Jerome Powell's speech at the Jackson Hole economic symposium on Friday was short and was perceived by investors as a warning. According to Powell, "reducing inflation is likely to require a sustained period of below-trend growth." This will "bring some pain to households and businesses," he added. However, the Fed Chair is sure that "a failure to restore price stability would mean far greater pain." All this confirms that the US central bank will keep raising rates in order to tame inflation despite the threat of a recession. Apparently, stagflation is considered an even more negative scenario.

As for the rate hike, there was no clarity on this matter. The Fed will be choosing between a 50 and 75-basis-point rise. Depending on this, markets may move in any direction.

All three major US stock indices lost more than 3%, with NASDAQ posting the biggest loss of 3.9% (S&P 500 -3.4%). US Treasuries yields are appreciating together with the US dollar which strengthened across the board. On the positive side, the trade deficit decreased by almost $10 billion in July (to -89.1 billion instead of - 98.5 billion predicted earlier). In addition, the Atlanta Fed's GDP estimate was upwardly revised to 1.6%, up from 1.4%.

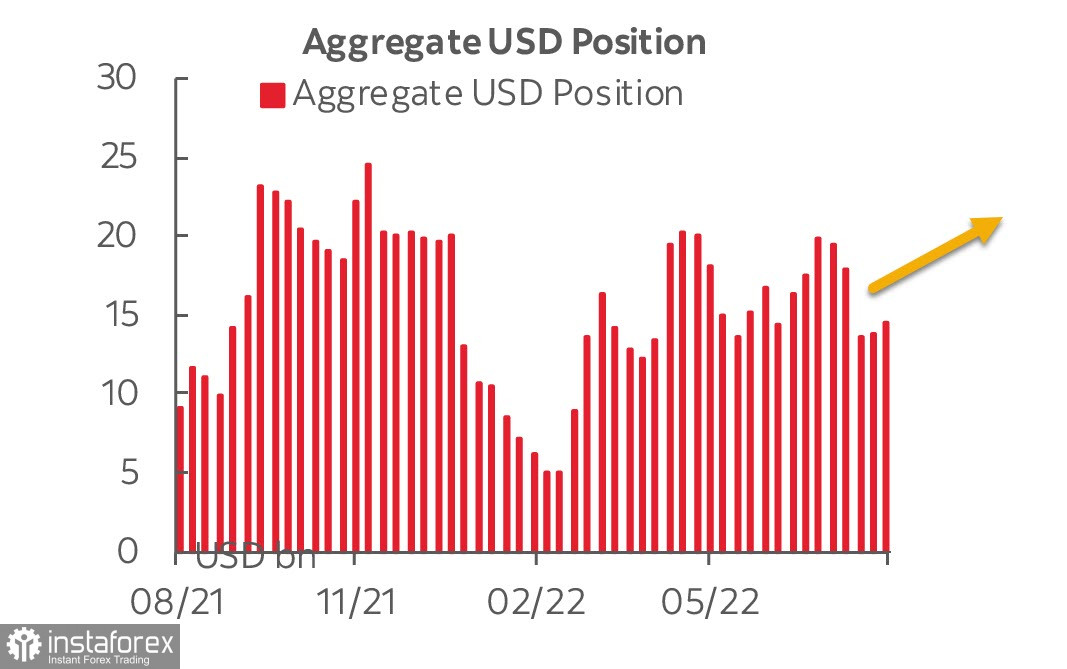

According to the CFTC data, speculators raised bullish bets on the US dollar in the past week. The value of the net long dollar position increased by $870 million to $14.7 billion.

The data from the CFTC report looks rather mixed. The net long position on gold fell sharply by $3.066 billion to $22 billion. At the same time, the net short yen position increased which makes it hard to say what is the actual demand for safe-haven assets. In general, commodity currencies had negative dynamics. The only currency that posted higher demand along with the US dollar was the British pound.

This week, traders will be waiting for the eurozone inflation data for August, scheduled for Wednesday. On Thursday, the ISM manufacturing PMI is due to be out, while on Friday, nonfarm payrolls will be published. After Powell's speech, no positive reaction can be expected.

