The EUR/USD pair rebounded after reaching the 0.9910 level. USD depreciated after the Dollar Index was rejected by the 109.00 psychological level. DXY's deeper drop could push the currency pair higher.

Fundamentally, the US data came in mixed today. Durable Goods Orders rose by 0.0% versus 0.9% expected. Core Durable Goods Orders registered the 0.3% growth exceeding the 0.2% growth forecasted, while Pending Home Sales dropped only by 1.0% compared to the estimates of 2.6%.

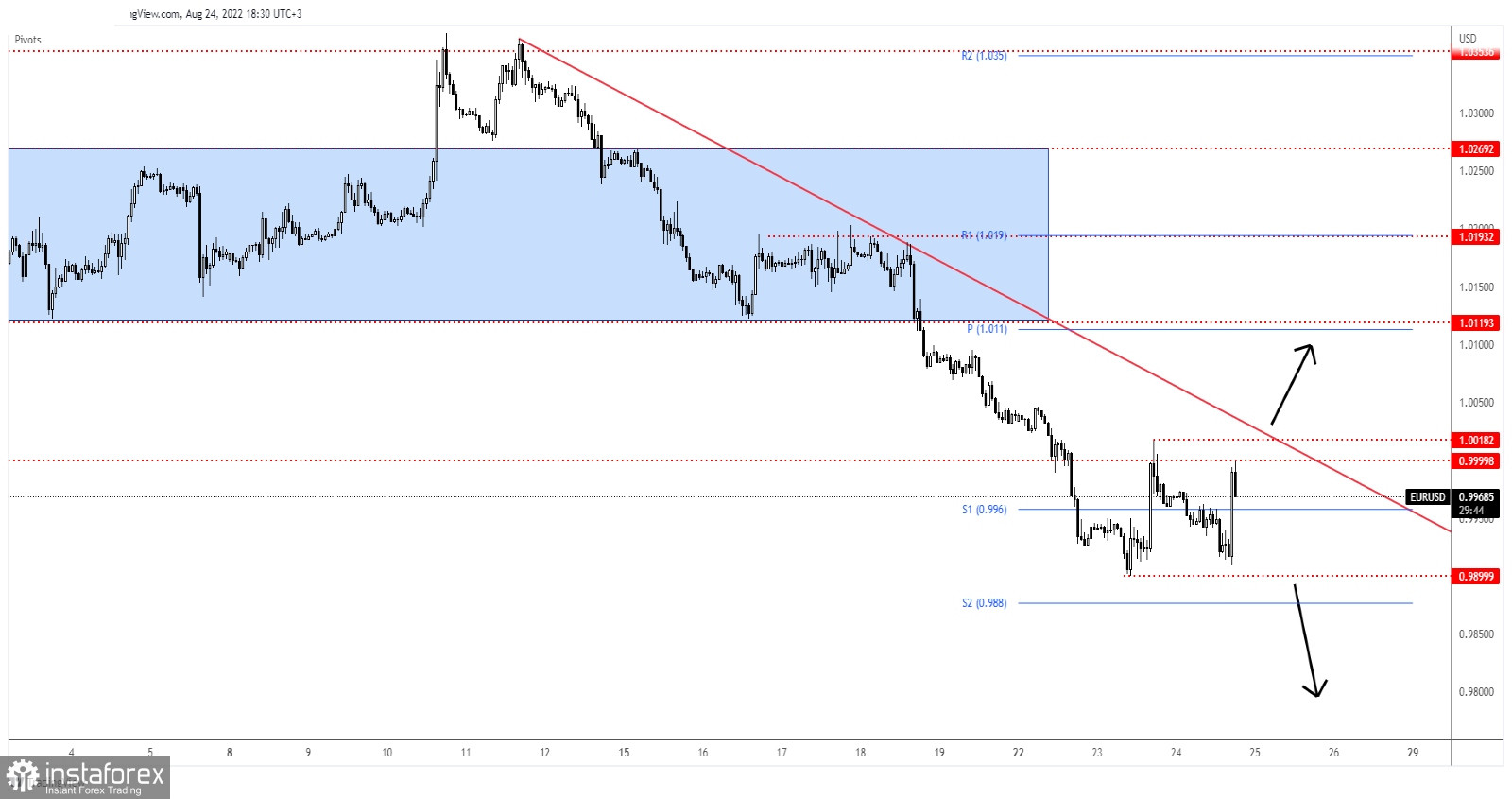

EUR/USD New Range

As you can see on the H4 chart, the EUR/USD pair dropped after yesterday's rally but it has failed to reach the 0.9899 former low. It has rebounded in the last hours and found resistance right below the 0.9999 key resistance.

Also, the 1.0018 and the 1.0000 psychological levels represent upside obstacles. The downtrend line stands as dynamic resistance, so the bias remains bearish. On the other hand, support is seen at 0.9899.

EUR/USD Outlook

A valid breakout above the 1.0018 level and through the downtrend line may signal a larger rebound. This scenario could bring long opportunities.

A new short opportunity could be announced by false breakouts above the immediate resistance levels. Also, dropping and closing below 0.9899 could activate a larger drop.