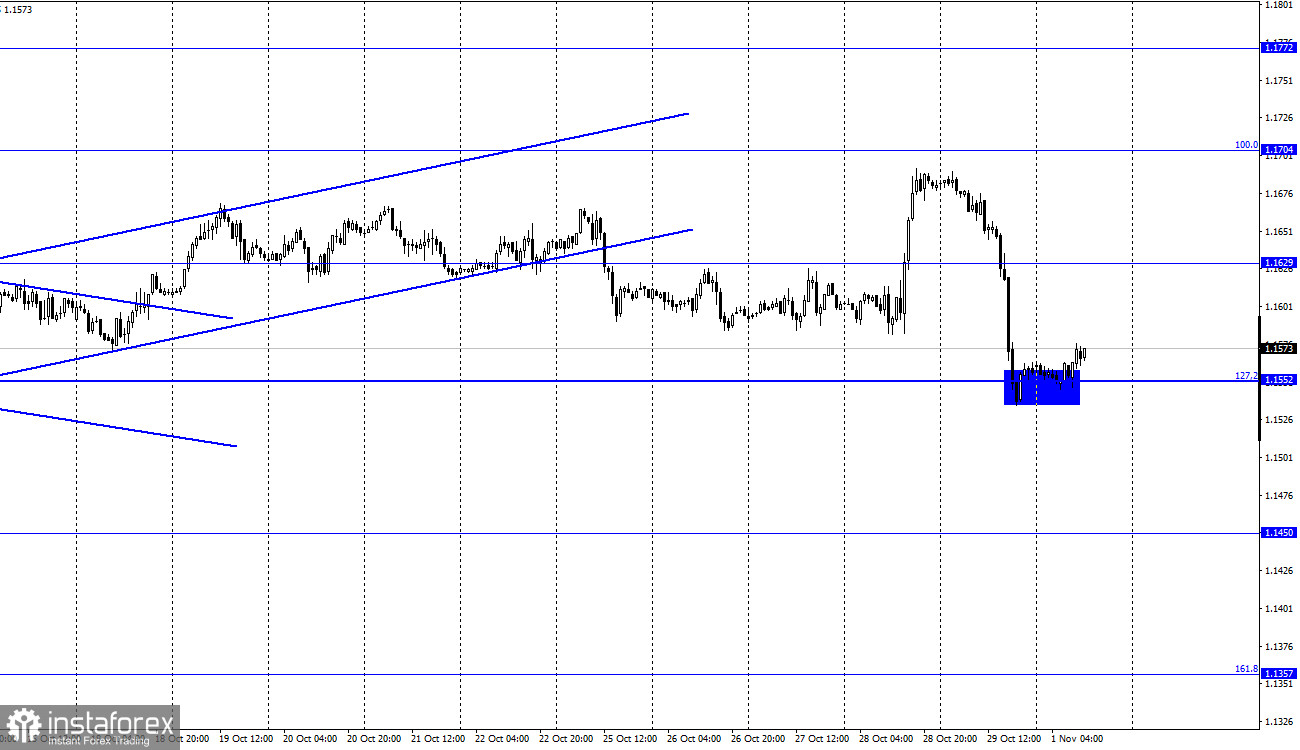

EUR/USD – 1H.

The EUR/USD pair performed a reversal in favor of the US currency on Friday and began an even stronger decline than the growth on Thursday. As a result, the quotes dropped to the corrective level of 127.2% (1.1552). Thus, some growth of the pair is possible in the direction of the level of 1.1629, around which the quotes have been spinning for a couple of weeks. The information background on Friday was quite strong, but not as strong as on Thursday. Nevertheless, on Thursday we learned the results of the ECB meeting, as well as GDP in the United States. On Friday, the European Union also released a report on GDP for the third quarter, and also an inflation report for October. And these two reports could be treated as anything, but not the way traders did it. The fall of the European currency began late at night and at first corresponded to the graphic picture since a strong growth was to be followed by a pullback. But what was the reason for the fall of the European currency in the daytime, when the GDP report exceeded traders' expectations, and inflation accelerated to 4.1% y/y?

After all, both of these reports were supposed to cause new growth of the European currency, but instead, we saw an even stronger drop than Thursday's growth. Thus, on Friday, bear traders completely blocked all the efforts of bulls Thursday. It turns out that the US GDP report, which turned out to be significantly weaker than traders' expectations, did not matter much, since it did not prevent the US currency from showing strong growth the very next day. This week, however, the movement may be even more fun than at the end of last week. On Wednesday, the results of the Fed meeting will be announced in America, and on Friday a standard set of reports on the labor market and wages will be released, within which the Nonfarm Payrolls report. It will be released two days after the Fed meeting, although the Fed relies on this report when making a decision. And the last two nonfarm reports left much to be desired. Thus, there are fears that the Fed will again decide to wait for the acceleration of the labor market recovery and only after that will announce the end of QE.

EUR/USD – 4H.

On the 4-hour chart, the quotes closed under the corrective level of 100.0% (1.1606). Thus, the process of the fall of the euro quotes can be continued in the direction of the next Fibo level of 127.2% (1.1404). However, the pair has been spinning around the level of 1.1606 for a long time, and the movements in the last two days of the past week do not fit into the current picture of things at all.

