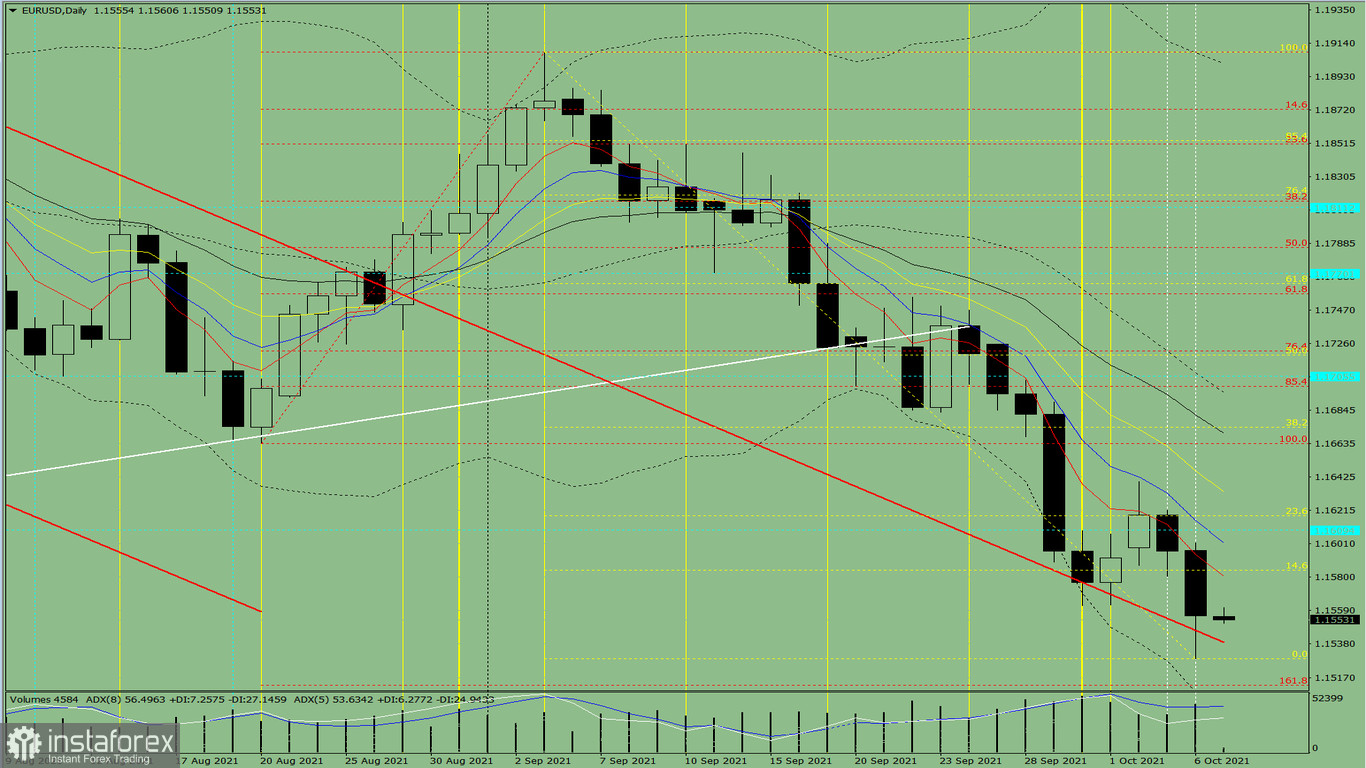

The pair moved down on Wednesday, tested the support at 1.1545 (red bold line), and closed the daily candle at 1.1556. Today, the price may roll back up. News is expected at 11:30 UTC (euro) and 12:30 UTC (dollar).

Trend analysis (Fig. 1).

The market may roll back up from the level of 1.1556 (closing of yesterday's daily candle) to test 1.1584 - the 14.6% retracement level (yellow dashed line). Upon reaching this level, the price may continue to move upward with the target at 1.1618 - the 23.6% retracement level (yellow dashed line).

Fig. 1 (daily chart)

Comprehensive analysis:

- Indicator analysis - up;

- Fibonacci levels - up;

- Volumes - up;

- Candlestick analysis - up;

- Trend analysis - up;

- Bollinger lines - down;

- Weekly chart - up.

General conclusion:

Today, the market may roll back up from the level of 1.1556 (closing of yesterday's daily candle) to test 1.1584 - the 14.6% retracement level (yellow dashed line). Upon reaching this level, the price may continue to move upward with the target at 1.1618 - the 23.6% retracement level (yellow dashed line).

Alternative scenario: from the level of 1.1556 (closing of yesterday's daily candle), the price may move down with the target of testing the target level of 161.8% at 1.1512 (red dotted line). Upon reaching this level, the price may start moving upwards with the target at 1.1529 - the lower fractal (yellow dashed line).