At the end of the trading week, US equities drifted as traders weighed disappointing earnings and bond-market gyrations sparked by concerns over inflation and monetary tightening.

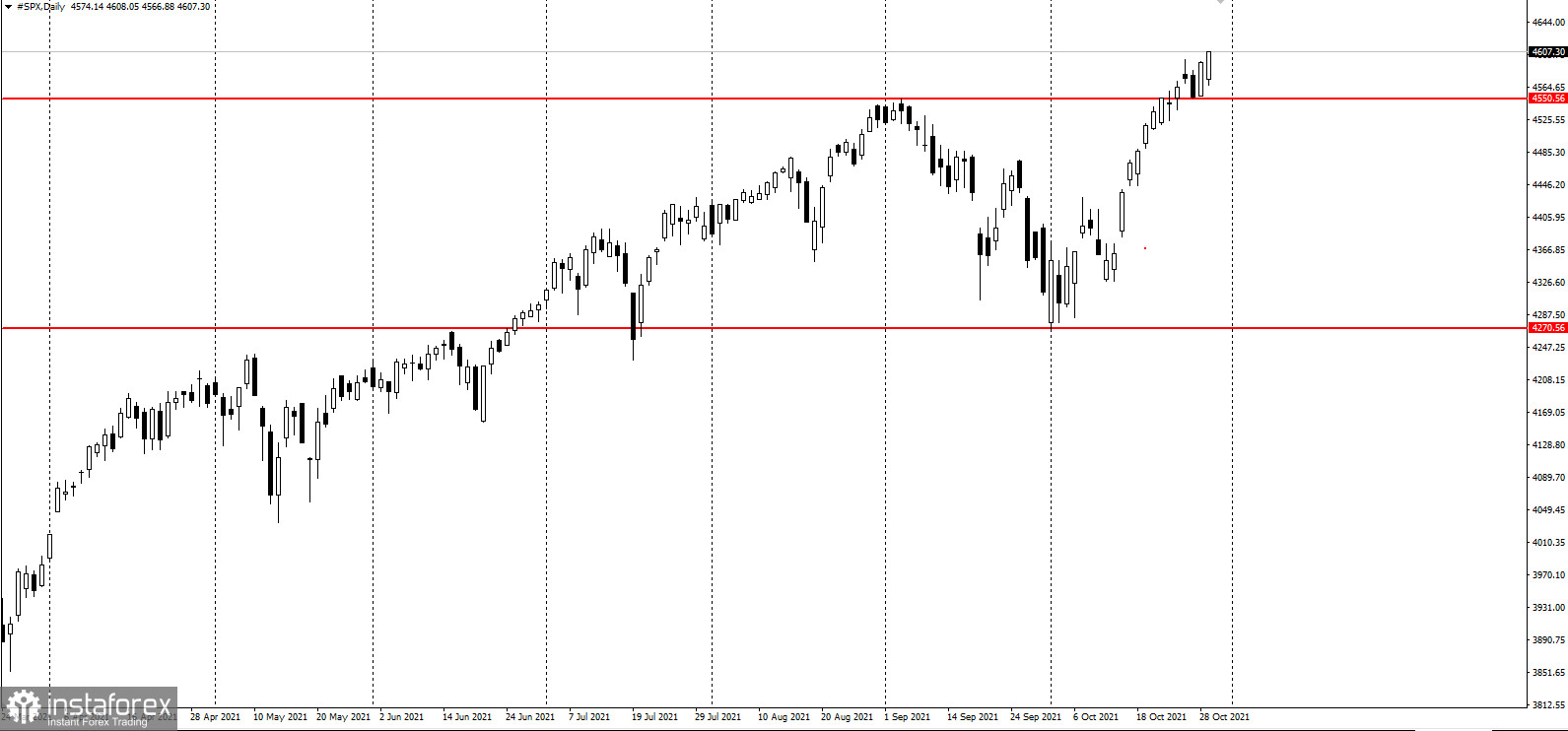

On Friday, for example, the S&P 500 index oscillated between gains and losses after opening lower as a result of Amazon.com Inc. and Apple Inc. slumping. However, by the end of the day it had again hit the top of the year.

The benchmark index posted its biggest monthly gain since last November. Meanwhile, the Nasdaq 100 rallied, offset by gains from stocks such as Tesla Inc and Meta Platforms Inc after a name change from Facebook Inc.

"Front and center are the results from Apple and Amazon yesterday missing expectations, but more importantly the commentary about the supply chains," said Cliff Hodge, chief investment officer at Cornerstone Wealth Group.

Short-dated Treasury yields rose more than longer-dated ones. Inflation pressures and the prospect of interest-rate hikes are whipsawing bond markets. This has allowed the US dollar to gain since June this year.

Markets are facing a number of crosscurrents. Generally positive corporate performance has helped to support global equities. However, inflation risks from supply chain disruptions and more expensive raw materials are raising expectations of rate hikes and dimming the economic outlook.

"Almost any data series you look at, be it the bond market, be it inflation, GDP, the labor market, anything is still showing these signs of fibrillation and that's going to take some time to sort out," said Scott Clemons, chief investment strategist at Brown Brothers Harriman.

The latest data showed US growth slowed more than expected in the third quarter, hampered by supply chains and a surge in Covid-19 cases. A separate report showed that weekly jobless claims fell to a pandemic low, and personal spending slowed in line with analysts' estimates in September.

Here are some events to watch this week:

- China's Manufacturing PMI

- Manufacturing PMI in the United States