The US stock market is systematically deflating the financial bubble that was inflated during the coronavirus pandemic.

Global stock indices continue to decline following the fall in the US stock market. This process is led by the high-tech NASDAQ 100 index, which reflects the broad sell-off in the shares of companies leading this sector of the American economy. In fact, we are witnessing the deflation of the financial bubble inflated during the COVID-19 pandemic in the shares of those companies that grew in the wake of lockdowns and large-scale stimulus measures from the Fed and the US Treasury Department.

It can be recalled that the growth in demand for shares of companies such as Amazon, Facebook, Apple, and so on, was formed in conditions of limited opportunities for Americans to visit traditional stores, and the need to stay at home, which led to an increase in demand for all kinds of computer programs, online trading products, as well as internet services, for example, fitness classes via a computer. Huge amounts of dollar liquidity entered the financial system, and then as a result of speculative transactions into the stock market, which accelerated the value of shares of companies that flourished during the pandemic to inadequate heights.

But now, before the beginning of the process of reducing the volume of dollar liquidity, as well as the growth of the yield of treasuries and high inflation values, there is a process of active exit of investors from the shares of these companies, which pushes down the stock indexes.

In our opinion, the situation may change only if the US employment data show weak growth in the number of new jobs in September. If this happens, then the local stock market will continue to decline, dragging other world stock indices. However, this might be a local process since the frankly bad situation in the labor market may force the Fed and its leader personally to announce either a decision on a relaxed approach to the rate of reduction of liquidity volumes or to postpone it all together during its next meeting. In this situation, the continued easing of inflationary pressure will be of great help if the latest inflation data turn out to be such. At the same time, the decline in the US stock market will stop and a rebound will most likely occur.

Another positive moment may be the Congress' decision to raise the debt ceiling, which is called for primarily by the Republican faction of J. Biden. It seems that this decision will be made since the American authorities have no choice. More importantly, it exists, but a government default will lead to shocks not only economically, but also politically.

Assessing all that is happening, we believe that the high volatility factor will dominate the markets until the US employment data is released.

Forecast of the day:

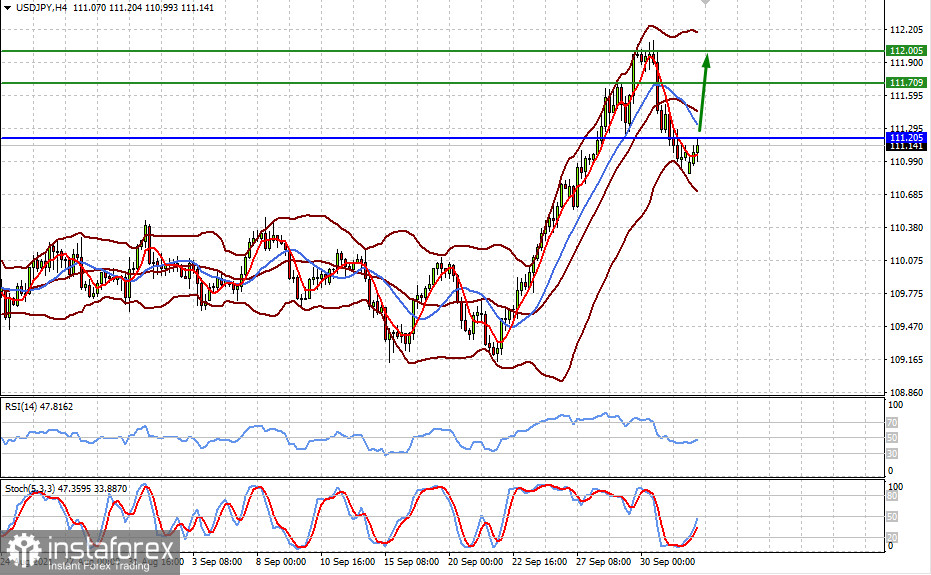

The USD/JPY pair is trading at the level of 111.20. The breakdown of this level and consolidation above it will allow the pair to further rise first to the level of 111.70, and then to 112.00.