European gas prices have soared to 60% in two days. The impact of growing energy costs rippled through equity and bond markets and the European Union sounded the alarm.

Dutch and UK gas futures continue to reach new record highs along with rising power prices. The rise in energy prices increases inflationary pressure and raises fears that economic recovery will slow down. If so, this will lead to a slump in the European stock market.

"It looks like a classic short squeeze to me," Ronald Smith, a senior analyst at BCS Global Markets, said. "I expect we're going to see some traders going bankrupt and liquidating their positions."

After the beginning of the heating season in the northern hemisphere, when demand increased sharply and supply was limited, global gas and coal markets have tightened. According to forecasters, colder weather is expected in Europe next week.

Several European countries, including France and Spain, called on the EU to take urgent measures to mitigate the blow of rising gas prices. The bloc's energy chief, Kadri Simson, promised to revise market rules by the end of the year so that surging gas prices would not undermine economic recovery.

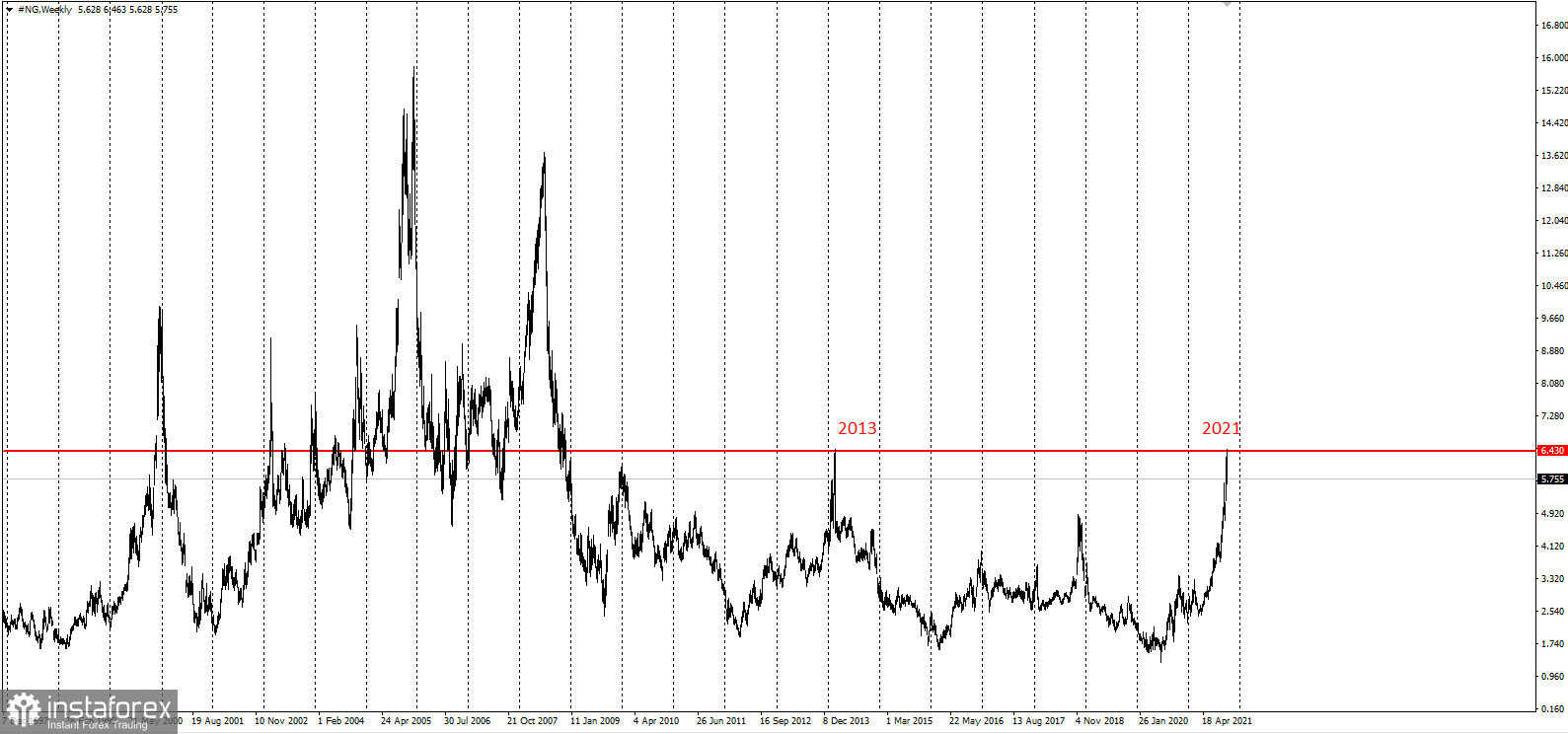

The gas crisis is getting worse day by day. Some energy-intensive companies are shutting down their operations due to the fact that it is too expensive to run. Stockpiles in Europe are at the lowest seasonal level in more than a decade, deliveries from Russia are limited, and global competition for liquefied natural gas is high. The squeeze will only worsen as winter is just around the corner.

Front-month Dutch gas jumped by 40% to a record €162.125 a megawatt-hour. The UK equivalent rose by 39%, hitting an unprecedented 407.82 pence a therm, before dropping to 335.81 pence.

According to Bloomberg Economics, inflation in the eurozone will average almost 4% in the fourth quarter, which is significantly higher than the forecasts of the European Central Bank at the beginning of the year.

Europe continues to compete with Asia for deliveries of LNG. Despite the staggering rally in European gas prices, Asian LNG importers are willing to pay a premium to the Dutch benchmark to attract supply for the winter, according to traders in Singapore. Thus, Europe are gping to struggle to attract extra LNG shipments to provide enough gas supplies for the region.