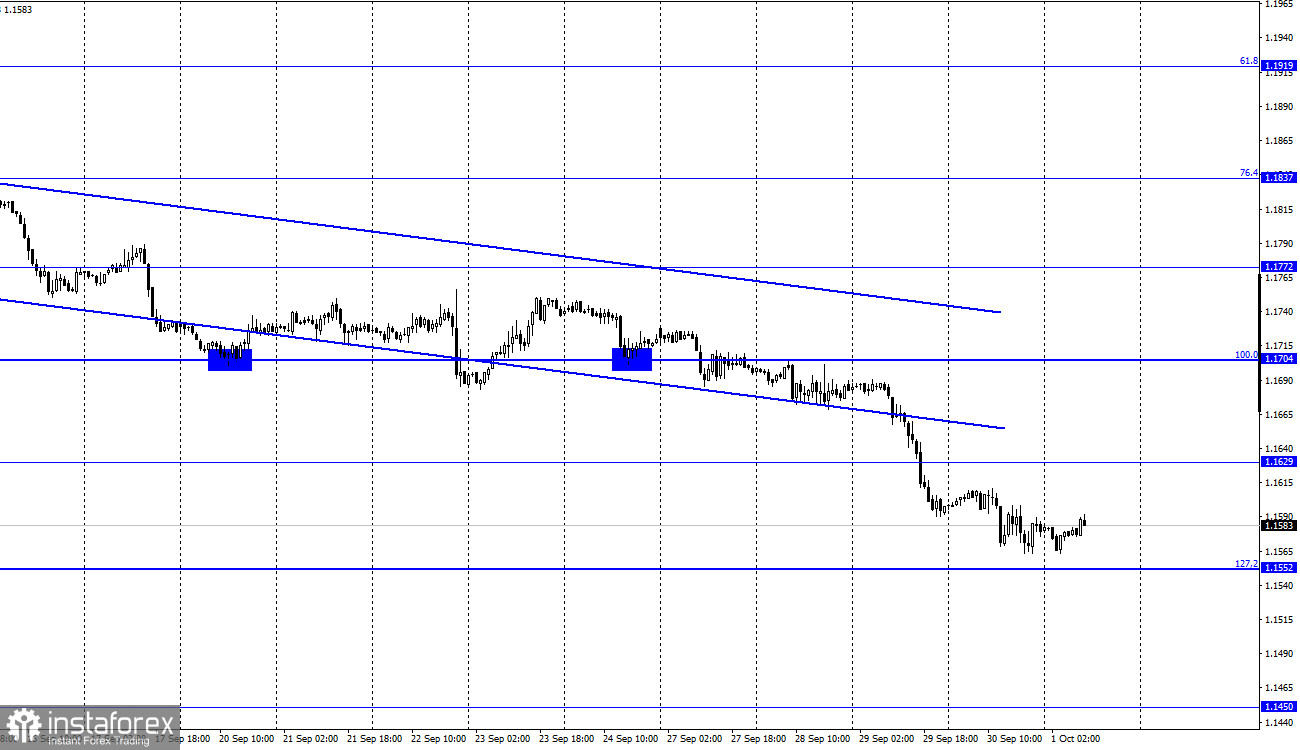

EUR/USD on 1H

The EUR/USD pair continues to decline after consolidating below the correction level of 100.0% at 1.1704. Thus, the pair may extend its fall towards the next correctional level of 127.2% at 1.1552 which is very close already. The rebound of the pair from the level of 1.1552 will act in favor of the European currency and support an upside movement in the direction of 1.1629. If the pair closes below 1.1552, we can expect a continuation of the downtrend towards the next level of 1.1450. Yesterday, US Treasury Secretary Janet Yellen addressed the Congress and urged it not to delay the increase in the US government debt limit, otherwise a new financial crisis may emerge. Notably, late on Wednesday, the House of Representatives approved the debt ceiling suspension but also reported that Republicans may block this decision.

In any case, the Senate has not approved the decision yet. Janet Yellen also warned that the failure to raise the debt limit will lead to a halt in the payment of tax benefits for 30 million American families, as well as to a delay in payment of social insurance for 50 million seniors. In fact, the national debt limit has already been exceeded: it now amounts to $28.43 trillion with the maximum allowed value of $28.4 trillion. Thus, this is a very critical issue, and we all need to wait for the US Senate to vote. Yesterday, the EU released a report on unemployment for August. It showed that the unemployment rate fell from 7.6% to 7.5%. However, the markets downplayed this data, and the European currency failed to advance. At the moment, markets seem to be paying more attention to public debt issues. However, in this case, it would be difficult for the US currency to strengthen, and this is exactly what the greenback has been doing for about a month. The information background at this time is ambiguous.

