At yesterday's trading, the US dollar suffered losses on a wide range of currencies, including against the euro. Now, it isn't easy to guess what caused such a course of trading. Some analytical departments of large commercial banks write that this happened against the background of upcoming data on the US labor market, which will be published this Friday. The data will indeed be of increased interest and importance to investors. However, the US currency sell-off on Monday is unlikely to have a connection with the US labor reports, which will be published on the last day of weekly trading. According to the author's personal opinion, the US dollar is being adjusted to its recent strengthening, which took place at last week's auction.

Nevertheless, no one has canceled the fundamental component. Thus, we will outline the most important macroeconomic events planned for today. If yesterday was very poor on statistics (except for US production orders, which came out better than expected), then today it is worth highlighting data on the US trade balance, which will be published at 13:30 London time. And at 16:00 (London time), the President of the European Central Bank (ECB), Christine Lagarde, is scheduled to speak. However, it should be noted right away that the press conference of the head of the ECB, which takes place after the announcement by the European Central Bank of its decision on rates, has a special impact on the markets. Given this factor, today's speech by Christine Lagarde may not have a special effect on the course of trading. Therefore, I propose to consider the technical picture and look for answers to existing questions there.

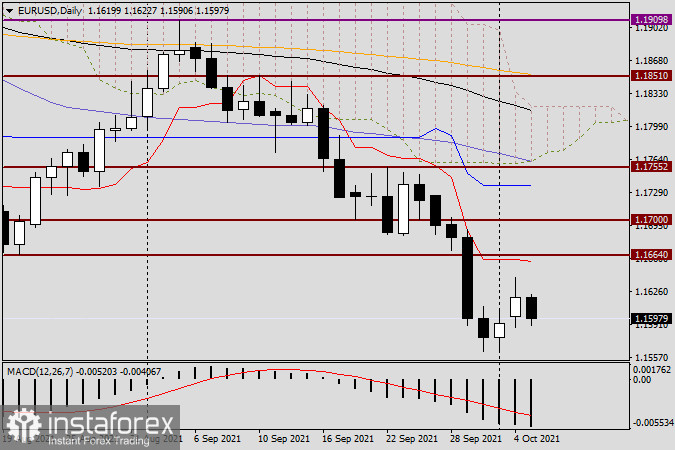

Daily

So, as already assumed at the beginning of the article, the growth of EUR/USD was most likely dictated by technical factors. The main and one of the most technical currency pairs decided not to spoil its reputation and give a rollback to the previously broken support level of 1.1664. It turned out not quite exactly, but still, the pair reached the 1.1640 mark, after which it rolled back and ended Monday's trading at 1.1620. Given the importance and significance of the 1.1600 level for the market, this is a good closing price. As for the resistance and the opportunity to open short positions, in my opinion, this is now the price zone 1.1635-1.1665. However, at the moment of writing, the euro/dollar is declining and trading near the significant level of 1.1600, so we may not see a rise in the designated resistance area today. Another option may be after the pair finds support in the area of 1.1600-1.1575 and turns in the north direction.

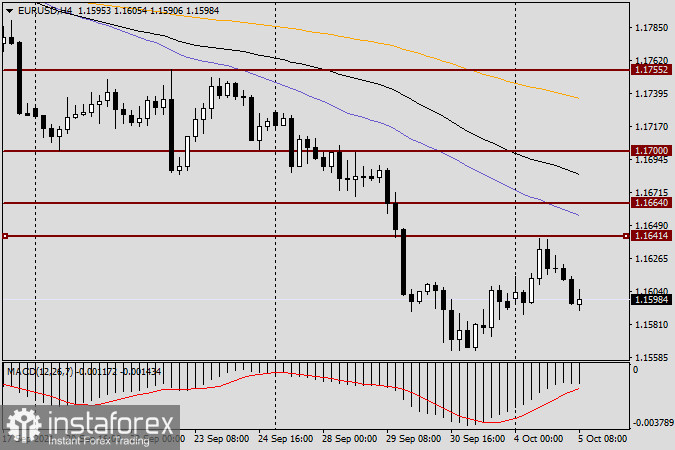

H4

The assumption of sales after the rise to the price zone of 1.1635-1.1665 on the four-hour chart is confirmed by finding 50 simple moving averages here, which can provide additional and quite strong resistance to the price. If we consider the opening of sales at more attractive prices, I recommend paying attention to the 1.1680, 1.1700, and 1.1730 marks. Although the pair is unlikely to reach these prices today, it means 1.1700 and 1.1730. For purchases, the options are the same as those indicated when describing the daily schedule. And in general, as already noted, sales at this point seem to be the main trading idea. However, it is better to open them not at the very bottom of the market but after corrective rollbacks to the prices indicated in this review.