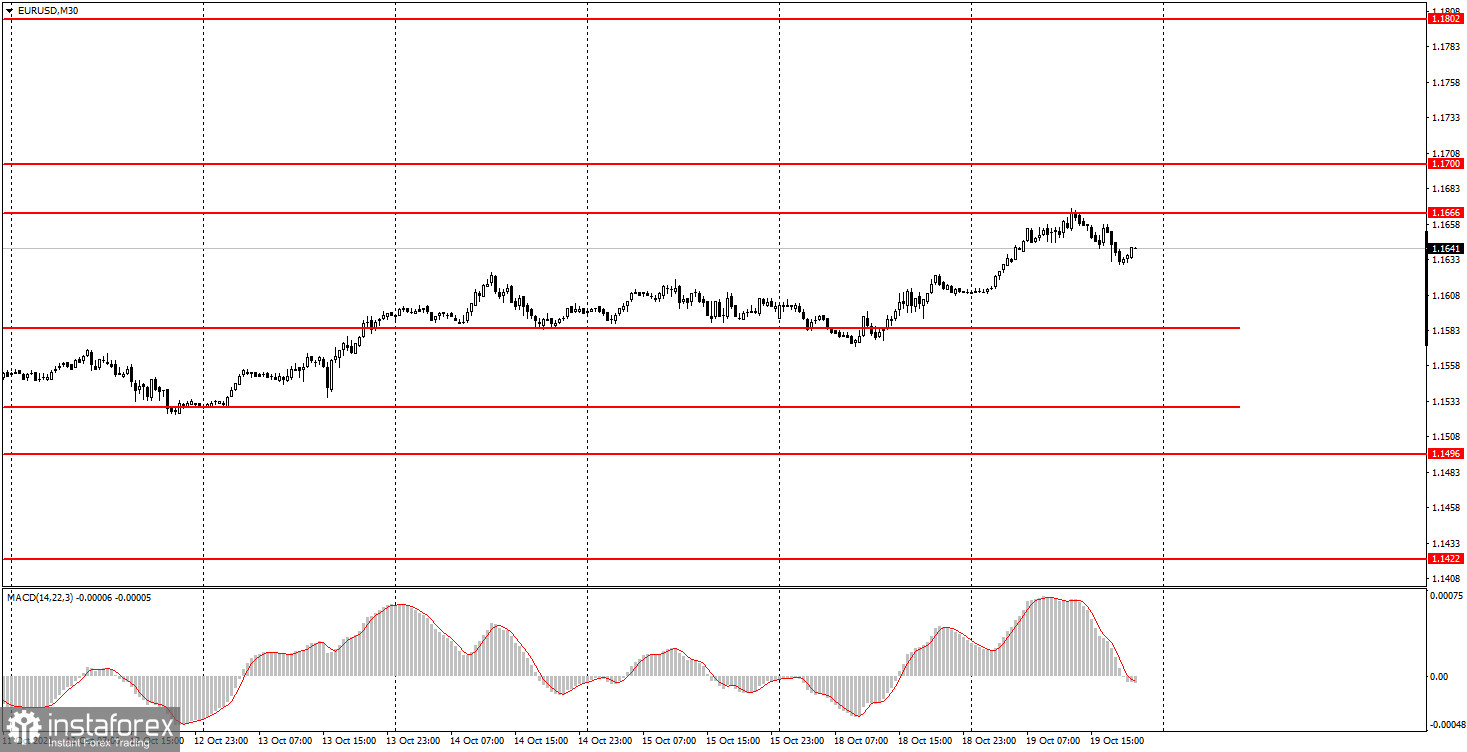

30-minute chart

On Tuesday, the euro/dollar pair showed a quite confident movement. Volatility rose and the pair left the sideways channel, where it was hovering during the last 2-3 weeks. Thus, the pair unexpectedly jumped. However, a day before, it was impossible to predict such changes. It looks like an accident.

It is quite possible that the pair will move in the same direction tomorrow. However, judging by the recent few months, it will hardly do this. Thus, it is not recommended to rely on the signals provided by MACD.

At the moment, we cannot see a trend, a trend line, or a channel. There were neither fundamental nor macroeconomic reasons for such a dynamic. What is more, it began at night. It is really strange since the Asian trade is usually very calm. As a result, we do not have any reasons to wait for a trend formation on the 30-minute chart.