News calendar for the USA and the European Union:

US - ISM manufacturing index (14:00 UTC).

On November 1, the calendar of economic events in the European Union is empty, and in the United States there will be one, but important, ISM index of business activity in the manufacturing sector. The information background for the pair today will be medium-weak.

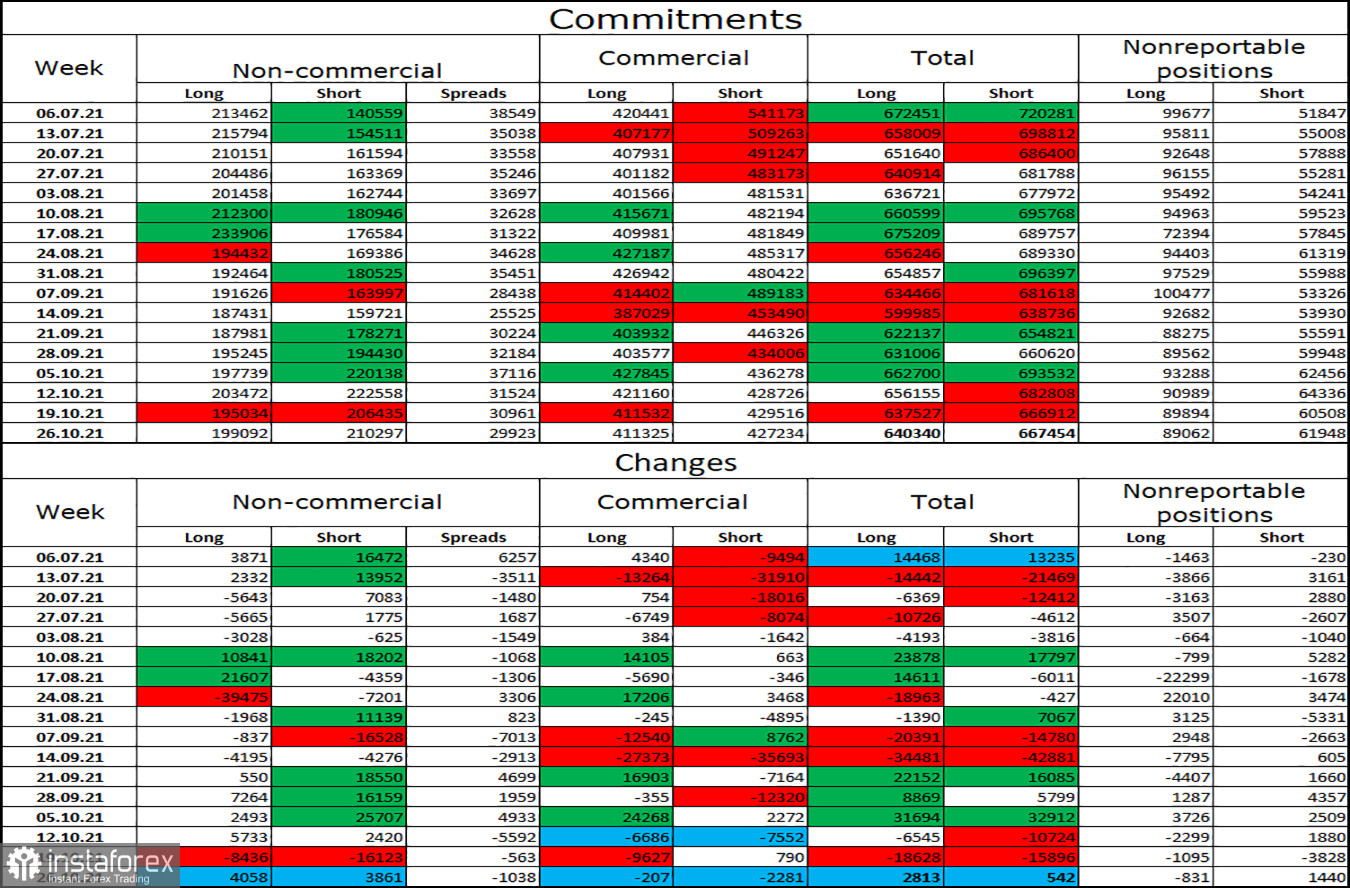

COT (Commitments of Traders) report:

The latest COT report showed that during the reporting week, the mood of the "Non-commercial" category of traders did not change. Speculators have opened 4,058 long contracts on the euro and 3,861 short contracts. Thus, the total number of long contracts in the hands of speculators has grown to 199 thousand, and the total number of short contracts - up to 210 thousand. Over the past few months, the "Non-commercial" category of traders has tended to get rid of long contracts on the euro and increase short contracts. Or increase short at a higher rate than long. In general, this process continues now, but in the last three weeks, the European currency has been leaning towards weak growth (if we do not take into account the last day of last week). In general, the fall of the euro still looks more preferable.

EUR/USD forecast and recommendations to traders:

Traders are still not trading the pair too actively. On Thursday and Friday, the movements were strong, but it looks more like a one-time action. I recommend buying a pair if there is a rebound from the level of 1.1552 on the hourly chart, with a target of 1.1629. I recommend selling the pair if a close is made under the level of 1.1552, with a target of 1.1450.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits, but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.