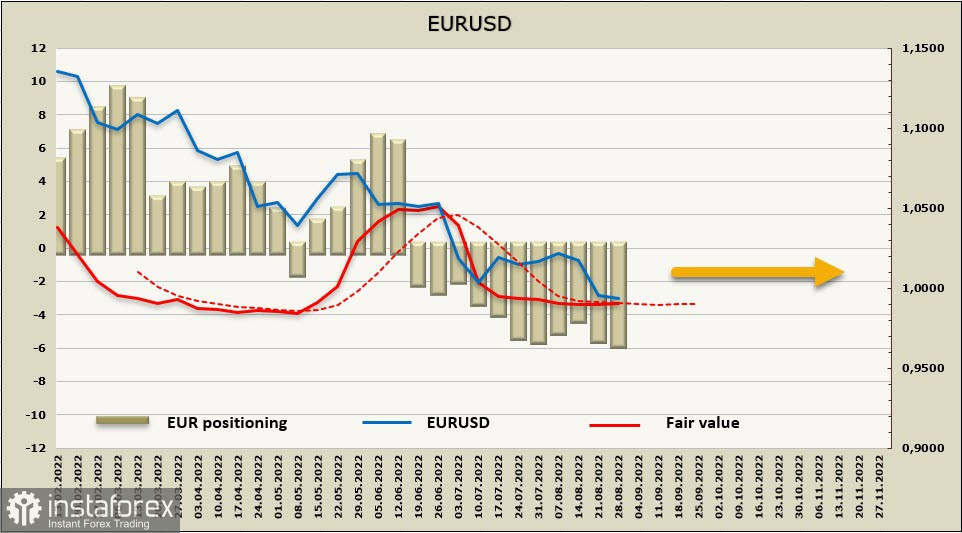

EURUSD

Speculations on Friday suggested that some ECB members were ready to consider a rate hike of 75 instead of 50 basis points at the next meeting. Also, Bloomberg reports that some ECB officials are mulling over the possibility to launch quantitative tightening. This news provided some support to the euro. Yet, it is still a question how this measure will affect the region's economy which is facing a serious energy and food crisis. The trade deficit increased, and limited liquidity will put additional pressure on the economy.

The net short position on the euro rose by 58 million to -5.497 billion in the last week. Bears obviously prevail although their pace is slow. The closing price stood at the long-term average which may be an indirect indication of capital outflow from Europe.

From the technical viewpoint, the euro is steadily holding within the downtrend with well-distinguished channel boundaries. There are currently no conditions for growth. The pair is highly likely to retest the local low of 0.9901. However, given the weak price dynamics, we can assume that the formation of a local low will be followed by an upside pullback. There are no strong support levels seen at the moment. The boundary of the channel is found around the 0.96 area which looks like a very distant target even though Europe is pressured by the looming energy crisis.

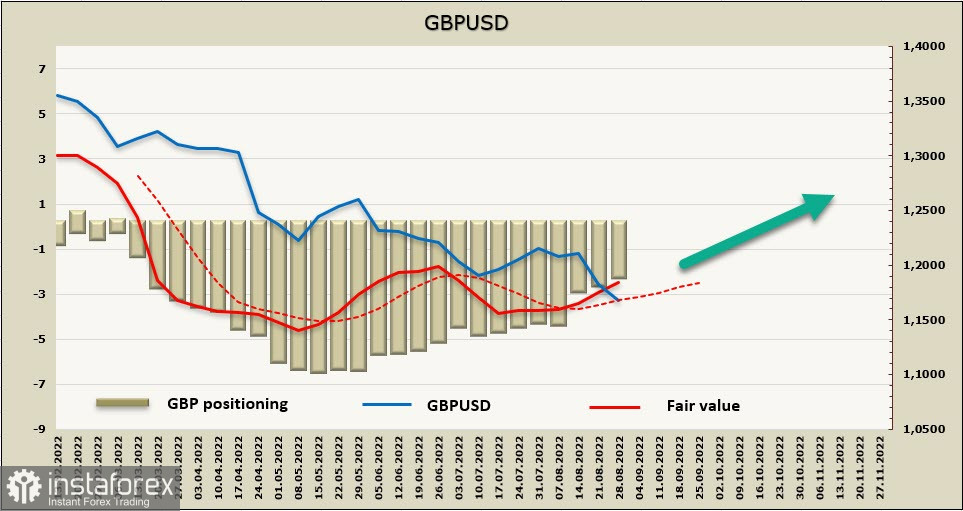

GBPUSD

Meanwhile, the pound is suffering from increasing pressure caused by rising energy prices. Britain's energy regulator Ofgem has raised the energy price cap by 80%, from £1,971 to £3,549 per annum. What is more, a further increase to ~£4,500 should be expected next January. Soaring energy prices will fuel inflation further, putting the main burden on households. This, in turn, will lead to a drop in consumer demand and will contribute to a further slowdown in the economy.

The pound continues its rapid decline although its net short position has been decreasing since May, according to the CFTC report. The net long position increased by +434 billion for the reporting week, while short positions fell to 2.069 billion. The closing price is getting higher every time.

Despite the strong bearish momentum, the pair may attempt to perform a pullback to the upside. It still has a long way to go until it reaches the support level of 1.1414 (the low of March 2020 formed at the start of the pandemic). The drop is facilitated by expectations of an energy crisis and a capital flight from Europe. Currently, there are no conditions to buy the pair as the bearish bias is strong, and we need to wait for their weakness in the support area of 1.1570/90.