The CEO of Sprott Inc. Peter Grosskopf said that investors should not view digital currency as a competition, despite the fact that Bitcoin is now more attractive and prices are at an all-time high.

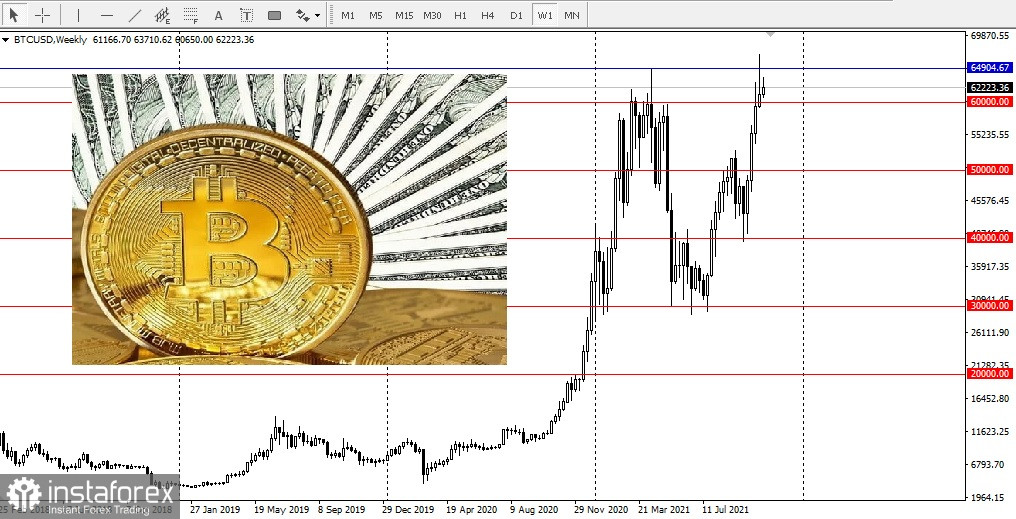

Last week, Bitcoin rose to a new record, exceeding $ 66,000 per token. The reason for this growth - the search for investors to protect against inflation. Currently, the main digital asset is trading at only $ 62,000 per token.

According to Grosskopf, people doubt the Federal Reserve System, as well as the inflationary picture presented to them. Therefore, at the expense of bitcoin, people hedge the risk of the US dollar.

He also stated that Bitcoin is winning against gold in the short term. In this regard, these two assets will go toe-to-toe in the future. He is only worried by the fact that the market value of the digital currency has grown to $ 2 trillion and competes with gold. And this is a sign that investors are looking for alternative currencies.

Grosskopf said that if gold wants to compete with the digital market, it must become digital itself, adding that the gold market is likely to have about two more years before there is a digital presence with enough critical mass to sustain itself. The CEO believes that gold will become digital eventually and attract even more new investors.

Just as gold-backed exchange-traded products opened the market to small retail investors in the early 2000s, the digital market will create new opportunities for ordinary consumers.

Sprott Inc., the world leader in the precious metals market with assets under management of more than $ 18 billion, was not left out of this new digital revolution. The firm has also invested in various digital projects, including Glint Pay, a credit card that allows users to store their balance in gold. The company was one of the first sponsors of Tradewind Markets, which created the first digital gold exchange and allowed investors to buy fractional ounces of gold.

Sprott Inc. has announced that this technology is not available, and now commercial investment banks need to participate in creating the critical mass needed for these digital markets.