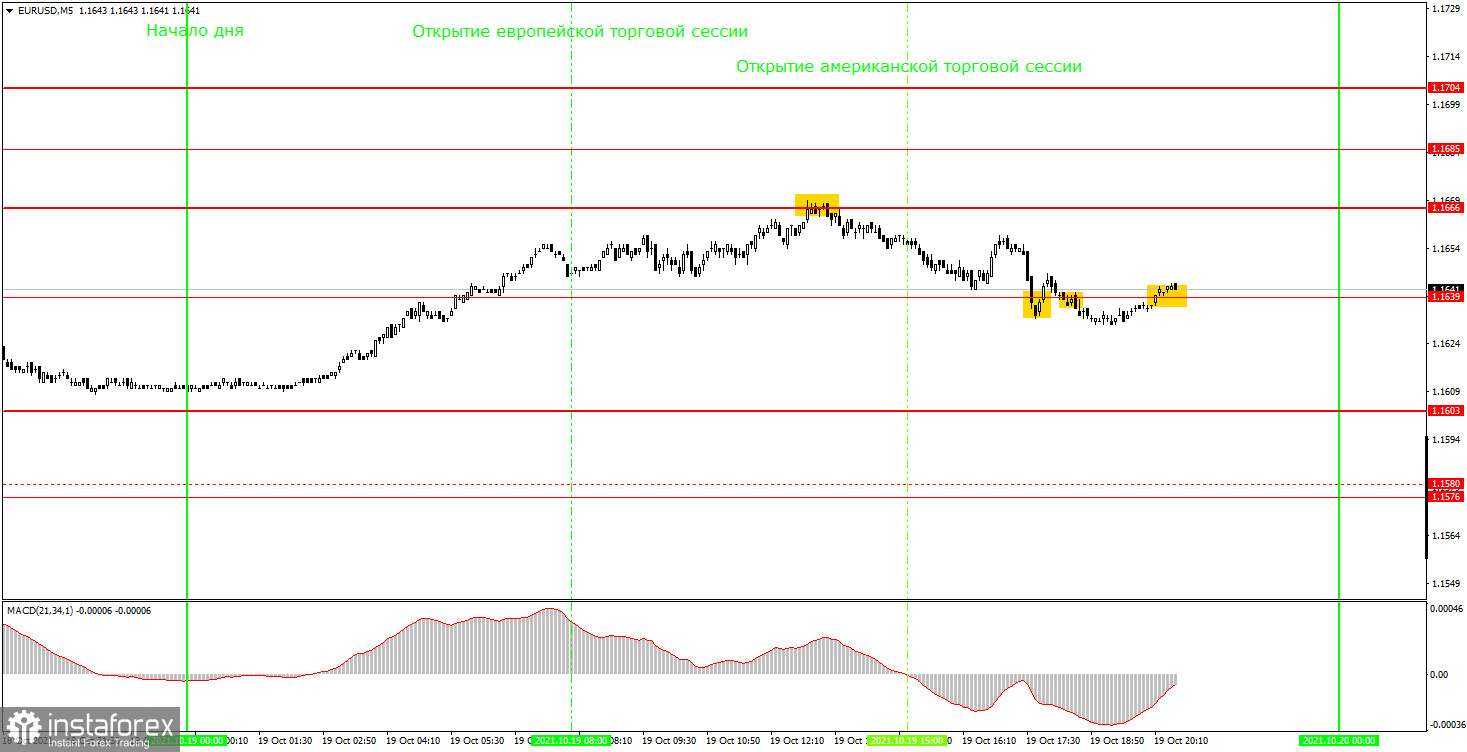

5-minute chart

On the 5-minute chart, the technical picture is clearer. Notably, it is important to get strong trading signals to earn money and avoid false signals in order not to lose money. As we have already mentioned, the euro/dollar pair began rising before the European session. At the beginning of the European trade, the pair was above 1.1639. That is why we missed the buy signal.

The following signal was formed during the European session, when the price dropped from 1.1666. The signal was really strong. After that, the price slid to 1.1639 and rebounded from this level. At that moment, traders should have closed short positions.

The profit totaled 13 pips. However, it was not a good idea to open long positions following the signal formed after the rebound from 1.1639. All the following signals were formed during the US trade. Notably, it is not recommended to open positions in the evening. On average, the order remains open for at least 2 hours. Thus, it is too late to close orders at 9 or 10 p.m. Please note that in the evening, the market is less volatile, and the trend (if there was one) loses momentum.

How to trade EUR/USD on Wednesday

On the 30-minute chart, the pair will hardly trade sideways, but an upward trend has not been formed yet. The volatility is still 40-50 pips a day. Thus, we do not recommend trading on the signals provided by the MACD indicator. On the 5-minute chart, the key levels for October 20 are located at 1.1576, 1.1639, 1.1666 and 1.1685. A take profit order should be placed at the distance of 30-40 pips.

On Wednesday, the eurozone will disclose its CPI report for September. This is the only report that may cause the market reaction. However, the effect could be rather tepid. According to the forecast, inflation growth will total 3.4% per annum.

Key rules of trading:

1) A signal strength depends on the time it took to generate the signal (a rebound and a break of a particular level). The less time it took, the stronger the signal was.

2) If traders used a false signal and opened two or more trades near a certain level, then all the following signals from this level should be ignored.

3) Trading sideways, any pair can form a lot of false signals or not form them at all. In any case, once there are signs of a flat, it is better to stop trading.

4) If a trader opens orders in the time period between the beginning of the European session and the middle of the American session, they should be closed manually.

5) On a 30-minute chart, signals from the MACD indicator could be taken into account only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 pips), then they should be considered as a support or resistance area.

On the chart:

Support and resistance levels are the levels that act as targets when opening buy or sell positions. A take profit order could be placed near them.

Red lines are channels or trend lines that display the current trend and show in which direction it is preferable to trade now.

The MACD indicator (14,22,3) is a histogram and a signal line, the intersection of which provide signals to enter the market. It is recommended to use it in combination with trend patterns (channels, trend lines).

Important speeches and reports (you can always find them in the calendar) can greatly influence the movement of a currency pair. Therefore, during their publication, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners should remember that every transaction cannot be profitable. A clear strategy and money management are the key to success.