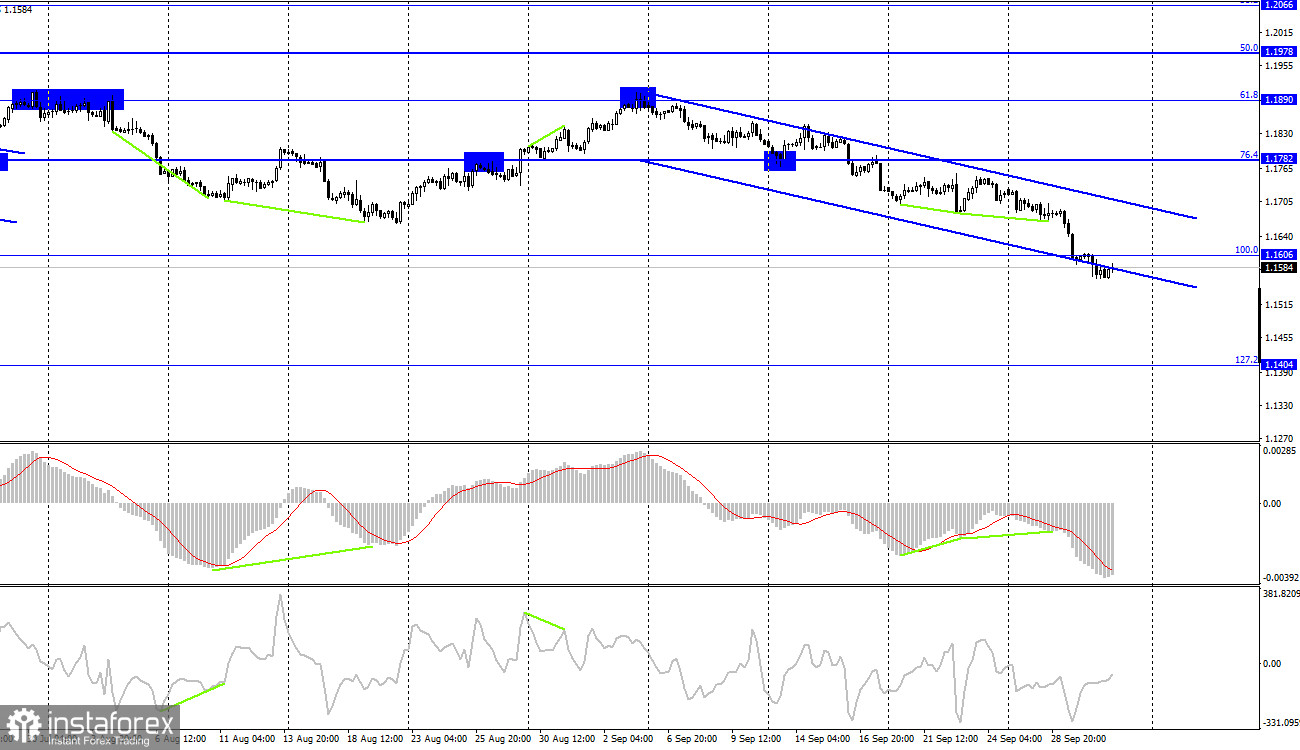

EUR/USD on 4H

On the 4-hour chart, the pair closed below the 100.0% retracement level at 1.1606. Thus, the downward movement may continue towards the next Fibonacci level of 127.2% at 1.1404. None of the indicators is showing any divergences today, and consolidation above the level of 1.1606 will suggest a slight increase in the pair.

Economic calendar for US and EU:

EU - Manufacturing PMI (08-00 UTC).

EU - Consumer Price Index (09-00 UTC).

US - Personal Consumption Expenditures Price Index (12-30 UTC).

US - Changes in the level of household spending (12-30 UTC).

US - ISM Manufacturing Index (14-00 UTC).

US - University of Michigan Consumer Sentiment Index (14-00 UTC).

On October 1, the economic calendar for the EU has several important events, including the inflation data. At least one important report will be released in the US, in particular, the ISM index for the manufacturing sector. The rest of the reports are unlikely to affect the trajectory of the euro/dollar pair.

