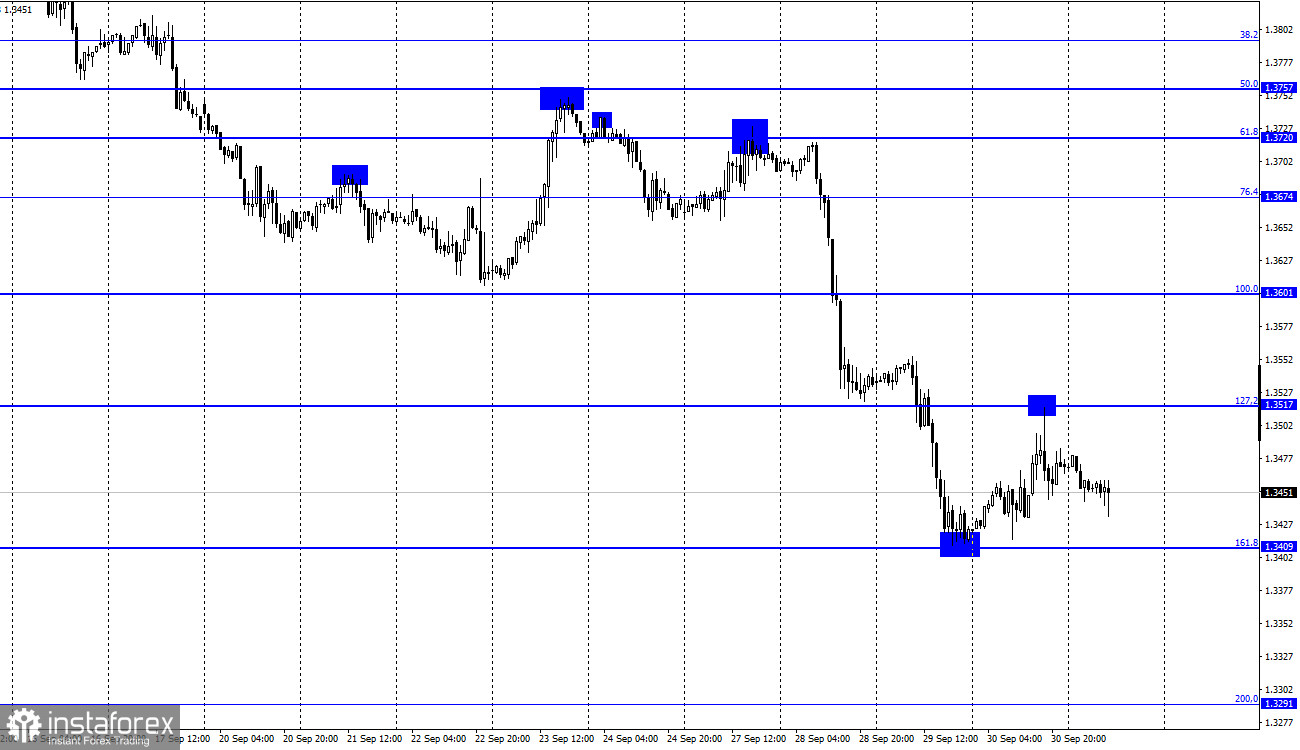

GBP/USD – 1H.

Hello, dear traders! On the hour chart, the GBP/USD pair completed the growth to the correctional level of 127.2% - 1.3517. Then the pair rebounded from it, reversed in favor of the US currency and started a new fall to the level of 161.8% - 1.3409. If the quotes are fixed under the Fibo level of 161.8%, we may expect a further downward movement towards the correctional level of 200.0% - 1.3291. Yesterday's news background was rather strong for the British currency. However, the pair resumed its decline by the end of the day. In the first half of the day, the report on the GDP for the second quarter was released with the reading 5.5% q/q instead of 4.8% q/q. Investors did not expect it. However, the US GDP report was also better than traders' expectations, so the dollar rally started in the second half of the day. Overall, the GBP continues to come under trader's pressure due to the fuel chaos in the country this week. At the moment, the problem has not been completely solved, although Boris Johnson involved the military in distributing gasoline at gas stations.

However, many news agencies are reporting that the country may face constant shortages of gasoline, as well as other goods before Christmas, as the problem of lack of truck drivers has not been resolved. The British government has made a move to grant temporary work visas to all drivers, though they are in no hurry to go to work only for a couple of months. Therefore, affected by this problem, the pound may still have difficulties with a rise in the coming weeks. Britain's manufacturing PMI report for September is also due in the near future. Traders do not expect this indicator to change. They consider it will total 56.3 points. The US statistics may have a greater impact on the GBP/USD pair today. However, all daily reports do not cause any excitement among traders. They are likely to pay more attention to the fuel crisis, rather than to the statistics.

