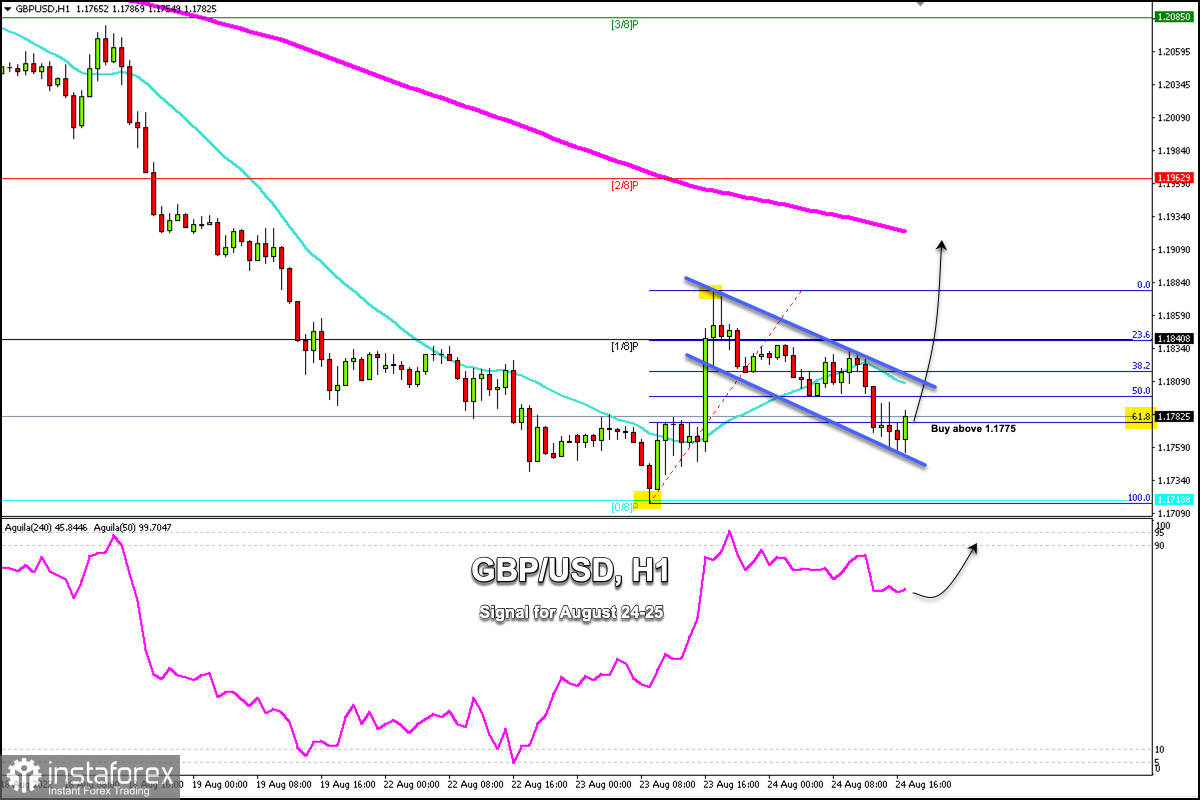

Early in the American session, the British pound was trading around the 61.8% Fibonacci retracement zone.

Yesterday, GBP/USD rebounded from a yearly low at 1.1716, reaching a high of 1.1877 in the American session.

Failing to consolidate above the 1/8 Murray support, the British pound made a technical correction. Now it is trading around 1.1782 after hitting a daily low of 1.1755.

On the H1 chart, we can see the formation of a descending channel. In the last hours, the pound has been bouncing above the bottom of this channel around 1.1755.

The 61.8 Fibonacci zone could offer a technical bounce for the pound and it could reach the 21 SMA around 1.1809. In the event that there is a sharp break and consolidation above the 21 SMA, we could expect the bullish acceleration to continue. So, the price could reach 1/8 Murray at 1.1840 and could even go towards the 200 SMA located at 1.1930.

On Tuesday, the data from the US was disappointing as the Services PMI showed a contraction in business activity. The disappointing data caused the US dollar to weaken against its rivals which favored the GBP/USD pair.

As seen on the H1 chart, GBP/USD is consolidating above the critical support at 1.1760. A daily close below this area could resume the main downtrend towards the support at 1.1596 (-1/8 Murray).

Our trading plan for the next few hours is to buy the British pound above the 61.8% Fibonacci (1.1775) with targets at 1.1810 and 1.1840 (1/8). A break and consolidation above 1.1820 will be a signal to resume buying with targets at 1.1930. The eagle indicator is giving a positive signal which supports our bullish strategy.