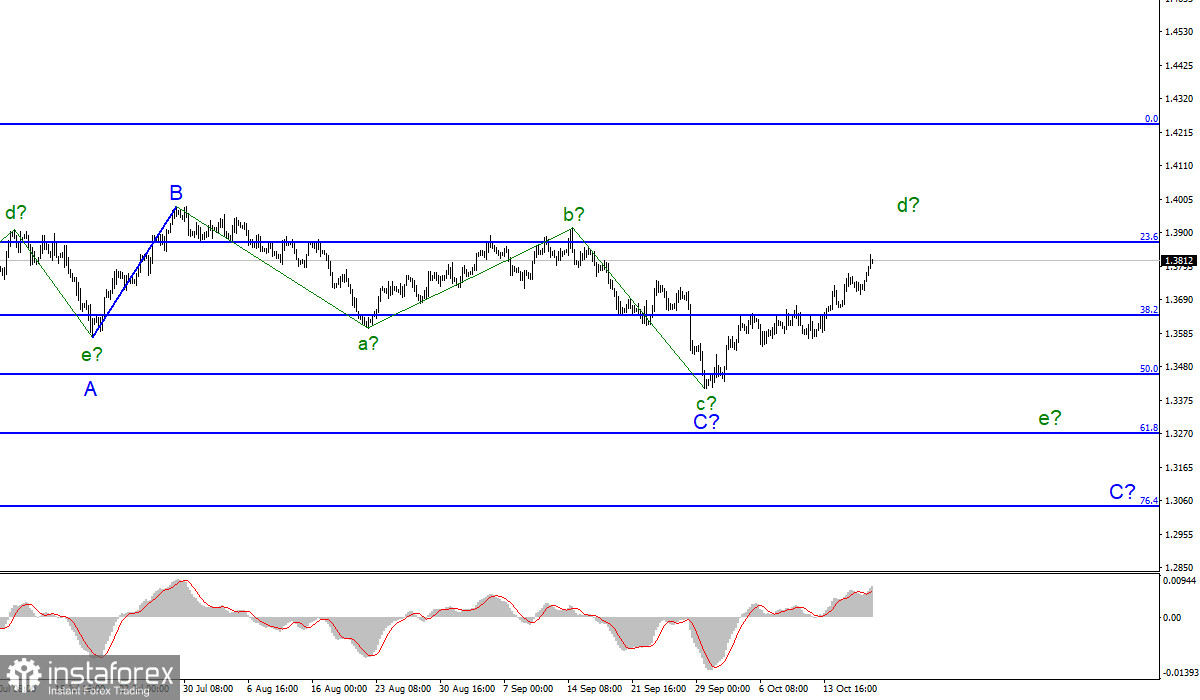

Wave pattern

The wave counting for the Pound/Dollar instrument has become more complicated recently and may become more complicated again. The instrument made a successful attempt to break through the low of the previous waves a and e. Thus, adjustments were made to the wave pattern, and now it has acquired the form of a downward trend section, which is corrective in nature. This assumption is prompted by the internal structure of the proposed wave A, which cannot be called impulsive. The assumed wave c in C from this section of the trend also took an absolutely non-impulsive form, with only three waves visible in it.

However, within the corrective structures, wave markings can be both three-wave and five-wave, and take a very complex form. Thus, after completing the construction of the current wave, presumably d in C, I expect a resumption of the decline in quotes within the framework of wave e in C. However, it should also be taken into account that wave C may turn out to be three-wave and be already completed. In this case, the construction of a new upward trend section could now begin. An unsuccessful attempt to break through the 1.3871 mark, which corresponds to 23.6% Fibonacci level, will indicate that the instrument is ready for a new decline within the wave e. Otherwise, the wave pattern will require adjustments again.

Maros Sefcovic offers a compromise option to Boris Johnson.

The exchange rate of the Pound/Dollar instrument increased by 100 pips on Tuesday. Even before the opening of the European markets, the pound sterling has already added about 45 basis points. The Bank of England Governor Andrew Bailey gave a speech, but the markets did not witness any new and important information. Much more interesting information came from the European Union, where Maros Sefcovic offered Britain customs exemptions for 80% of goods transported from the UK to Northern Ireland and sold in supermarkets.