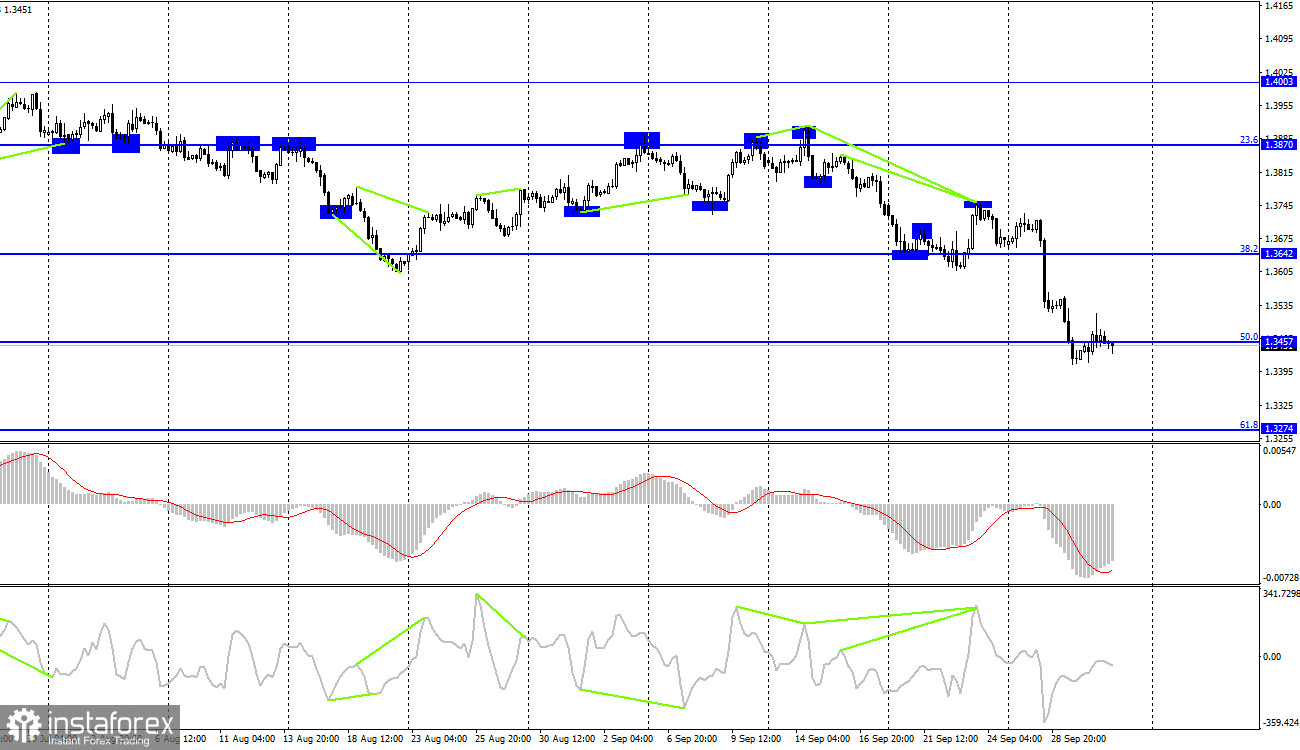

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair performed a reverse fixing above the 50.0% correction level at 1.3457. However, at the moment it is at this level, so I cannot make any definite conclusion about a consolidation or rebound. Consequently, we have to wait for the first or the second situation to happen. The retention of the pair above the 50.0% level will give reasons to count on a further growth in the direction of 1.3642. Besides, the hour chart is highly significant now.

The US and UK news calendar:

UK - Manufacturing PMI (08-30 UTC).

US - Core Personal Consumption Expenditures Price Index (12-30 UTC).

US - Personal Spending Change (12-30 UTC).

US - ISM Manufacturing Index (14-00 UTC).

US - Michigan Consumer Sentiment Index (14-00 UTC).

On Friday, Britain's PMI will acquire significance for the pound, and the US ISM index for the US currency respectively. Jerome Powell and Janet Yellen's speeches yesterday did not produce a big effect. The news background is quite weak today.