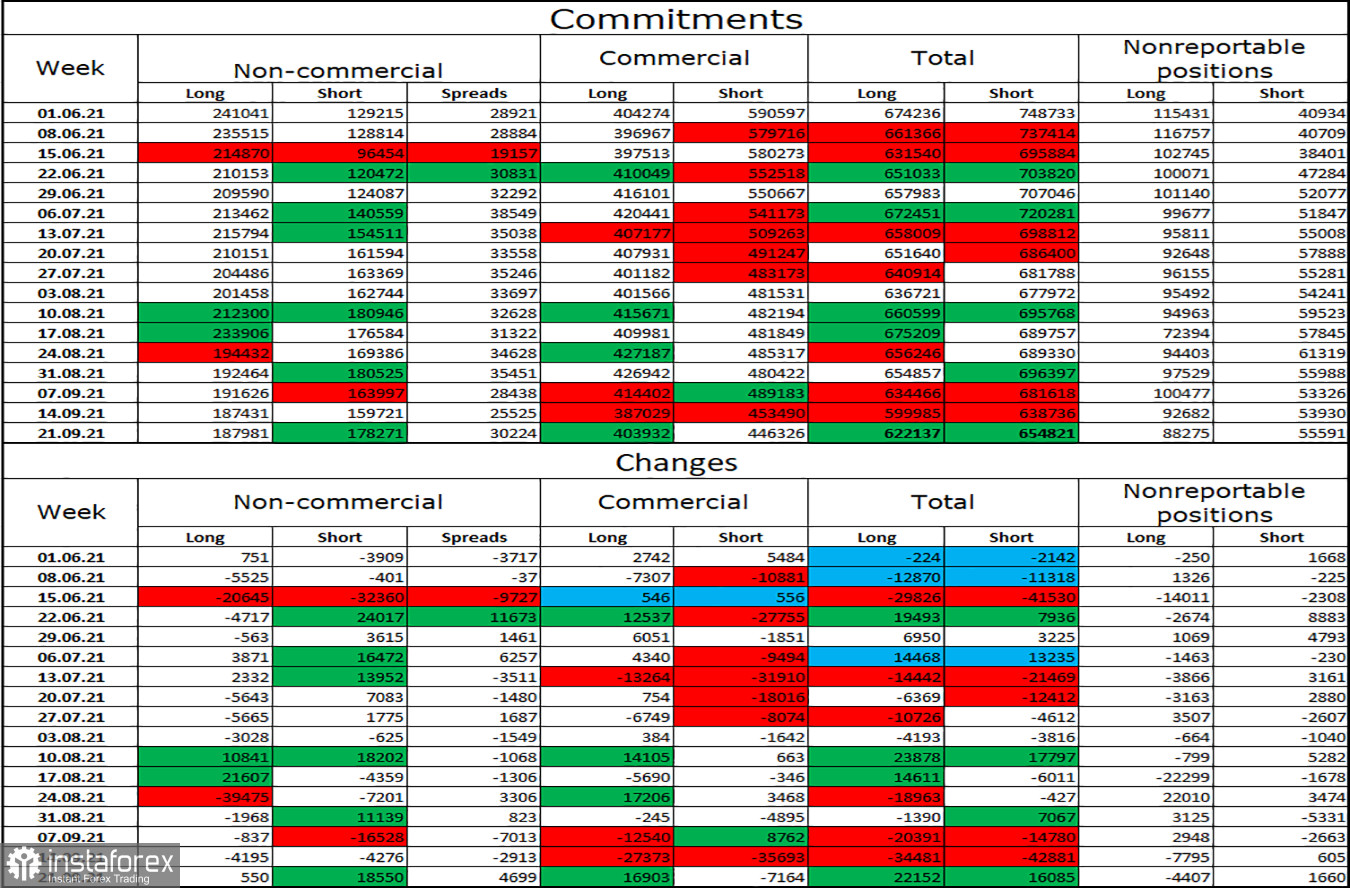

COT (Commitments of traders) report:

The latest COT report showed that the sentiment of the non-commercial category of traders has changed significantly over the week. The speculators opened 550 long contracts and 18,550 short contracts on the euro. Thus, the total number of long positions increased to 188,000 and the total number of short positions went up to 178,000. Over the past few months, the non-commercial category of traders has been actively getting rid of long contracts on the euro and increasing short ones. This process still continues. At the same time, the euro's fall was very weak over this period of time. Thus, the euro may continue to fall, but bears' activity remains rather slow on the euro.

Outlook for EUR/USD and trading recommendations

I recommend going long on the pair as soon as it rebounds from the level of 127.2% - 1.1552 on the 4-hour chart with the target at 1.1629. I recommend selling the pair if it closes below 1.1606 on the 4-hour chart with the targets at 1.1552 and 1.1450. These trades can now be held open.

Definitions:

Non-commercial traders are large market players, including banks, hedge funds, investment funds, private, and large investors.

Commercial traders are commercial enterprises, firms, banks, corporations, companies that buy currency not to obtain quick profit, but to ensure current activities or export-import operations.

Non-reportable category of traders refers to small speculators who do not have a significant impact on the price.