Without going into details, now all trucks that are sent to Northern Ireland can pass customs control under a simplified scheme that will not require licenses and certificates for each line and category of transported products. Some products will leave the "risk group" altogether and will no longer require constant checks. All this should reduce the paperwork and the amount of bureaucracy in the ports, which now act as the border between Northern Ireland and Ireland. In turn, Brussels wants to have access to all the data from the inspection points in real time. However, few people believe that Boris Johnson will agree to such a proposal. The other day, Brexit Minister David Frost again spoke about the need to develop a completely new protocol on the movement of goods to Northern Ireland.

General conclusions.

The wave pattern continues to raise some questions, although it looks quite convincing so far. It received a downward view, but not an impulsive one. Since the construction of an upward wave is continuing now, I advise you to wait for its completion before selling the instrument in order to build the expected wave e in C. An unsuccessful attempt to break the 1.3871 mark may be a confirmation of the readiness of the markets for new sales.

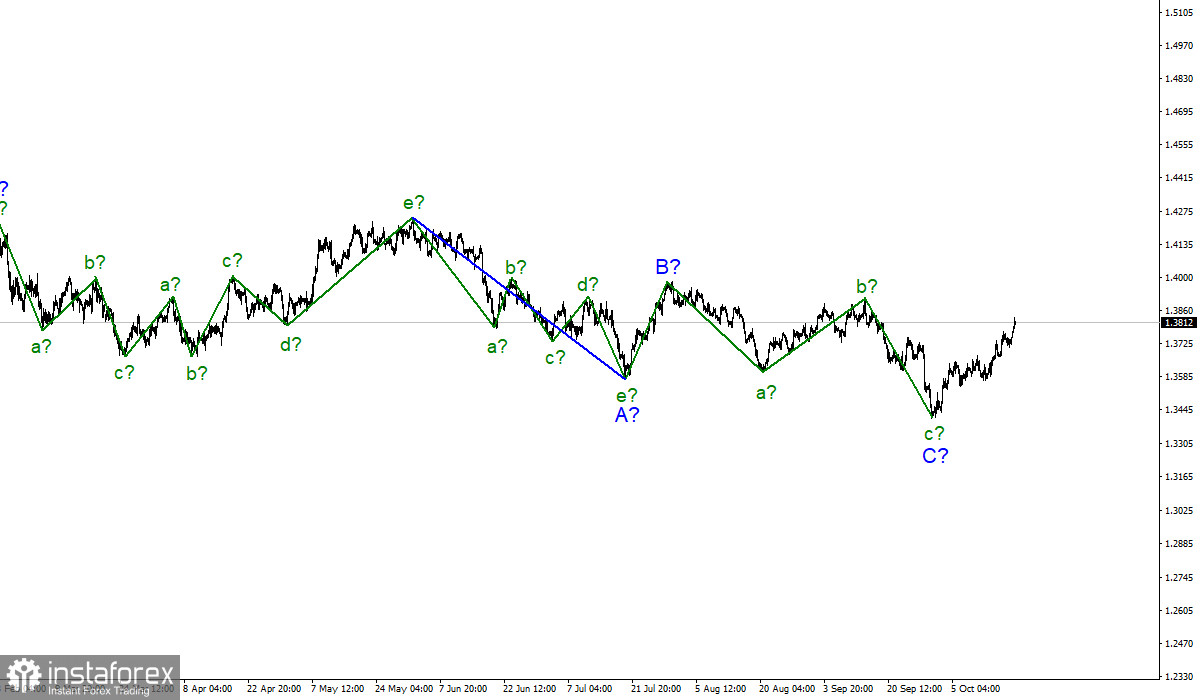

The upward section of the trend, which began its construction a couple of months ago, has taken a rather ambiguous form and has already been completed. The construction of the upward trend section has been canceled, and now we can assume that on January 6, the construction of a new downward trend section began, which can turn out to be almost any size.