Recently, Australia has unveiled a rather weak unemployment report. Yet, the Aussie did not fall sharply due to a significant drop in employment. The AUD/USD pair is now trading with a bullish bias. Apart from that, it is gaining momentum amid the weakening of the US dollar. The pair is likely to test 5-week highs. Negative jobs data did not spook bulls. Traders factored in such an outcome given the worsening epidemiological situation in the country and reintroduction of lockdowns in some regions. Even in the pessimistic report, there were some positive factors. On top of that, life began to gradually return to normal after the prolonged lockdown. This is why the Australian currency reacts largely to positive news.

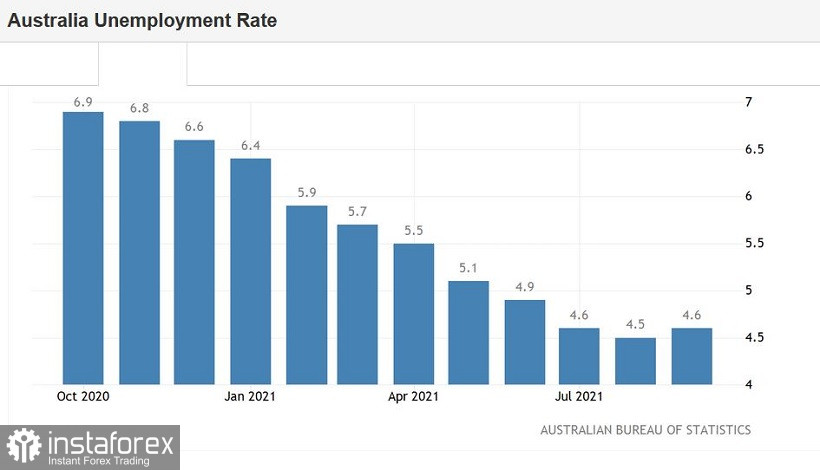

Among all the components of the September report, the unemployment indicator surprised trades. This was the only component that turned out to be positive. Unemployment in September was at the level of 4.6%. The reading was better in comparison with the preliminary expectations. Economists had predicted an increase to 4.9%. Yet, this indicator belongs to lagging economic indicators. Therefore, it would be wise to focus on the leading ones. The published figures still reflected the labor market situation in the largest Australian states in early autumn. The Australian authorities imposed a strict quarantine at the end of July, gradually tightening restrictive measures in August and September. They even introduced a curfew in Sydney. The report published yesterday covers the period up to the middle of the previous month. Thus, the Australian economy remains resilient to coronavirus woes.

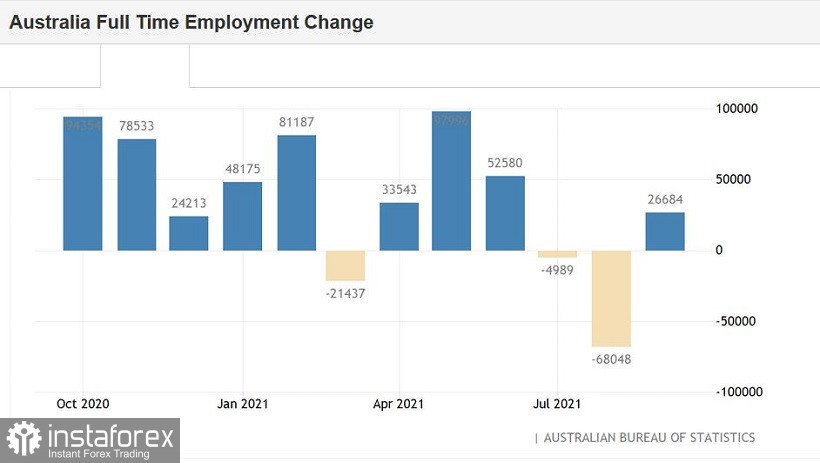

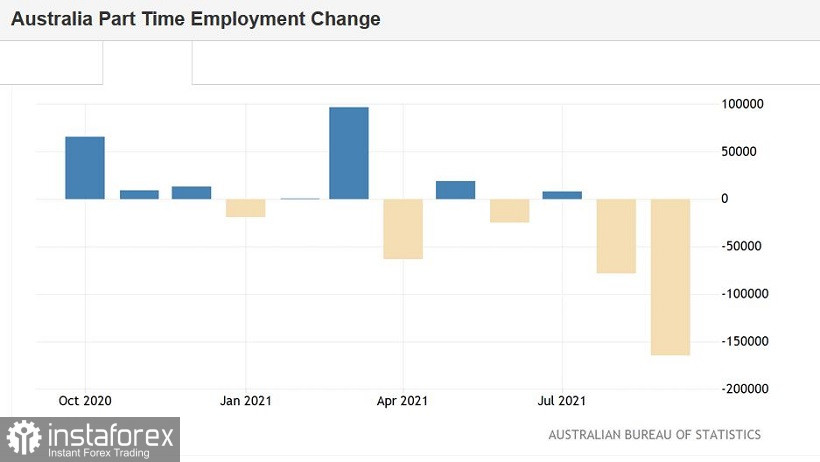

Importantly, more actual data signals a significant slowdown in the labor market. For example, the number of employed in September decreased by 138,000. This indicator turned out to be in the negative area again, as it was a month ago. Such a decline was logged only in April 2020 during the first wave of the epidemic. However, it is necessary to pay attention to the fact that the decrease in the indicator occurred solely due to a drop in part-time employment. Full employment grew by almost 27,000 for the first time since June. Of course, the Australian labor market is experiencing a crisis. However, at the same time, there were some positive shifts last year. What is more, the situation has been getting better for several months.

This is why the Australian dollar has ignored the September figures, focusing on the prospects for the recovery of the national economy and the labor market. For example, this week, the two largest Australian states, which account for almost half of the country's population (New South Wales and Victoria) will gradually ease quarantine restrictions. On October 11, the largest city in Australia, Sydney, came out of a 4-month lockdown. Fully vaccinated people in NSW will enjoy greater freedoms in October as the state has reached 70% double-dose vaccination.

Notably, the Aussie did not drop even after yesterday's negative coronavirus reports. Australia reported about 2,750 new cases yesterday. This is a record daily figure since the beginning of the pandemic. Not long ago, the Australian dollar would have plunged after such news. apparently, traders are focusing only on positive news as the country is moving towards the target vaccination level. According to the authorities, when the state reaches 70% vaccination, quarantine restrictions will be significantly relaxed (New South Wales is an example of this). Therefore, investors ignore negative news on the epidemiological situation.

Thus, the AUD/USD pair is likely to grow higher. The nearest target is the 0.7480 level. This is a five-week high, which has been reached in early September. At the moment, on the daily chart, the pair is on the upper line of the Bollinger Bands indicator, while the Ichimoku indicator continues to show a bullish signal. The main resistance level is located at 0.7500. This is the Kijun-sen line on the weekly chart.