The USD/CHF pair moves somehow sideways in the short term. The price tries to accumulate more bullish energy before resuming its growth. It was traded at 0.9673 at the time of writing.

Fundamentally, the US Flash Services PMI, Flash Manufacturing PMI, and New Home Sales came in worse than expected yesterday, that's why the USD is sluggish in the short term. The greenback depreciated a little as DXY retreated.

Earlier today, the US data came in mixed. Pending Home Sales dropped by 1.0% versus the 2.6% drop expected. Durable Goods Orders registered only a 0.0% growth, while Core Durable Goods Orders surged by 0.3% beating the 0.2% forecast.

USD/CHF Bullish Pattern

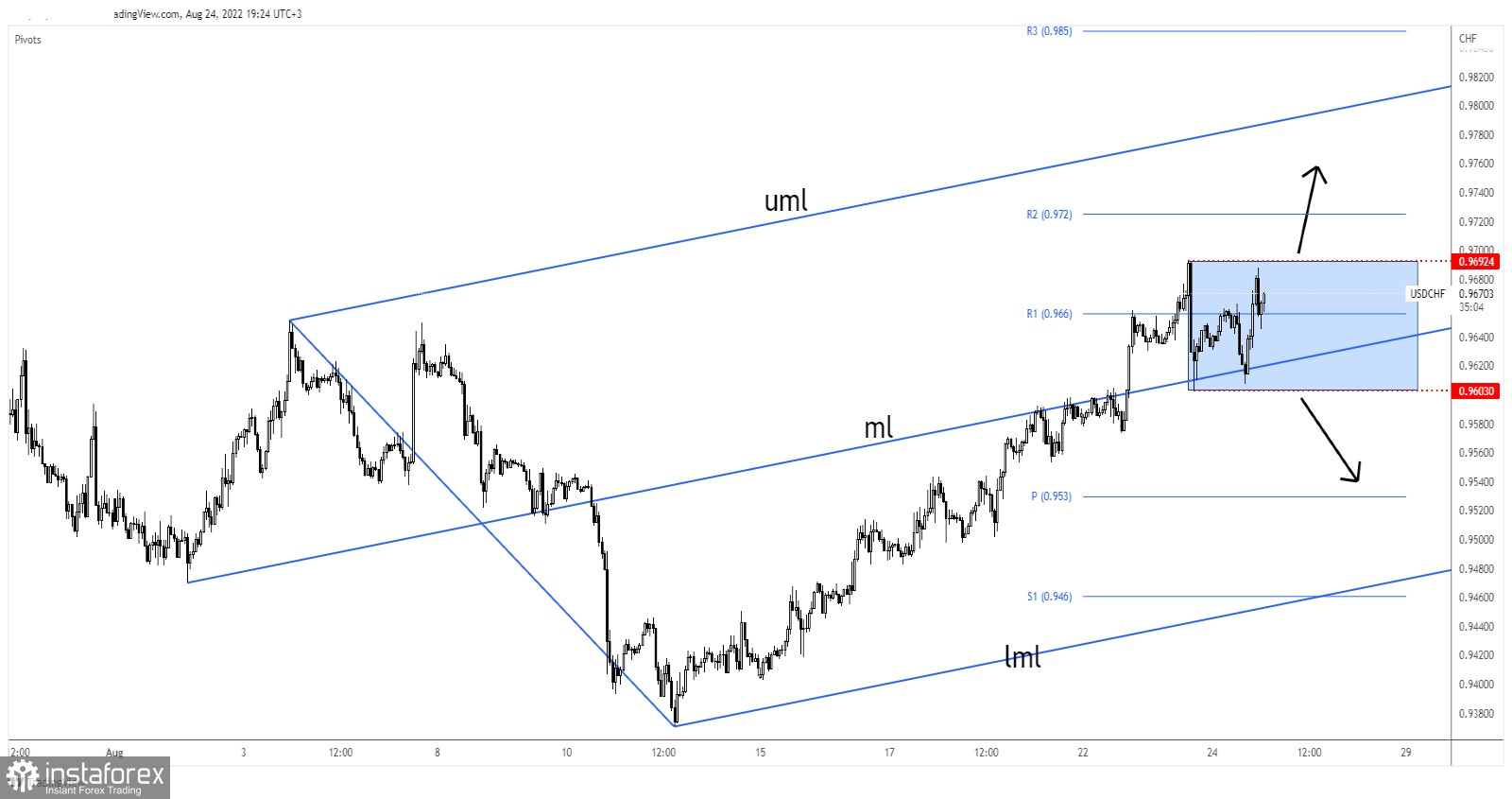

As you can see on the h1 chart, the USD/CHF pair climbed to as much as 0.9692 where it has found temporary resistance. In the short term, the rate dropped and tested and retested the median line (ml) which represents dynamic support.

As long as it stays above this dynamic support, the USD/CHF pair could still resume its growth. The current range could represent an upside continuation pattern.

USD/CHF Prediction

Making a valid breakout through 0.9692 could activate further growth. This scenario could bring new long opportunities. The upper median line (uml) of the ascending pitchfork stands as a potential target if the upside scenario is confirmed.