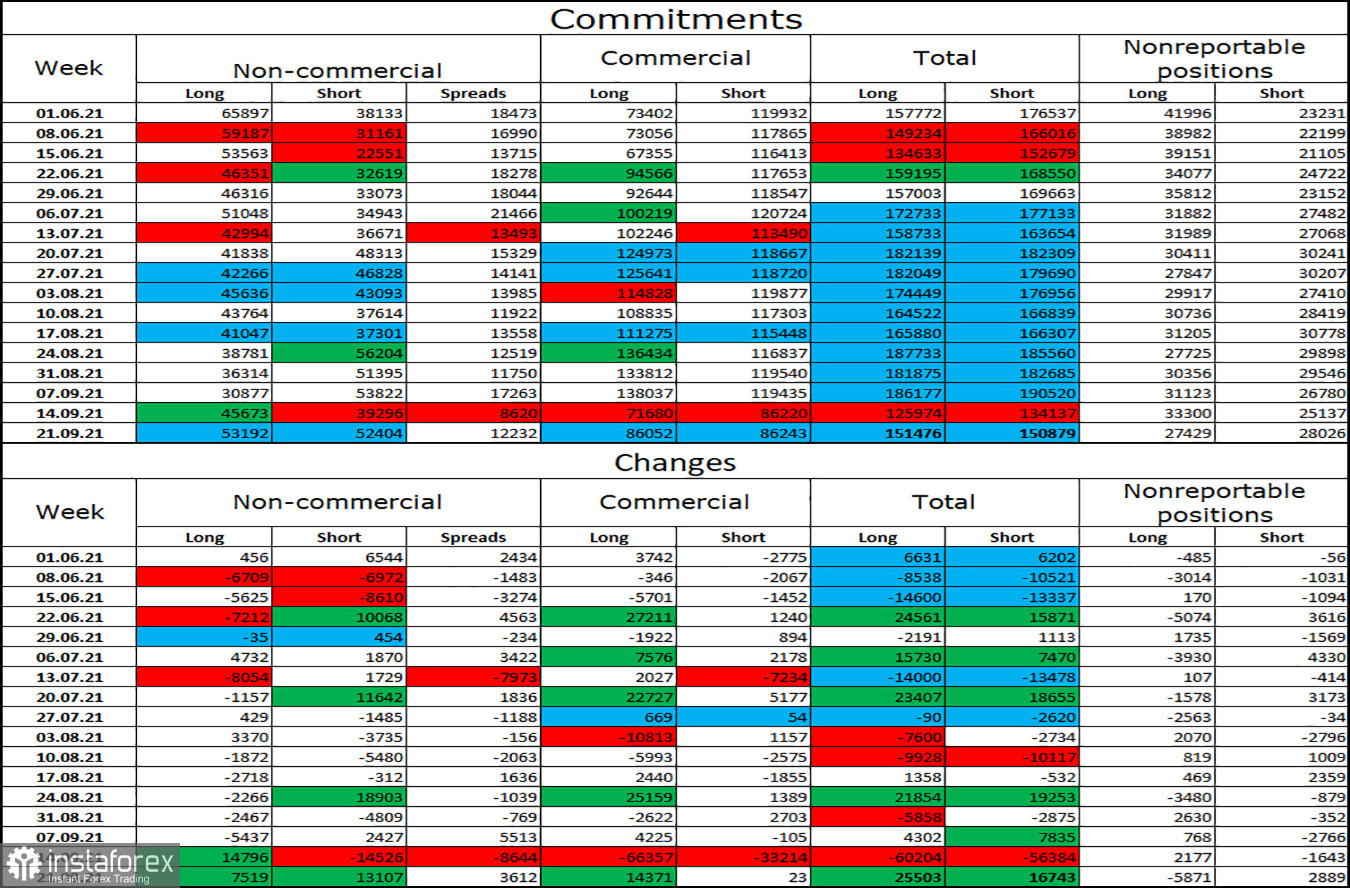

COT report (Commitments of traders):

The latest COT report (September 21, 2021) on the British currency indicated that the mood of major players has become more bearish. During the reporting week, speculators opened 7519 long contracts and 13107 short contracts. That is, almost twice as many. This allowed bear traders to catch up with bulls traders in all aspects. In the picture above, you can see that the number of long and short contracts for all categories of traders coincide now. However, a week ago the situation was the opposite. Consequently, after the last COT report the chances for the British pound's growth are falling again. There is no clear advantage of either bulls or bears at the moment.

GBP/USD forecast and recommendations for traders:

I recommend buying the British pound at the new rebound of quotations from the level of 1.3409 on the hourly chart with the target of 1.3517. It is dangerous to open new buy orders now as the pair has already declined by 300 pips. Despite this fact, it is possible to do so if you can close the order below the 1.3409 level with a target of 1.3291.

TERMS:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profit, but for ensuring current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant influence on the price.