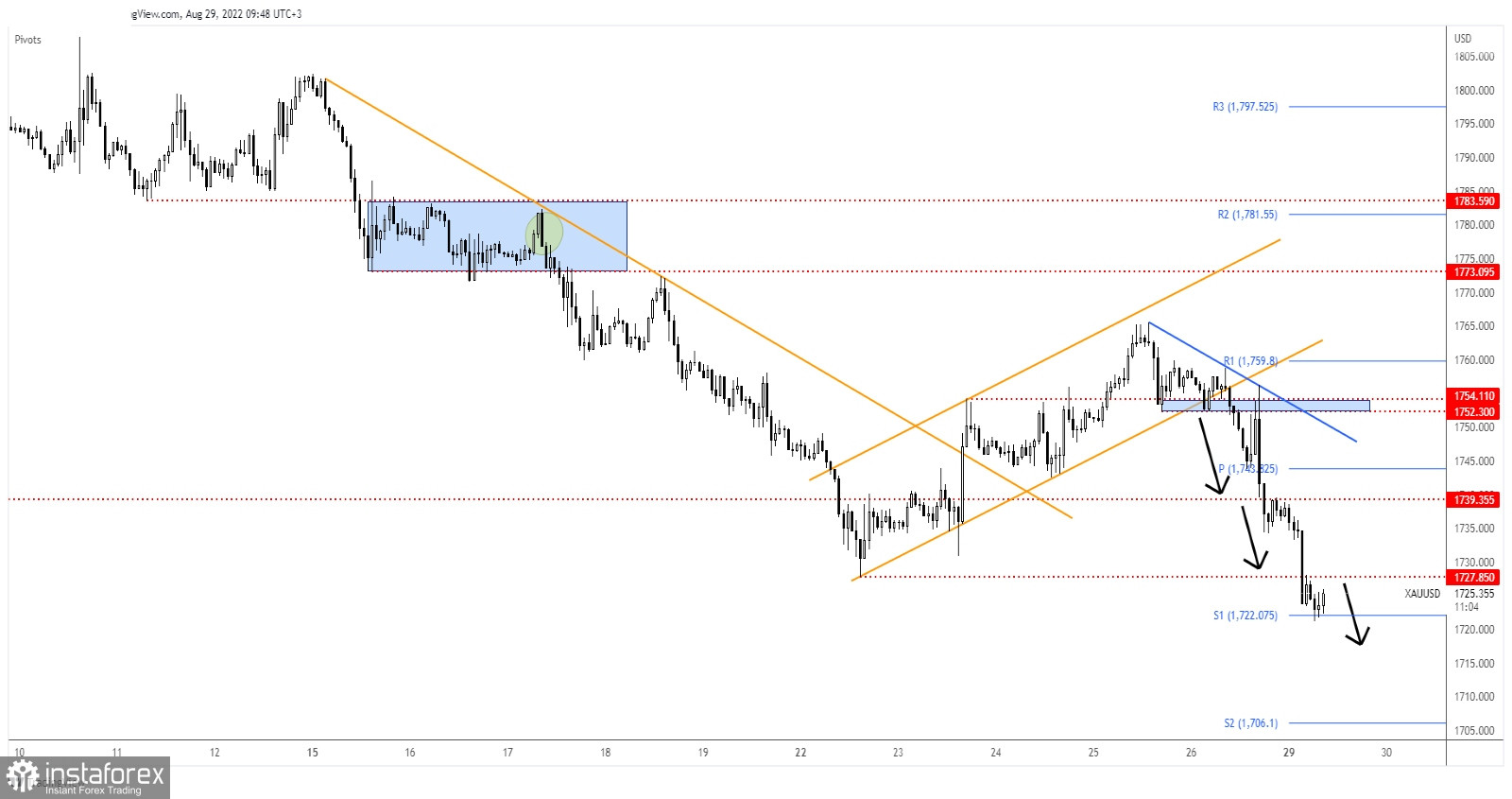

Gold plunged in the short term as the Dollar Index rallied. As you already know from my analyses, when the USD appreciates, the yellow metal commonly drops. XAU/USD was trading at 1,724 at the time of writing and it seems determined to come back to test and retest the near-term upside obstacles.

As you already know, the precious metal crashed after Powell's speech on Friday. The Federal Reserve is expected to proceed with another rate hike at the next monetary policy meeting. A 50bps rate hike is expected in September.

XAU/USD Temporary Rebound?

XAU/USD dropped as expected after escaping from the up-channel pattern and after retesting the downtrend line. You knew from my previous analysis that the yellow metal could drop deeper after failing to stay above the uptrend line.

It has ignored the 1,739 and 1,727 downside obstacles, confirming more declines and a downside continuation.

XAU/USD Forecast

Breaking below 1,727 activated a downside continuation. This was seen as a new short opportunity. Testing and retesting this obstacle, registering only false breakouts could announce strong sellers.

The S1 (1,722) stands for static support, a valid breakdown below it may signal more declines and could bring selling opportunities.