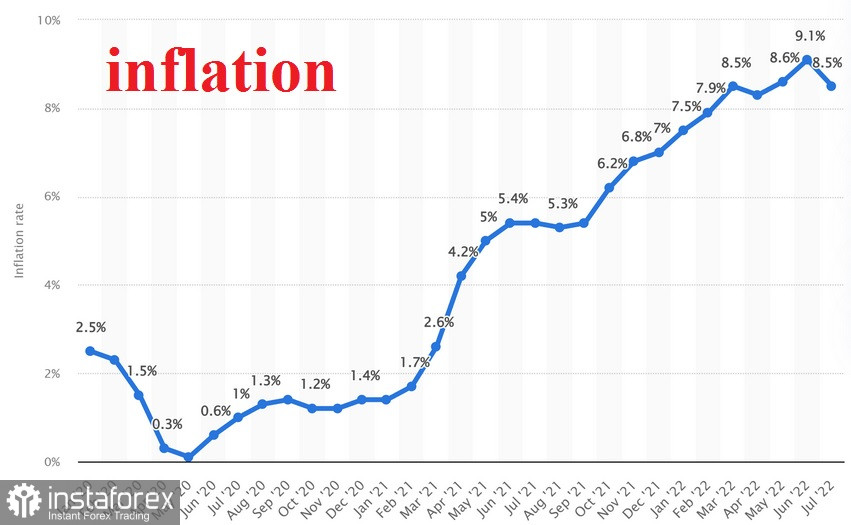

This year's Jackson Hole Symposium will undoubtedly be the most important event of this month. Central bankers, bankers and analysts will face a unique economic backdrop, very different from last year's symposium. Last year, inflation was about 5%, and the vast majority of central bankers and politicians believed that inflation was temporary. It was assumed that the problems in the supply chain, which were an important component that increased inflation, would disappear naturally.

Given that inflation currently stands at 8.5%, market participants are preparing for Federal Reserve Chairman Jerome Powell's keynote speech, which will take place on Friday. Everyone is now expecting Powell to be tough on the aggressive monetary policy of raising interest rates to effectively reduce inflation, which is still at a 40-year high. Nevertheless, his upcoming speech contains an extreme degree of uncertainty: whether the Fed will express an aggressive tone or, conversely, in which Powell will say that the Fed may moderate its aggressive rate hikes.

Powell may take a more dovish stance based on recent reports indicating a serious downturn in the US economy. A report on new home sales showed that sales have fallen to their lowest level in six years.The S&P Global index in the US services sector fell from 47.3 to 44.1. This was the fifth consecutive decline, resulting in the weakest performance since May 2020. In addition, the US manufacturing index fell from 52.2 to 51.3, the lowest level in two years.

Powell faces a dilemma in which the necessary steps to reduce inflation could easily lead to a deeper economic downturn, which could lead to a severe measure that would plunge the US economy into recession.

It is clear that the Fed has been very slow to respond to rising inflation, and a series of four consecutive interest rate hikes over the past four FOMC meetings has had a profound impact, leading to a severe economic downturn. The Fed has done too little and too late, and now it faces a more difficult task, which is to effectively reduce inflationary pressures without further serious economic downturn.

In other words, market participants and investors are waiting for any information about the upcoming monetary policy of the Fed. Regardless of what Fed members and Powell say, it will definitely have a profound impact on financial markets.