The EUR/USD pair stayed below the psychological level of 1.0015 over the weekend, indicating a lack of urgency to accumulate at the current levels.

The bears are attempting to extend EUR/USD pair's decline below 1.0015 to bottomed at 0.9901 but the trend rebounded to hit 0.9975 right now.

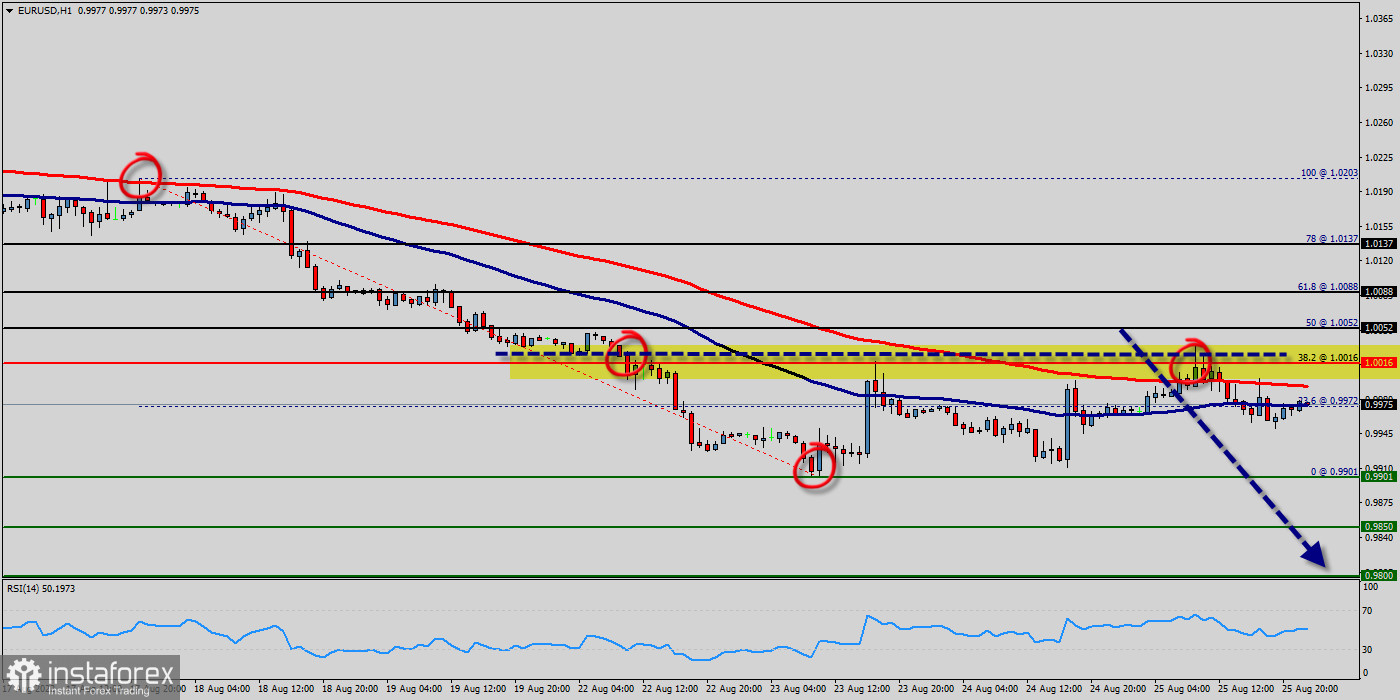

Today, the first resistance level is seen at 1.0015, and the price is moving in a bearish channel now. Furthermore, the price has been set below the strong resistance at the level of 1.0015, which coincides with the 38.2% Fibonacci retracement level.

This resistance has been rejected several times confirming the downtrend. Additionally, the RSI starts signaling a downward trend.

The EUR/USD pair remains downside for consolidation below 0.9975 temporary low. Down side of recovery should be limited by 0.9975 support turned resistance to bring another fall.

The Euro pair depreciated further to 0.9975, the lowest level in last three weeks, falling towards parity against the dollar on concerns the energy crisis would lead Europe's region to a deep recession, placing the ECB between a rock and a hard place as it tries to curb inflation and rest a slowing economy.

The EUR/USD pair decreased within a down channel. Closing below the pivot point (1.0015) could assure that the EUR/USD pair will move lower towards cooling new lows.

Then, the bears must break through the price of 0.9975 in order to resume the downtrend. Alos it should notice that the Euro is edging lower against the U.S. Dollar late in the session this morning in a volatile session that saw the single currency posting an early loss before continuing after data in the U.S.

showed the world's largest economy created more jobs than expected this month.

If the pair fails to pass through the level of 0.9975, the market will indicate a bearish opportunity below the strong resistance level of 1.0015. The trend is still calling for a strong bearish market from the spot of 1.0015 - 0.9975.

Sellers are asking for a high price. In this regard, sell deals are recommended lower than the 0.9975 level with the first target at 0.9901.

It is possible that the pair will carry on downwards continuing the development of the bearish trend to the level 0.9850.

However, stop loss has always been in consideration thus it will be useful to set it above the last double top at the level of 1.0088 (notice that the major resistance today has set at 1.0088). Please check out the market volatility before investing, because the sight price may have already been reached and scenarios might have become invalidated.

Also, it should be noted that a bear market is a period when the price of an asset has fallen by about 20% or more from recent highs. At this point, the investor fear index increases and panic is possible in the market. A bear market is the same as a bear market, it is also called a downtrend. It is opposed to a bull market. Bullish - vice versa.

Forecast :

Since there is nothing new in this market, it is not bullish yet. Sell deals are recommended below the level of 1.0015 with the first target at 0.9901 so as to test the double bottom. If the trend breaks the double bottom level of 0.9901, the pair is likely to move downwards continuing the development of a bearish trend to the level of 0.9850 in order to test the weekly support 2.